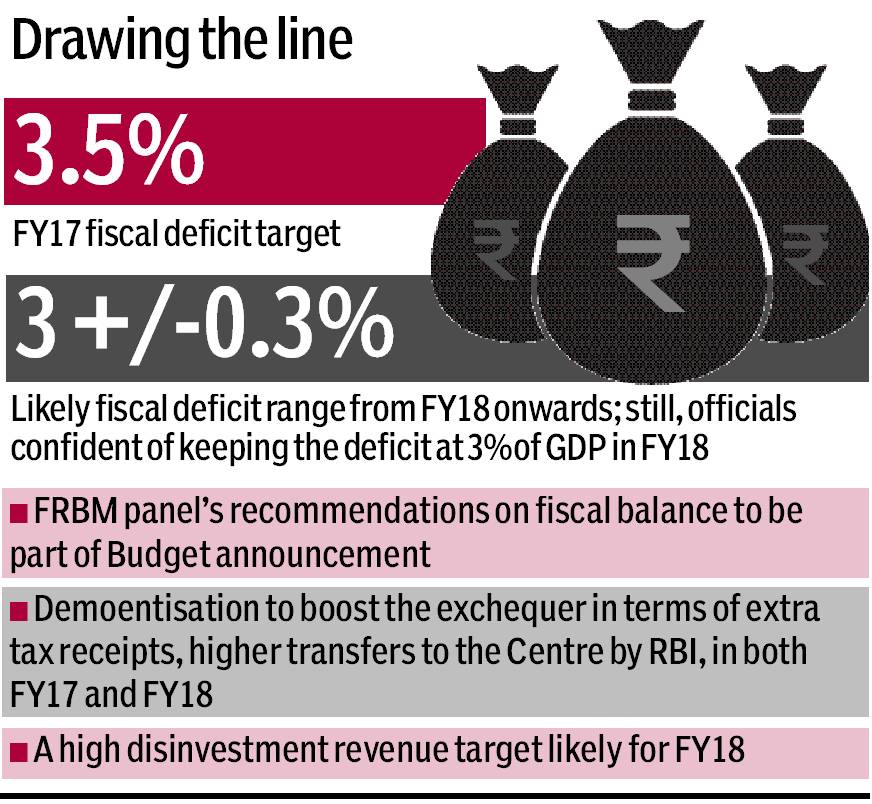

The Centre will very comfortably meet its FY17 fiscal deficit target of 3.5% of the gross domestic product (GDP) thanks to buoyant tax receipts, likely boosted further by the two income disclosure schemes announced in the year. However, it could set a fiscal deficit range as target for FY18 and thenceforth. This is because it’s incumbent on the government to step up spending. Also, the looming uncertainties over goods and services tax (GST) and how economic growth will pick up in the early part of the next year make a case for a slightly flexible target.

This will give the government legroom to have a deficit of, say, 3.3% for FY18, instead of 3% required under the fiscal road map announced in the FY16 Budget. However, a senior official told FE that the Centre might still try to adhere to the 3% target for next fiscal. Citing that India’s deficit is one of highest among G-20 nations, RBI governor Urjit Patel recently advised the Centre to cut down on borrowing and augment infrastructure spending.

Apart from robust tax revenue — especially from indirect taxes — and relatively strong performance on the disinvestment front, the fact that the recently released advance estimate put nominal GDP in FY17 at Rs 151.9 lakh crore, higher than the Rs 150.6 lakh crore budgeted, would also make meeting this year’s deficit target easier.

You May Also Like To Watch This:

In April-December of FY17, direct tax receipts grew by 12% while indirect taxes grew by 25% over the corresponding period last year. Official data showed that Centre’s excise duty collections rose 43% y-o-y (against 11% growth rate required to meet the annual target) in April-December 2016, helped greatly by higher taxes on petrol and diesel.

The annual growth target set in the Budget FY17 for direct and indirect taxes were 12.6% and 10.8%, respectively.

As for next year’s fiscal math, both direct and indirect tax receipts are expected to grow at a healthier pace thanks to demonetisation which has forced many entities to disclose a higher turnover than they declared earlier. Separately, steps being taken to scrutinise reported black money deposits of Rs 3-4 lakh crore post-demonetisation are also expected to fetch additional revenue, Sanjay Kumar, senior director at Deloitte, said.

There is a high probability that certain items which are now being taxed at rates lower than prescribed for them under the proposed GST regime could be moved up in the Budget itself, an exercise that could yield some extra revenue. “As for next year’s fiscal math, indirect tax collections should continue to drive total tax revenues. Excise duties – the largest component of indirect taxes at 2% of GDP – could, however, suffer if oil prices rally sharply and trigger duty cuts,” said Radhika Rao of DBS Bank.

As for expenditure, the emphasis will be as much on boosting consumption as on pepping up investment via capital expenditure, given the urgency of fighting the adverse effect of demonetisation. While some steps have already been announced to boost consumption, more sector-specific measures to reverse the slump in demand are likely in the Budget.

Even though the government and RBI are yet to announce how much of the Rs 15.5-lakh-crore scrapped high-value notes have come back to the banking system and the value of extinguished currency could be less than Rs 1 lakh crore, the government is also banking on a possible transfer from the central bank once the liability is nullified.

Separately, the PSU disinvestment target could be kept high next year given the string of candidates for strategic sales.

The government has already given the approval for strategic sale of nearly 20 PSUs, about which preparatory work is underway. Out of Rs 56,500 crore target from disinvestment, including strategic sale for this year, the government has raised nearly Rs 24,000 crore so far through a mix of buybacks and small stake sales.

Unlike between FY13 and FY15, when the fiscal deficits were reined in at budgeted levels by slashing expenditure, the Centre is poised to achieve the 3.5% fiscal deficit target for FY17 even after likely spending Rs 38,000 crore or so more than the Budget estimate of 19.78 lakh crore, sources said. As capital spending would get a boost next year, the Centre could look for more avenues to raise non-tax revenues as it does a balancing act to retain fiscal deficit target at 3%. The NK Singh committee, which is undertaking a comprehensive review of the Fiscal Responsibility and Budget Management (FRBM) Act and the FRBM road map, is likely to give its report to the government for incorporation in the Budget. Given the Modi government’s focus on government spending — which can’t be reined in the election year of FY19 — sources said the fiscal deficit range 3 +/- 0.3% was likely as the target from FY19 onwards.