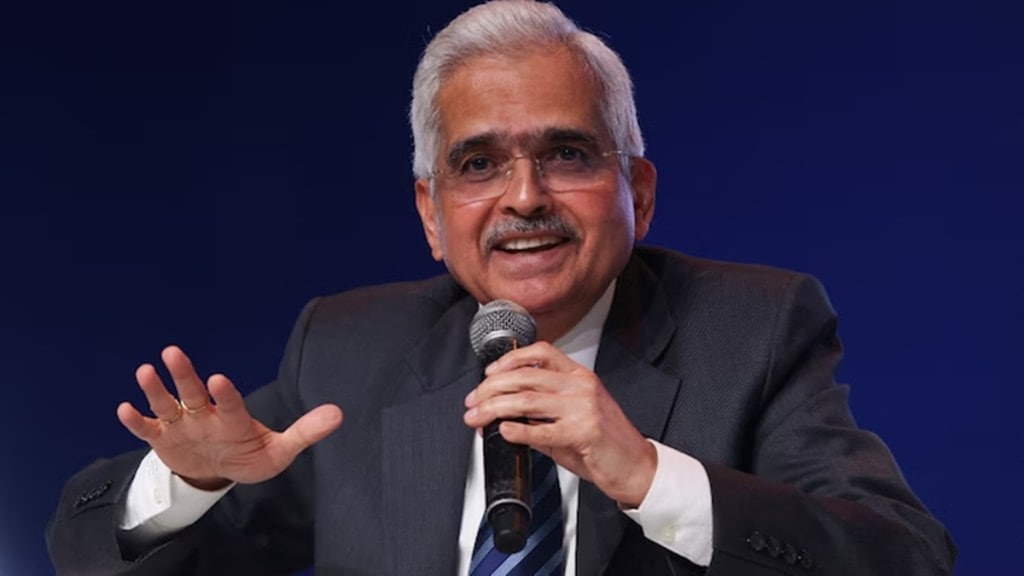

Stable inflation acts as the foundation for sustained economic growth, boosts people’s purchasing power, and creates a stable environment for investment, Reserve Bank of India’s (RBI) governor Shaktikanta Das said on Thursday. The governor’s comments follow recent calls from finance minister Nirmala Sitharaman and commerce and industry minister Piyush Goyal for interest rate reductions to stimulate economic growth.

“A stable inflation or price stability is in the best interest of the people and the economy. It acts as a bedrock for sustained growth, enhances the purchasing power of the people and provides a stable environment for investment,” Das said in his address at the High-Level Policy Conference of Central Banks from the Global South.

Earlier this week, the finance minister urged the banks to reduce the cost of borrowing for businesses by making interest rates “affordable.” Similarly, Goyal said last week that RBI should cut the key benchmark interest rates to boost economic growth and ignore food prices while deciding on monetary policy.

Although the apex bank changed its monetary policy stance to ‘neutral’ from ‘withdrawal of accommodation’ in October, it has kept the repo rate unchanged at 6.5% since February 2023 due to high inflation. The recent hike in prices have further dashed the hopes of a rate cut in December. The Consumer Price Index (CPI) jumped to a 14-month high of 6.21% in October from 5.5% in September, breaching the RBI’s comfort level of 6%.

The governor noted that price stability is equally important as growth. It allows economic agents to plan confidently, reduces uncertainty and inflation risk premiums and encourages savings and investment. “In the long run, price stability supports sustained high growth. Price stability is also important because high inflation is disproportionately burdensome on the poor,” Das added.

The governor said that resilient growth has given the central bank the space to focus on inflation to ensure its durable descent to the 4% target.

He added that the RBI has actively used communication to manage expectations. “When conditions warranted, we combined rate and liquidity operations with appropriate forward guidance for greater effectiveness of our policies,” he said.

Das stressed the role of fiscal-monetary coordination, particularly for countries in the Global South. “Effective fiscal-monetary coordination was at the core of India’s success in the face of a series of adverse shocks. From this perspective, macroeconomic stability becomes a shared responsibility of both monetary and fiscal authorities,” he said.