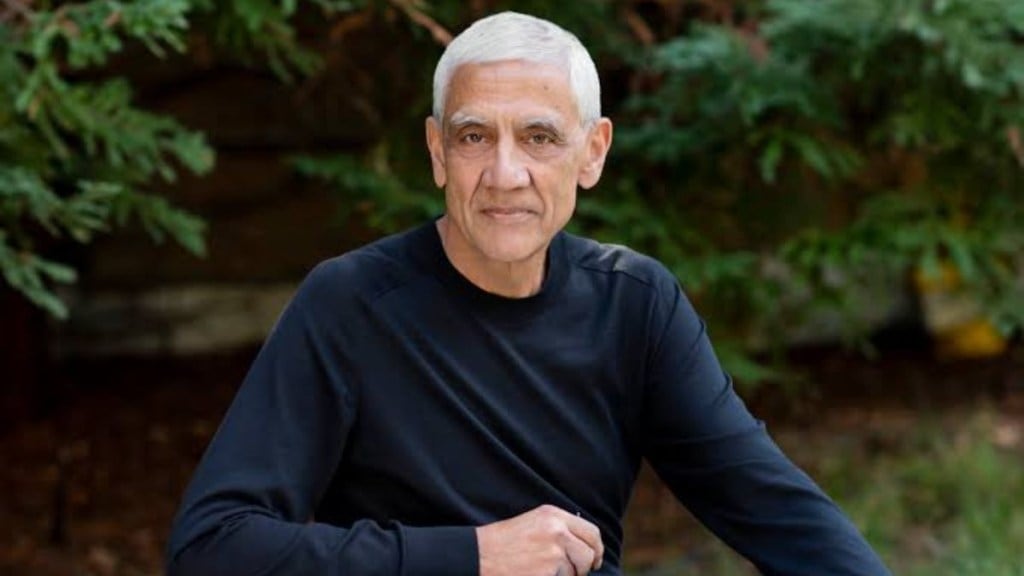

Venture capitalist Vinod Khosla has made waves in recent days for his somewhat grim outlook towards the markets — predicting a ‘collapse in valuations’ and assurance that AI would ‘take 80% of jobs in five years’. Against this backdrop, his earlier comments about the origin of major innovations have also come to the fore. Khosla argued during an event in late 2024 that it was entrepreneurs rather than corporations who could instigate a “true disruption”.

‘Instigators show the way’

“In the 40 years I’ve been doing innovation (and I’ve only done technology-based innovation), I can’t think of a single example of large-scale innovation that was done by a large player…or a large Institution, government program. I like to put it this way: Did Amazon reinvent retailing or was it Walmart/Target?” he asked during the Masters of Scale interaction.

Khosla opined that a similar situation was seen across industries — including healthcare — with “instigators showing the way” for big companies to “pile on” eventually.

“Vaccines were done by startups. Now big companies help…they pile on. Today, we are dependent on the big auto companies to build EVs. But they’ve all switched because somebody has shown the way. And that’s what instigators do…and that is happening in healthcare. Vaccines were done that way. Almost all the large innovations is happening at many levels…” he told the interviewer.

‘Investments will lose money’

Khosla predicted earlier this month that the “vast majority” of investments will likely lose money in 2025, stressing the need to make the ‘right’ financial choices. The billionaire businessman also noted that recent developments would also bring “many more opportunities than we’ve ever seen before” — which could be “good news” for entrepreneurs.

“I might even guess north of 80% of investments…more money will be made than lost. Of the next thousand startups, 990 can lose money, and you can still make money by investing in the right portfolio. So…I do think we will see that. I do think we will see a collapse in valuations,” he warned during a podcast with Nikhil Kamath.