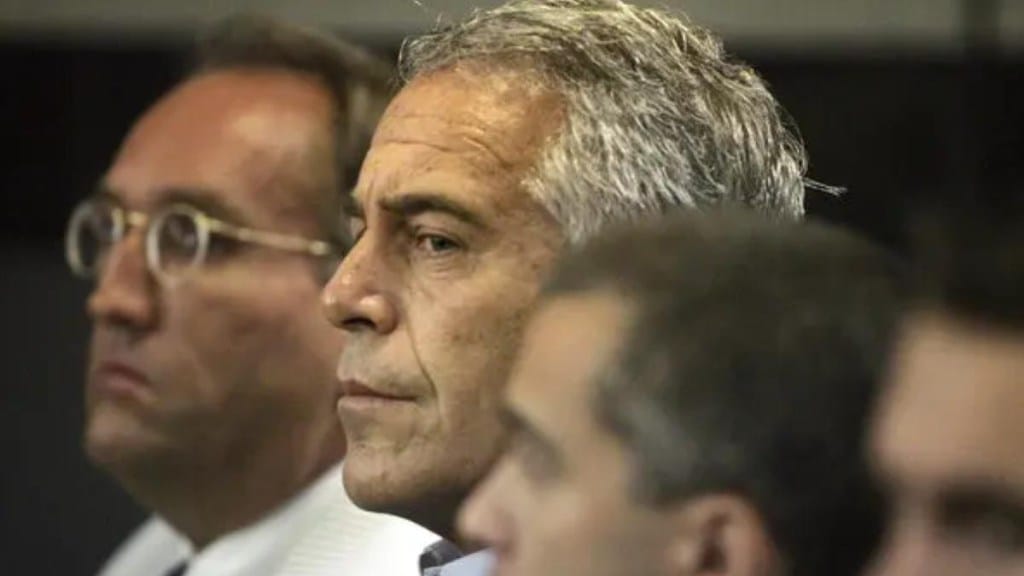

A review of thousands of emails connected to Jeffrey Epstein showed that major financial institutions and investment firms continued engaging with him despite public allegations and criminal proceedings. Emails obtained by Bloomberg News showed that Epstein continued to receive investment opportunities even after he pleaded guilty to state-level sex crimes.

The cache, comprising more than 18,000 emails from Epstein’s private Yahoo account, provided new detail on how Epstein operated as an investor and intermediary on Wall Street by leveraging long-standing relationships with banks, hedge funds and billionaire clients.

$1 million investment opportunity in 2006

In August 2006, weeks after Epstein was charged in Florida with soliciting prostitution, a Citigroup wealth manager invited him to invest in a feeder fund linked to Renaissance Technologies, one of the most successful hedge funds globally. At the time, media outlets were reporting allegations that Epstein had paid teenage girls for sex.

Epstein committed $1 million to the fund through his Financial Trust Company. The investment closed days before the Palm Beach Post published an editorial detailing the allegations against him, Bloomberg reported.

A spokesperson for the wealth manager involved told Bloomberg that the interaction was professional and that the adviser did not learn about Epstein’s crimes until later.

Continued access after guilty plea

Epstein pleaded guilty in June 2008 to state charges in Florida, including procuring a minor for prostitution and served 18 months in jail. It has previously been reported that JPMorgan Chase & Co. and other financial institutions continued working with Epstein after that conviction.

The newly obtained emails showed that Epstein’s Wall Street access extended beyond traditional banking relationships to include hedge funds, investment advisers and billionaire family offices, both before and after his guilty plea, Bloomberg reported.

Congressional investigators are examining the conduct of financial institutions that did business with Epstein. President Donald Trump signed legislation requiring the Justice Department to release records related to Epstein.

Bear Stearns relationship

The emails detail Epstein’s long and complex relationship with Bear Stearns, where he had worked briefly in the early 1980s before leaving under disputed circumstances.

Despite his departure, Epstein later invested tens of millions of dollars in Bear Stearns funds and stock through his entities. He also chaired Liquid Funding Ltd., a Bermuda-based investment vehicle co-owned by Bear and oversaw Bear accounts linked to billionaire retail executive Les Wexner, Epstein’s most significant client.

When Bear Stearns hedge funds collapsed during the subprime mortgage crisis in 2007, Epstein initially supported a group of investors seeking to remove fund leadership and investigate losses. Emails show that Epstein directed his attorney, Darren Indyke, to participate in the effort.

However, subsequent emails indicate that Epstein later withdrew support and shared internal communications with then-Bear CEO Jimmy Cayne. After Bear Stearns collapsed and was acquired by JPMorgan, Epstein prepared a lawsuit seeking more than $70 million in damages, alleging fraudulent misrepresentation, Bloomberg report stated.

Court records showed Epstein later settled related claims for about $9 million in 2011.

Adviser relationships and client overlap

The emails reviewed by Bloomberg showed repeated instances where financial advisers treated Epstein and Wexner family trusts interchangeably when allocating investments. Advisers sought Epstein’s direction on whether trades should be placed under his own entities or those linked to Wexner.

At Merrill Lynch, adviser Ed Spector discussed currency trades and leveraged investment strategies involving both Epstein and Wexner. Some opportunities were described as limited to clients with net worth exceeding $1 billion.

While Spector expressed internal concerns in emails about certain requests from Epstein, business dealings continued. Epstein remained eligible for exclusive investment opportunities after his July 2006 arrest. Spector died in 2009.

Hedge funds and private capital

The emails showed Epstein in contact with Icahn Capital Management, founded by billionaire investor Carl Icahn. Epstein received revised fee schedules and investment terms typically shared only with investors.

Other investment firms pitched Epstein strategies designed to profit during market declines, including volatility trades linked to Indian equities. These discussions continued into mid-2008, while Epstein was preparing to plead guilty in Florida.

In one email exchange, a former Bear Stearns executive confirmed that trading could begin immediately and attached documentation for a $5 million investment.

Role as adviser to billionaires

Beyond managing investments, the emails showed Epstein acting as a strategic adviser to wealthy clients. For Leon Black, Epstein reviewed internal governance, criticised senior executives and advised on family office structure.

Epstein also exerted broad influence over Wexner’s personal and business affairs, including financial planning, executive assessments and personal expenditures.

Continued engagement after conviction

Financial outreach to Epstein continued years after his 2008 guilty plea. Emails show communications with Morgan Stanley in 2016 regarding derivatives strategies.

Epstein continued receiving investment proposals into 2018, including opportunities in energy, carbon trading and entertainment. One proposal involved backing a Broadway musical about singer Donna Summer. Epstein did not invest.

Federal prosecutors charged Epstein in July 2019 with sex trafficking minors. He died in jail the following month.