India’s services activity growth momentum showed a pick-up at the end of the 2023 calendar year, rising from 56.9 in November to 59.0 in December, according to the data released by S&P Global. The seasonally adjusted HSBC India Services PMI Business Activity Index highlighted a sharp increase in output that was the most pronounced since September. Owing to lower readings in October and November, however, the latest quarterly average was the lowest since Q4 fiscal year 2022-2023.

According to S&P Global’s survey data, the demand buoyancy spurred sales, subsequently fuelling business activity. Job creation extended into a nineteenth successive month, while business optimism strengthened. Meanwhile, cost pressures receded further, reaching their lowest in nearly three-and-a-half years. Still, there was a quicker and solid upturn in selling charges.

Favourable economic conditions and positive demand trends were the key determinants of output growth, anecdotal evidence showed. Not only did new business intakes rise further in December, but also to the greatest extent in three months. The rise in total new business, it added, was supported by continued growth of international sales. Demand came in from clients based in Australia, Canada, Europe, the Middle East and South America during December. Having eased since November, however, the rate of expansion in new export orders was modest and the softest since June.

Pranjul Bhandari, Chief India Economist at HSBC, said, “India’s services sector ended the year on a high note, with an uptick in business activity, led by a three-month high new orders index. Input costs rose at a slower pace than in November, continuing the softening trend which began in mid-2023. But output prices rose at a faster pace, indicating improved corporate margins in December.”

Services firms in India expect the strong demand momentum to carry forward to 2024 which, coupled with advertising and better customer relationships, underpinned upbeat forecasts for output.

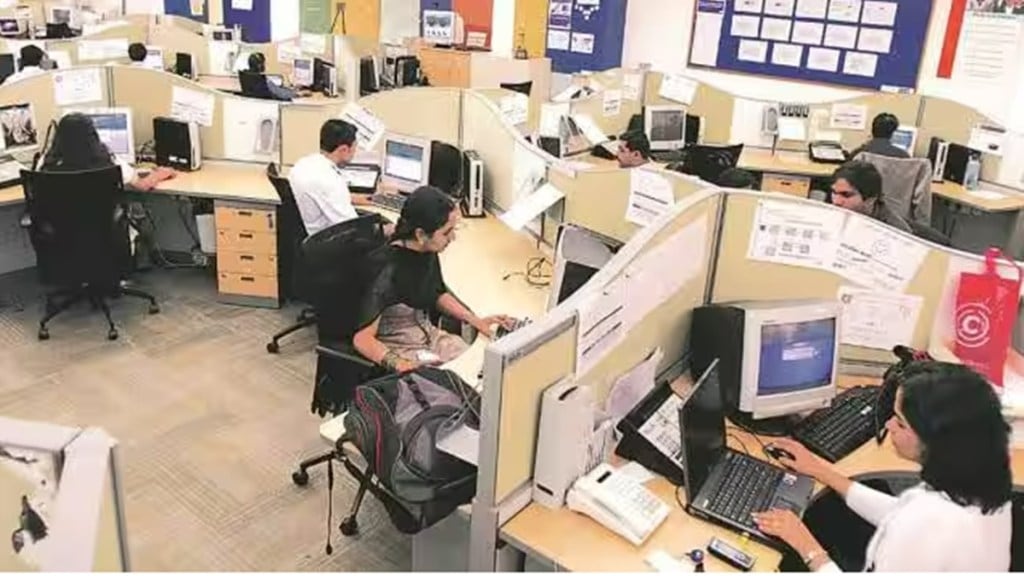

Elsewhere, the HSBC PMI data showed ongoing job creation in India’s service economy. Survey participants indicated that new workers had been hired on both full- and part-time bases. Although slight, the aggregate rate of employment growth was faster than in November.

Amid reports of higher prices paid for food and some other inputs, the average expense of services firms continued to increase at the end of the third fiscal quarter.