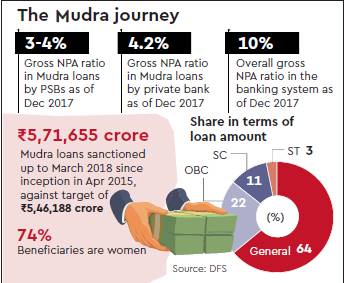

Housewives, poor widows and small and budding entrepreneurs seem to be more reliable in loan repayment than the promoters of some of the large corporations. Contrary to perceptions, loans under the Mudra Yojana — a pet initiative of Prime Minister Narendra Modi aimed at supporting budding entrepreneurs in vulnerable sections of society — had a gross non-performing asset (NPA) ratio of only 4% as of December 2017, much lower than roughly 10% for the entire banking industry. Interestingly, at 4%, state-run lenders (barring SBI) outperformed private peers’ record of 4.2% gross NPAs under this scheme, showed the latest data by the department of financial services.

SBI’s record was even better — only 3%, against its overall bad loans ratio of 10.35% as of December 2017. The performance of public sector banks (PSBs) in the Mudra scheme is in sharp contrast with their poor record in overall bad assets ratio, which is around two-and-a-half times of the private lenders’. To further promote this scheme, the DFS has roped in 40 entities — including Flipkart, Amazon, Patanjali and Amul that are also big job creators — which will identify people who need loans under Mudra Yojana.

Modi will interact with some of the Mudra loan beneficiaries through video conference on Tuesday. Some analaysts caution against excessive jubilation over low NPAs in Mudra loans yet, saying repayment tends to be higher in the initial years after the grant of a loan and may falter in later years.

However, a senior finance ministry official told FE that since most of the Mudra loans are for a short duration of up to three years and the fact that the scheme already completed three years in April — a reasonable period for a fair assessment of a short-duration loan scheme — the NPA record is still impressive. “Mudra loans are short-term ones and unlike long-duration credit to industry where NPA levels can potentially rise in later years even if initial repayments are on schedule,” said the official.

Nevertheless, both the government and banks have to be careful in not letting this scheme abused by fraudsters, especilly because loans are usually collateral free until some assets are created out of them, while ensuring that the intended beneficiaries reap the benefits, said the analysts.

Apart from low bad debt levels, what makes this scheme impressive is its inclusive character. Financial services secretary Rajiv Kumar said as many as 74% of the Mudra scheme beneficiaries are women. People belonging to SC/ST and OBC categories make up for 36% of loans worth close to Rs 5.72 lakh crore that were sanctioned by end-March since the scheme’s inception in April 2015.

As many as 55% of the 12.77 crore loan accounts belong to these categories of people. Over 9 crore loans were offered to women entrepreneurs, cutting across all categories.The finance ministry hopes its tie-ups with the 40 entities will attract more such entrepreneurs to benefit from the scheme and boost inclusive growth.