With shareholders of Vedanta and Cairn India set to vote on September 8 and 12 on the proposed merger of the two Anil Agarwal-promoted firms, Vedanta chief executive officer Tom Albanese said the recently-made revised offer is final and would not be sweetened further. “The board has already made it clear that it is the final offer,” Albanese told FE.

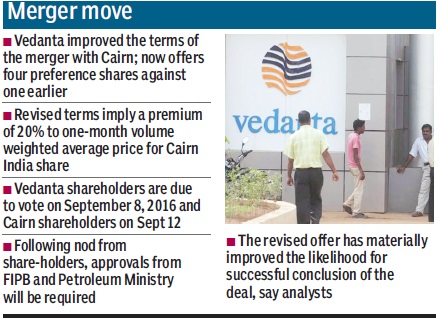

In the revised offer, minority investors of oil and gas explorer Cairn India will receive one equity share and four redeemable preference shares of Vedanta for each Cairn India share they hold. This is in contrast to the June 2015 offer where one equity share and one preference share had been offered.

While the 1:1 merger ratio is unchanged, Cairn shareholders will now receive four redeemable preference shares (RPS) with a coupon of 7.5% and tenure of 18 months compared with one earlier. The RPS will be listed on bourses, but their holders will also have an option to redeem them for cash after 30 days from issuance.

If shareholders approve the deal, nods from the Foreign Investment Promotion Board and the ministry of petroleum and natural Gas are required.

A calculation by HSBC Securities estimates Vedanta shareholders to gain R40/share, largely owing to cancellation of the inter-corporate deposit and faster generation of free cash flows. “Management also expects cost of debt to reduce by 1% from 7.5% on the back of potential re-rating. However, Cairn India has indemnity in the tax liability (currently under arbitration), which in the event of merger, would transfer to Vedanta Limited and is a concern,” it said in a note.

Sudhir Mathur, CFO and interim CEO of Cairn India, said the revised terms take into account the change in the market conditions over the last six months. “Shareholders are pleased with the idea that the deal has been sweetened and they will get more preference shares than what they were getting in the past. They appreciate a few things in the revised offer,” Mathur said.

The consolidated gross debt of Vedanta as on June 30 stood at R76,953 crore, while the cash and cash equivalents were at R52,299 crore. This implies the net debt of Vedanta at R24,654 crore. On the other hand, Cairn India has cash reserves of more than R23,300 crore.

Shareholders have raised concerns that Vedanta would utilise Cairn’s cash to get rid of its debt. Meanwhile, Vedanta Group firm THL Zinc has sought a rollover of a $1.25-billion loan from Cairn India in July 2014.

Replying to the concern, Albanese said the discussion is always “around value.” “I just want to make it clear that the Vedanta Limited balance sheet is strong, if it was a graded instrument, we do not have a rating of Vedanta Limited, but we do have one for Vedanta Plc, but in that case Vedanta Limited would have been the best in grade. It does have debt, but the debt, for instance of the aluminium business is managed by the aluminium business,” he said.

London-based Anil Agarwal’s conglomerate claims that the final term provided 20% premium to the market and is quite untypical of other Indian transactions, where ‘minority shareholders see discount.’ “We are providing a 20% premium to the market for Cairn India minority shareholders,” said Albanese.

Credit Suisse said Vedanta have proposed revised terms after extensive consultations with stakeholders, and it expect these terms to be acceptable to minorities. “Cairn trades at a 7% discount to the transaction price, which should narrow as the deal approaches closure. The shareholder vote (September 16) and petroleum ministry approvals (with no change of terms) can be key catalysts,” it said.

Vedanta is trying to woo its shareholders saying this merger will help create a stronger diversified company. The price movements over the past few months have reinforced these synergies. So, the merger will provide a buffer to the low price swings of commodities, particularly crude oil.