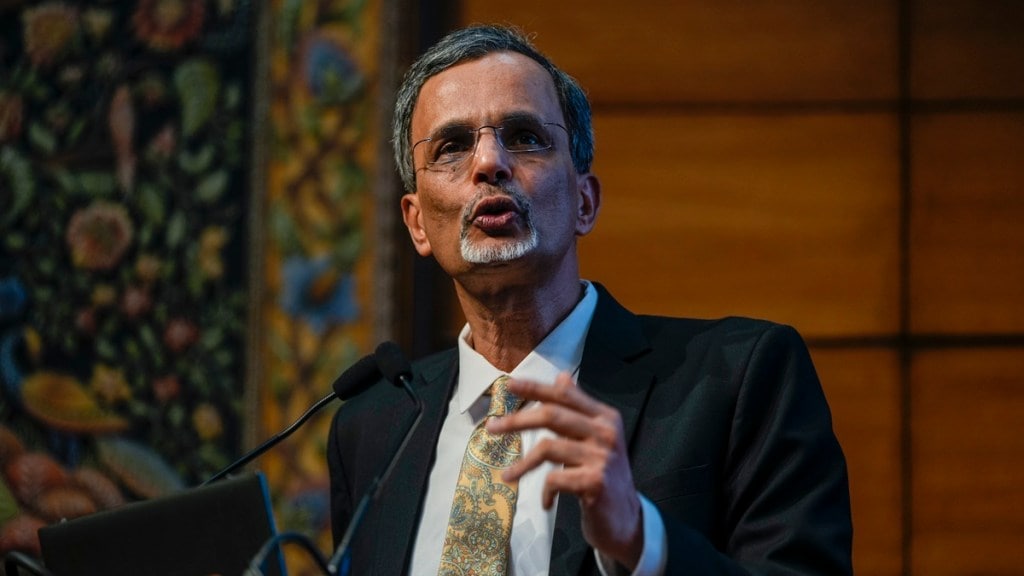

As the US trade court blocked President Donald Trump’s reciprocal tariffs from going into effect, V. Anantha Nageswaran, Chief Economic Adviser, Government of India, said that India has a few silver linings and this trade ruling adds to them. “There will be some sectors which will be advantageous for India from the tariff perspective,” said Anantha Nageswaran as quoted by a CNBC TV18 report. He said that the lower energy prices and reversal of punitive tariffs open up new avenues for Indian exporters. Nageswaran was speaking at the CII Annual Business Summit.

Earlier today, a US trade court blocked Trump’s reciprocal tariffs from going into effect, ruling that the President overstepped his authority by imposing across-the-board duties on imports from nations that sell more to the United States than they buy. “The court does not pass upon the wisdom or likely effectiveness of the President’s use of tariffs as leverage. That use is impermissible not because it is unwise or ineffective, but because [federal law] does not allow it,” a three-judge panel said in the decision.

Anantha Nageswaran said that this judicial intervention comes as a potential opportunity while outlining how it could play into the country’s broader economic strategy for FY26.

“Regardless of how the tariff numbers will play out after 90-day expiration from the liberation day, or 90 days given to China, there will be some sectors where India did not enjoy an advantage before, but there will be some sectors which will be advantageous for India from the tariff perspective,” Nageswaran said.

Meanwhile, the broader macroeconomic backdrop also supports cautious optimism. “Monetary policy is less unfavourable compared to 2024,” the CEA noted, pointing to a more stable interest rate regime and manageable inflation levels.

It is worth noting here that RBI Governor Sanjay Malhotra, post the MPC’s April meeting, had announced a 25 bps cut in the repo rate while also changing stance to accommodative from neutral. Furthermore, India’s retail inflation, based on the Consumer Price Index (CPI), for April stood at 3.16 per cent, down from 3.34 per cent in March. This is down 18 basis points in comparison to March 2025.

Looking ahead, Anantha Nageswaran said that India is targeting a 6.3-6.8 per cent growth in FY26 which is a ‘reasonable aim’ and is agreed by the International Monetary Fund (IMF) too. Earlier, Moody’s too upgraded its FY26 growth forecast to 6.2 per cent YoY (vs 6.1 per cent) and 6.5 per cent YoY (vs 6.3 per cent) for F2027.