While the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) pulled off a bold move on June 6, opting for a front-loaded 50 bps rate cut, the minutes of the meeting hinted at a deeper strategic pivot. Aastha Gudwani, India Chief Economist, Barclays, said, “Based on our new CPI forecast of 3.5 per cent YoY for FY25-26, which is lower than the MPC’s forecast of 3.7 per cent, we expect another 25bp cut by the RBI MPC in Q4 CY25, and lower our terminal rate expectation to 5.25 per cent.” The brokerage firm said that the move will be driven by a desire to support aspirational growth amid a sharply disinflating economy, without unsettling financial market expectations.

Will the RBI cut again?

After the June MPC decision, it was argued that the rate easing cycle was done for now. After the three-day deliberations in June, RBI Governor Sanjay Malhotra too had stated that after having reduced the policy repo rate by 100 bps in quick succession since February 2025, “monetary policy is left with very limited space to support growth”.

The governor had also argued that the MPC will be “carefully assessing the incoming data and the evolving outlook to chart out the future course of monetary policy in order to strike the right growth-inflation balance”.

A few days after this, the May CPI inflation data was released. India’s retail inflation, based on the Consumer Price Index (CPI), for May stood at 2.82 per cent, down from 3.16 per cent in April. This was lower than the market expectations. Barclays added that the currently available daily price data for June indicate that the CPI inflation for the month could be 2.1- 2.3 per cent YoY, implying a 20bps undershoot vs the RBI’s 6 June estimate of 2.9 per cent YoY for the April-June quarter.

Further, in a recent media interview as well, Governor Malhotra had remarked that “if the inflation outlook turns out to be below our projections, it will open up policy space”. Based on the aforementioned factors and Barclays’ new CPI inflation forecast, the brokerage firm pegged the possibility of another 25 bps cut in Q4 CY2025.

A look at MPC’s decision to front-load rate cut by 50 bps

According to the recently released MPC minutes, supporting growth, hastening transmission and offering certainty were at the heart of the outsized rate cut decision announced on 6 June. “Softening of inflation and below target inflation outlook offered room for this front-loaded move, instead of a staggered one,” Barclays noted.

On June 6, The central bank’s MPC voted with a majority of 5-1 to reduce the policy repo rate by 50 bps to 5.5 per cent. The MPC also reversed the stance to ‘neutral’ from ‘accommodative‘, and the governor also announced a staggered 100bp cut in CRR in four tranches, starting from September 2025.

Key takeaways from RBI MPC minutes:

1) Almost all the members are convinced that inflation is set to undershoot the target in FY25-26, driven by lower food inflation. The gradual rise in core inflation is not indicative of demand pressures.

2) Uncertainty emanating from the external environment calls for domestic policy to offer support and certainty through a front-loaded cut, aimed at improving transmission and assisting domestic demand.

3) A front-loaded rate cut also needs to be accompanied by a neutral stance, lest we run a risk of mispricing of financial assets. A neutral stance offers the MPC the flexibility to be data dependent.

To conclude…

While the June cut was seen by economists and experts as the end of the current easing cycle, the RBI’s own guidance has left the door open for further action—should inflation remain below projections. Barclays also agreed with the possibility of another rate cut, however, it maintained that the central bank will not move in a hurry.

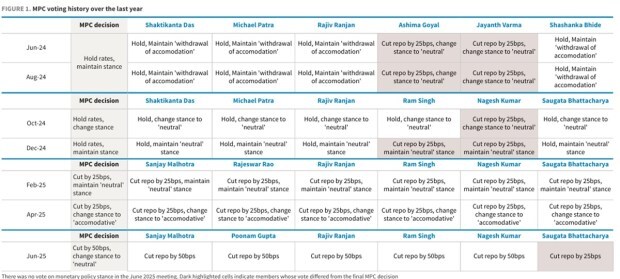

MPC voting history over the last year