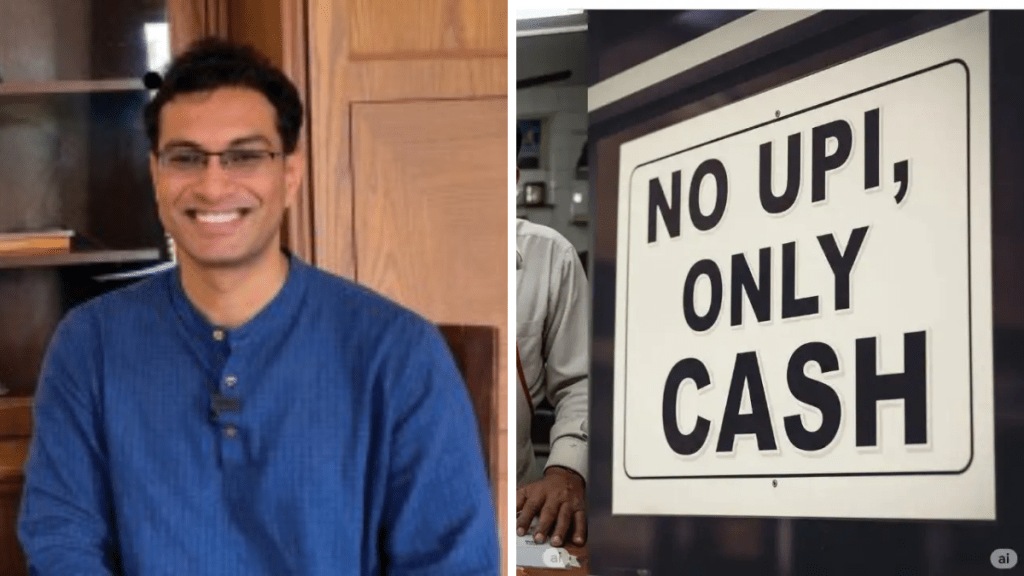

A large number of small shopkeepers across India are moving back to cash payments and skipping digital transactions. The decision comes amid rising concerns over small profit margins, complications related to Goods and Services Tax (GST), and fear about income scrutiny. According to Investor Akshat Shrivastava, small traders are facing mounting pressure to conform to formalised tax systems without the necessary support or infrastructure.

GST Burden Leading to Price Hikes, Drop in Sales

A key issue pushing small businesses toward cash payments is the fear of GST implications. Many of these vendors operate with razor-thin profit margins. If they register under GST, they would be required to add 5–18% GST to the final price of goods or services. This addition makes their offerings costlier, leading to a potential dip in sales as price-sensitive customers often prefer cheaper alternatives.

Shrivastava argues that while GST is meant to be collected on behalf of the government, the real-world impact is on end-user pricing. “Buyers only care about what they’re paying,” he notes. “If a small shopkeeper suddenly raises prices due to GST, it directly affects customer demand.” Thus, in the pursuit of maintaining affordability and retaining customers, many small vendors opt to stay out of the GST system—effectively avoiding digital records that could trigger registration obligations.

Informal Accounting and Financial Inclusion Gaps

Another factor driving this shift is the informal nature of accounting among small traders. Many do not differentiate between personal and business finances. For instance, a father might receive UPI payments meant for his children or relatives using the same account. This unsegregated financial activity can be misinterpreted as business income, inviting potential tax or GST liabilities.

In several cases, family members of these shopkeepers do not even have bank accounts, making the use of a single shared account necessary. “Expecting small vendors to practice enterprise-level accounting is unrealistic,” Shrivastava writes.

Criticism of Enforcement Focus on Small Vendors

While acknowledging that some small businesses do evade taxes, Shrivastava questions the government’s enforcement priorities. He argues that focusing enforcement on small vendors while large-scale financial irregularities often go unchecked shows a skewed approach. “1000s of crores are wasted or syphoned off by the powerful, but the focus is on extracting 100s from small traders,” he says.

The commentary, which has gone viral on LinkedIn, has sparked a larger debate on how India can improve tax compliance and digital adoption without penalising its smallest entrepreneurs.