Ease of Doing Business 2019: After being an underdog for years, India finally showed a huge progress on the World Bank’s Ease of Doing Business ranking by jumping 53 ranks in the last two years. Yet, the dream to enter the ‘top 50’ club remained incomplete.

After breaking into top 100 leapfrogging 30 ranks last year, India took a giant leap of 23 ranks this year to secure 77th rank on back many reforms.

However, Finance Minister Arun Jaitley said that there were many areas where the country needed significant improvement if it wished to continue with the success streak and make it to top 50 by next year.

Jaitley said that India can crack into top 50 if it improves on parameters such as time taken for registering real estate, starting business and enforcement of contracts.

Even as India became one of the top 10 improvers in the list of 190-countries, it lagged behind on many fronts. World Bank’s 2019 edition of EODB report showed that India needs dramatic improvement in at least five of the 10 parameters.

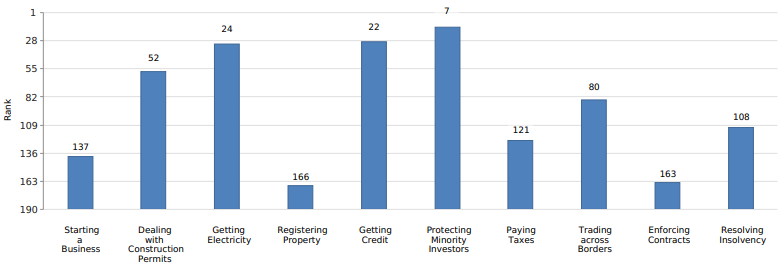

The World Bank’s Doing Business report assesses 190 economies on ten parameters — starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency.

Also Read – India jumps 23 ranks on World Bank Ease of Doing Business; becomes South Asia leader

The World Bank EODB report, which has unique significance among global investors, showed that India, despite some improvement, performed poorly on five parameters.

Where India needs improvement

- Starting a Business (Rank: 137; improved from 156)

- Registering Property (Rank: 166; improved from 181)

- Paying Taxes (Rank: 121; declined from 119)

- Enforcing Contracts (Rank 163; improved from 164)

- Resolving Insolvency (Rank 108; declined from 102)

It is interesting to note that two structural reforms — Goods and Services Tax (GST) and Insolvency and Bankruptcy Code (IBC) — emerged as winners but did not reflect significantly on their respective parameters ‘Paying Taxes’ and ‘Resolving Insolvency’ — leaving room for further improvement.

“India made paying taxes easier by replacing many indirect taxes with a single indirect tax, the GST, for the entire country,” the World Bank noted, also saying that the new indirect tax regime helped improvement under the ‘Starting a Business’ category as it made registering a business faster by replacing multiple layers in the earlier VAT regime.

Similarly, the IBC law helped India on ‘Getting Credit’ parameter, as the recovery of bad loans was made possible. “The establishment of debt recovery tribunals reduced nonperforming loans by 28% and helped in lowering interest rates on larger loans,” the report noted.

Where India fared well

- Dealing with Construction Permits (Rank: 52; improved from 181)

- Getting Electricity (Rank 24; improved from 29)

- Getting Credit (Rank 22; improved from 29)

- Protecting Minority Investors (Rank: 7; declined from 4)

- Trading Across Borders (Rank: 80; improved from 146)

The reason behind a huge jump in ‘Dealing with Construction Permits’ was the streamlining of the process for obtaining a building permit by making it faster and less expensive.

Moreover, the reduction in time for export-import documentation by allowing digital signature helped improve on ‘Trading Across Borders’.

Interestingly, despite a deterioration, India ranked among top 10 nations on ‘Protecting Minority Investors’. India, which has been doing well on Getting Electricity and Getting Credit, showed notable improvement this year.

Also Read – Ease of Doing Business: GST, IBC big winners; list of reforms that put India among top 10 improvers

“Over the last year, the government eased FDI rules across the various sector for ease of passage of investments apart from implementing GST and the Insolvency and Bankruptcy Code (IBC),” Richa Gupta, Senior Director and Senior Economist, Deloitte India said.

“Separately, the government had also announced the implementation of investor-centric online single window model for providing faster clearances and filing compliances,” she added.