In 2025, the Reserve Bank of India (RBI) has, thus far, cut the policy rate by 50 basis points (bps) – 25 bps in February and another 25 bps in April. One basis point equals 0.01%. The policy repo rate currently is 6%.

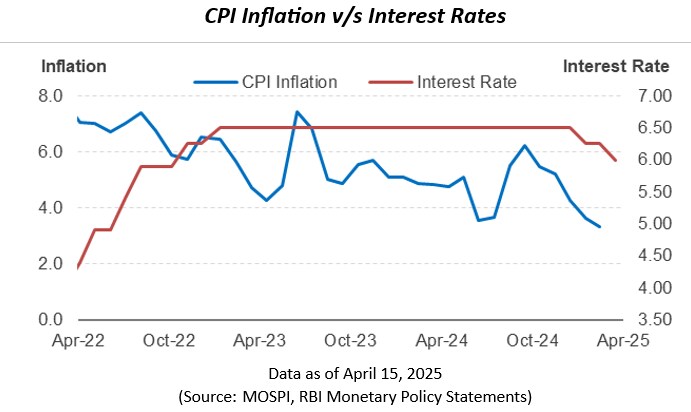

The easing of CPI inflation has nudged the central bank to cut rates and support economic growth. The CPI inflation is well within the RBI’s target of 4% (+/- 2%). The central bank is also confident that inflation will remain in this range over a 12-month due to lower food prices.

CPI Inflation v/s Interest Rates

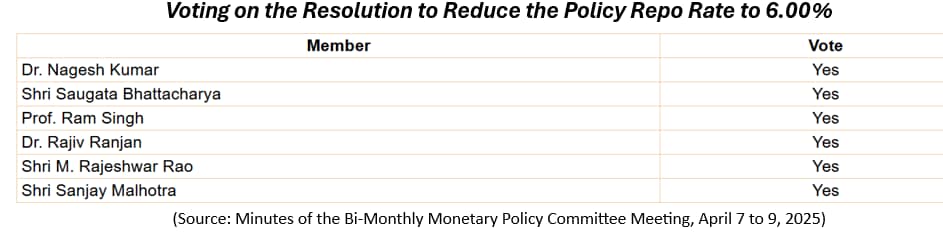

Moreover, challenging global economic conditions and a moderate growth outlook have resulted in the six-member monetary policy committee (MPC) of the RBI vote in favour of rate cuts to support growth.

Voting on the Resolution to Reduce the Repo Rate to 6%

In its last bi-monthly meeting held in April 2025; the MPC also decided to change its stance of monetary policy from ‘neutral’ to ‘accommodative’.

However, the MPC noted that the rapidly evolving situation requires continuous monitoring and assessment of the economic outlook.

Impact on the Bond Market

Now, those who are investing in the Indian debt market may know that interest rates and bond yields are directly related to each other i.e. bond prices go up when interest rates fall and vice versa.

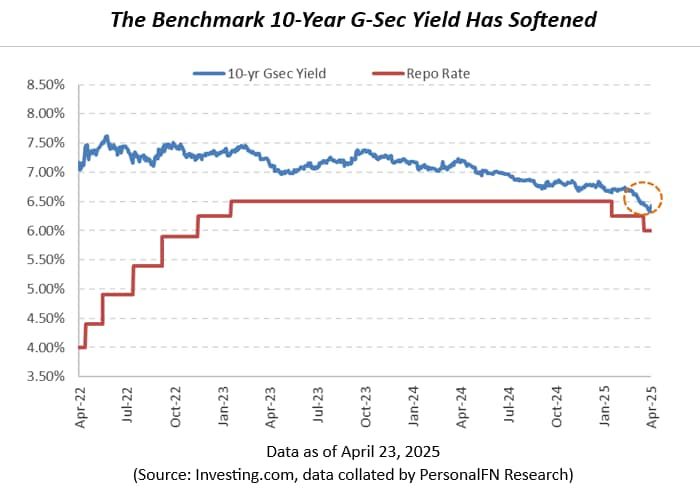

That is playing out right now in the bond market. The long-term Indian bond yields have softened in the past couple of months.

The Benchmark 10-Year G-Sec Yield Has Softened

Since the February 2025 MPC meeting, as the RBI cut the policy repo rate for the first time since the COVID-19 pandemic, India’s 10-year G-sec yield has softened by 27 bps.

In 2025, so far, the fall in the benchmark yield has been 35 bps. In fact, the benchmark has eased by 15 bps so far to 6.43% this month as of 23rd April.

If we look at long-term bonds, the yield of the 40-year 2064 bond is also down 7 bps since the start of the month to 6.78% as of 23rd April.

Even the yields of the medium tenor bonds of 3-year (maturing in 2028) and 5-year (maturing in 2030) have fallen by 28 bps and 22 bps to 6.04% and 6.12%, respectively as of 23rd April.

Currently, bond yields in the Indian debt market are at a 3-year low with positive FPI flows in the Indian debt market.

The inclusion of Indian bonds in JPMorgan’s emerging market debt index and RBI’s timely liquidity infusion into the system in the recent past have also helped. Besides benign headline inflation outlook, and thus rate cut expectations, have helped.

The fall in bond yields has augured well for the Indian debt market, as bond prices and yields are inversely related to each other. Simply put, when yields move down, bond prices go up and vice versa.

The current scenario is proving favourable for debt mutual funds, particularly the ones holding longer-maturity debt papers such as Medium to Long Duration Debt Funds, Long Duration Funds, and Gilt Funds.

Path of Interest Rates

The RBI has observed that there has been a decisive improvement in the inflation outlook. CPI inflation is currently well below the target, supported by a sharp fall in food inflation.

Now there is greater confidence of a durable alignment of headline inflation with the target of 4% over a 12-month horizon.

What’s more, due to an uncertain and challenging global environment, the MPC is of the view that it should support growth.

In the minutes of the last MPC Meeting, 7 to 9 April 2025, RBI Governor, Sanjay Malhotra states:

“The global economic landscape remains in a state of flux amidst heightened trade and policy uncertainties, with attendant implications for economies across the world, posing complex challenges and trade-offs in policy making.

The channels through which these global shocks could impact economies, particularly emerging market economies, include spillovers from global growth slowdown, elevated financial market volatility and dented consumer and investor confidence.

The Indian economy remains relatively less exposed and better placed to withstand such spillovers with its growth driven largely by domestic demand. Nevertheless, we are not immune to the aftershocks and ripple effects associated with global disturbances.”

As regards inflation, Governor Malhotra writes:

“There is now greater clarity on the food inflation outlook as the uncertainties related to rabi crops production have abated.

Core inflation (excluding fuel and food), although inching up to 4.1 per cent in February 2025 from 3.6 per cent in January, continues to be around the 4 per cent mark, suggesting that underlying inflationary impulses in the economy are benign and well-anchored.

Moreover, the decline in crude oil prices should impart a softening bias to the inflation outlook.

Coming to the imposition of tariffs, in my view, the implications for inflation are two-sided. On the upside, uncertainties may lead to possible currency pressures resulting in imported inflation.

On the downside, slowdown in global growth will further soften commodity and crude oil prices, which would ease the pressure on inflation.

Overall, favourable factors for the inflation outlook outweigh those with possible adverse impact and should drive further disinflation in the headline CPI. It is expected that inflation will be well aligned to the target during the current financial year.”

He has also expressed that going forward, considering the evolving growth-inflation trajectories, monetary policy needs to be accommodative.

Against this backdrop and the fact all six members are on the same page as regards policy rates, and the accommodative stance, it is possible that the RBI would cut the repo rate by another 25 bps in the next MPC meeting scheduled from 4th to 6th June).

An additional policy repo rate cut would prove supportive for growth. It would give a boost to domestic demand, push private consumption, and improve the growth momentum.

This is critical when global uncertainties have amplified downside risks to growth.

Strategy to follow now when investing in debt instruments

Those preferring bank Fixed Deposits (FDs) for stable/fixed returns to manage their cash flow needs, such as risk-averse investors and retirees, should go ahead and invest now before interest rates on deposits go down further.

To maximise the returns on bank FDs, consider following the ‘laddering strategy’ whereby you can maximise returns and take care of your liquidity needs.

Coming to investment in debt mutual funds, you need to be selective of the subcategories. As bond yields have dropped and the repo rate may be cut further, it would be meaningful to invest in Medium-to-Long Duration Debt Mutual Funds.

That said, keep in mind that Medium-to-Long Duration Debt Funds are moderate-to-high-risk funds. This is due to the interest rate sensitivity of these funds, as well as the fact that there is a slight credit risk.

A point to note here is that the higher the modified duration of the scheme, the higher will be its sensitivity to interest rates.

To take a calculated risk, make sure the maturity profile of the scheme is up to 5 years or so with G-secs making up around 30%. For this, evaluate the portfolio characteristics of the scheme and check the investment processes and systems followed by the fund house.

You may allocate around 25% of your debt mutual fund portfolio to some of the best Medium-to-Long Duration Debt Funds, keeping an investment horizon of 3 to 5 years.

To play the interest rate cycle dynamically in short and medium-to-long maturity debt papers, some of the best Dynamic Bond Funds can be a meaningful choice, provided you have an investment horizon of 3 to 5 years.

Regardless of the direction in which interest rates move, Dynamic Bond Funds are capable of taking advantage of dynamic market conditions and can invest accordingly to create an all-season portfolio that generates optimal returns.

Nevertheless, it is critical to invest in Dynamic Bond Funds that hold a robust portfolio of securities across maturities and high-quality debt & money market instruments. Around 25% of your debt mutual fund portfolio could be allocated to some of the best Dynamic Bond Funds.

Similarly, investing in some of the best Banking & PSU Debt Funds can be a good alternative if you have an investment time horizon of around 2 to 3 years.

Banking & PSU Debt Funds have exposure to debt papers across the yield curve but typically maintain a duration of around 3 to 5 years.

Banking & PSU Debt Funds are mandated to invest predominantly (80% of their assets) in top-rated corporate debt instruments issued by Banks, Public Sector Undertaking (PSUs), Public Financial Institutions (PFIs), Municipal bonds, and other such securities.

These entities are recognised for their robust credibility and liquidity compared to those from private issuers, making them a relatively safer investment option.

Around 25% of your debt mutual fund portfolio could be allocated to some of the best Banking & PSU Debt Funds.

For a shorter investment horizon of up to a year or so, it would be better to stick to some of the best Liquid Funds having the least or no exposure to private issuers.

Ideally, you would be better off with Liquid Funds that invest predominantly in Government securities (G-Secs), quasi-government securities, AAA/A1+ rated Public Sector Undertakings (PSU) debt, and T-bills.

In these funds usually there is no private corporate credit risk, the portfolio is highly liquid, it is marked-to-market daily (whereby the declared NAV is real), the AUM trend is stable, and the portfolio is disclosed regularly.

Investing in some of the best Liquid Funds with portfolio characteristics and true to its label, is a sensible way to hold some money safe, whereby it can offer you liquidity, help address unforeseen circumstances and meet short-term financial goals.

Words of caution when investing debt funds

Debt funds, in general, are not risk-free, and hence choosing the safety of the principal over returns is imperative. It is unlike investing in a bank FD, where you earn fixed and stable returns, plus deposits as covered by the DICGC for up to Rs 5 lakh per bank.

Avoid debt funds that compromise on the portfolio characteristics and engage in yield hunting for higher returns.

To Sum Up…

Falling yields would prove favourable for bonds and the NAV of debt mutual funds, particularly Medium-to-Long Duration Debt Funds, Long Duration Debt Funds, and Gilt Funds.

If you follow a sensible approach to select respective schemes within these subcategories of debt funds it can be a rewarding experience.

Don’t just go by the past returns as they are not necessarily indicative of the future. Instead, to make a prudent choice, check the portfolio characteristics, the risk ratios, and the investment processes and systems followed at the mutual fund house.

Also, make sure to choose debt mutual fund schemes that align well with your personal risk profile, investment objective, and investment horizon. Follow a sensible asset allocation model.

Be a thoughtful investor.

Happy Investing.

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.