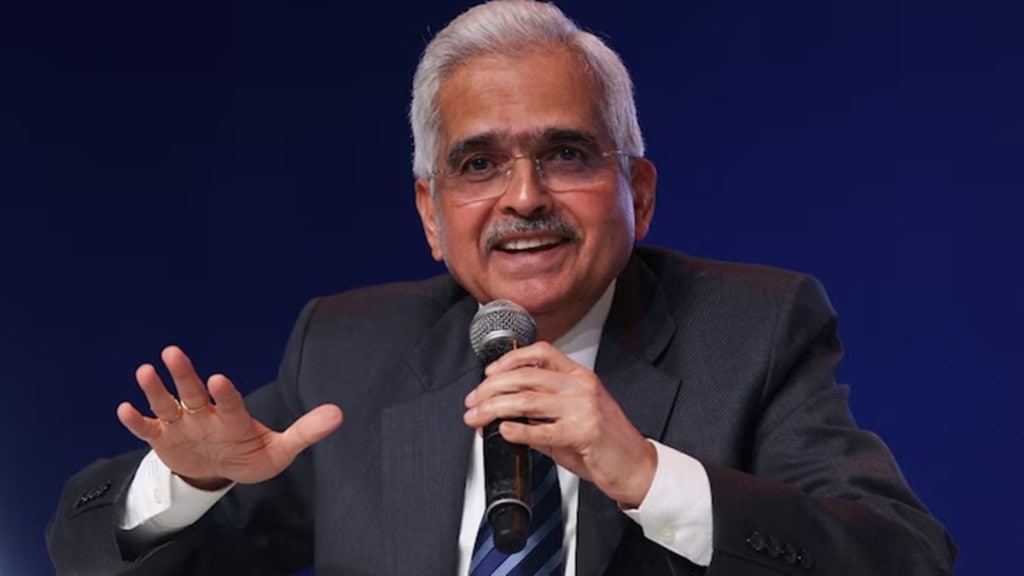

Reserve Bank of India (RBI) governor Shaktikanta Das on Thursday spoke about the central bankers’ perennial dilemma—doing ‘too little or too late’ versus ‘too much or too early’. “During this entire period of great volatility, maintaining price and financial stability has posed difficult trade-offs as evident among others from the banking sector turmoil in certain advanced economies in early 2023,” Das said.

He, however, refused to comment on commerce minister Piyush Goyal’s suggestion for a rate cut and reinforced that the rate-setting panel will take an appropriate call on it at its next meeting in December. “The Indian economy is sailing smoothly, powered by buffers like strong macroeconomic fundamentals, a stable financial system and a resilient external sector,” Das said.

He said that RBI’s “neutral stance from the “withdrawal of adoption” stance adopted at its last meeting in October provides “greater flexibility and optionality to act in sync with the evolving conditions and the outlook.”

Das said: “Reading the interplay between monetary policy action and the developments in the financial sector as well as the evolving situation correctly, and the timing of the decisions, is always challenging. Central banks, by and large, performed well this time around.”

He also said while ‘soft landing’ has been ensured, risks of inflation coming back and growth coming down remains.

Despite the rise in the last few months, Das expects that the Consumer Price Index (CPI) inflation to moderate. In October, the CPI hit a 14-month high of 6.2%, dashing hopes of a rate cut in December.

Das highlighted that emerging economies have shown greater resilience than advanced economies in this current phase despite escalation in geopolitical conflicts, and global trade is expected to be strong this year.

He noted that India has a relatively stable financial system, which has helped the country navigate these global challenges smoothly. India’s economy remains steady due to a robust external sector, strong economic buffers, and proactive measures by the banking regulator.

Also, as the holder of the world’s fourth-largest foreign exchange reserves, India has enough firepower to cover 12 months of imports. India’s merchandise exports have rebounded in the current fiscal, and the digital payment system has become more efficient due to RBI’s initiatives.

While acknowledging that the financial system will continue to encounter new challenges, he said that the Expected Credit Loss (ECL) framework has been reviewed by an external committee, and the RBI has completed its examination of the findings. Additionally, Das said the RBI’s focus on climate risk and its potential impact on the financial system, with updated norms is expected to be released soon.

“We now propose to issue a draft circular for implementation of ECL. So, the draft will be followed by the issuance of a final circular again,” Das added.