By Sandeep Budki

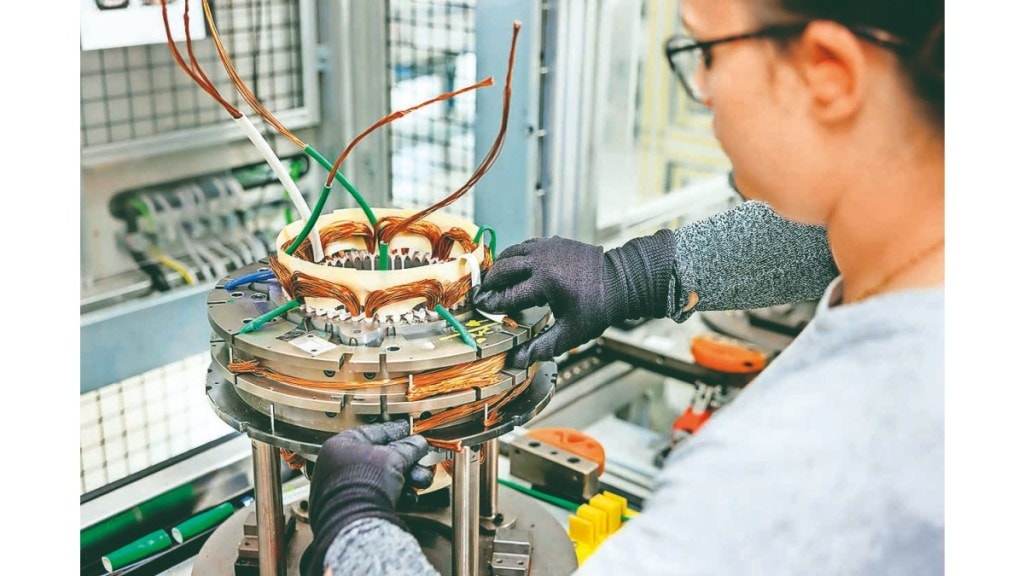

The recent rare earth magnet crisis, triggered by China’s export restrictions, has created supply chain disruptions across global automotive, defence and consumer electronics sectors. But there is also an upside. A new bunch of motor makers is designing solutions that replace rare earth magnets, particularly neodymium, most of which is mined and processed in China. The idea is to replace it with ferrite-based or magnet-free technologies that offer performance without geopolitical risk.

Among them is Chara Technologies, a Bengaluru-based startup that builds synchronous reluctance machines (SynRMs), motors that operate without any rare-earth elements.

Motors

“Most high-performance motors today use permanent magnets, but we’ve taken a different route,” said Bhaktha Keshavachar, CEO and co-founder of Chara. He said the company’s motors generate torque by guiding magnetic flux through preferred paths, avoiding magnetic attraction altogether.

While rare earth-free motors have historically faced trade-offs in weight and efficiency, Chara says its designs are closing the gap. “Our motors are about 15% heavier than typical permanent magnet motors,” Keshavachar said. “But for a 600 kg vehicle, an extra 3 kg is negligible. What you gain is cost predictability and supply chain resilience.”

Chara’s modular platform is already being deployed in electric two-and three-wheelers, agricultural machines, industrial automation systems and heavy-duty vehicles. “The technology is sector-agnostic,” Keshavachar said, adding, “We’re seeing adoption across use cases.”

In electric vehicles (EVs), rare earth magnets are essential in permanent magnet synchronous motors (PMSMs), the core of EV propulsion systems, ensuring high torque density, energy efficiency and reduced size of EV motors. They are used in defence guidance systems, missile actuators, radar systems; in consumer electronics, they are utilised in smartphones, speakers and hard drives.

Also building momentum is Conifer, a US-based company with R&D in San Francisco Bay Area and manufacturing operations in Pune. Conifer’s solution uses ferrite axial flux modular motors, which eliminate rare-earth magnets without compromising output. “Our motors boost electric vehicle efficiency by up to 30% and reduce weight and size by more than 50% in industrial applications,” said Ankit Somani, co-founder of Conifer. “These are drop-in replacements for OEMs—no design changes are needed. And ferrite magnets are around one-fifteenth the cost of neodymium,” he added.

Conifer’s manufacturing model relies on a software-driven process that requires minimal tooling, enabling the company to reduce capital expenditures and scale quickly. “We’ve created a flexible production line that allows us to bring new products to market faster. “You’ll start seeing our solutions in consumer applications by the end of this year,” said Somani.

Meanwhile, Viridian Ingni Propulsion, based in Chennai, is taking a hybrid approach by combining reluctance-based torque with ferrite magnet assistance. “We achieve high efficiency without rare-earth magnets. Our motors are 15-20% heavier, and torque density is slightly lower for naturally cooled systems, but the cost advantage is massive,” said the founder, Sriram G. According to him, neodymium magnets can cost Rs 5,000 per kg, while ferrite magnets are available for around Rs 600. “We currently focus on the domestic market and aim to expand internationally by 2026,” he said.

All three companies stress the importance of local sourcing—not only to improve supply chain security, but to reduce environmental impact. “We source 100% of our materials from India, and ferrite magnets are globally available,” Somani said. Chara’s Keshavachar added, “Our materials are sourced both locally and through diversified global channels. Compared to rare earth mining and refining, the environmental footprint of our motors is far lower.”

India, which has seen rapid EV adoption in categories like two-wheelers, light commercial vehicles, and agri-vehicles, is a natural testing ground for such innovations. “These segments don’t need rare-earths,” said Somani, adding, “With the right policies, India could lead in scaling rare earth-free mobility.”

Keshavachar concurs: “Today, with the products we have developed, we can serve 100% of the off-highway market (agriculture, industrial, golf carts, turfcare, and more) without using a single gram of rare-earths. If we (India) play this right, with the right mix of R&D, scale-up support, and export push, India can lead the world in the next generation of motor technologies.”