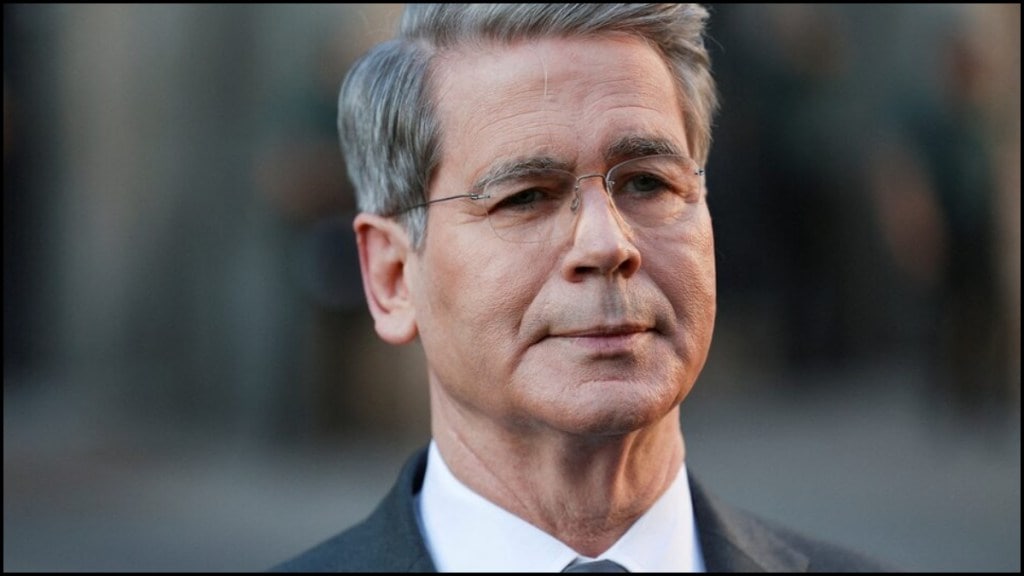

Taxpayers in the US may be in for a pleasant surprise in the coming months, as Treasury Secretary Scott Bessent announced that American households can expect “very large refunds” during the early 2026 tax filing season. He explained recent changes under the One Big Beautiful Bill Act (OBBBA) as the reason why this could be possible.

‘$100 billion to $150 billion in total refunds expected’

He projected $100 billion to $150 billion in total refunds, averaging $1,000 to $2,000 per household in the first quarter, NBC10 Philadelphia reported. The OBBBA, passed in July, features retroactive provisions affecting taxes on 2025 earnings, leading to bigger refunds since most working Americans have not adjusted their paycheck withholding.

“The bill was passed in July. Working Americans didn’t change their withholding, so they’re going to be getting very large refunds in the first quarter,” Bessent told NBC10.

‘Taxpayers take-home pay to see boost’

Once taxpayers receive these refunds and update their withholding, they will see a genuine boost in take-home pay throughout 2026, according to Bessent.

Bessent also encouraged Americans to check their withholding and estimated payments to avoid overpaying or underpaying in future years.

This follows the OBBBA’s extension of lower tax rates and higher standard deductions from the 2017 Trump tax cuts, which were set to expire and trigger hikes otherwise. President Donald Trump echoed this at a recent Cabinet meeting, calling it the “largest tax refund season ever.”

The Internal Revenue Service (IRS) typically begins accepting tax returns in late January, with the earliest refunds issued shortly afterward, according to Jackson Hewitt Tax Services.

As millions of Americans anticipate their returns, Bessent’s outlook suggests that 2026 could be a record year for tax refunds, offering families a welcome financial boost at the start of the new year.