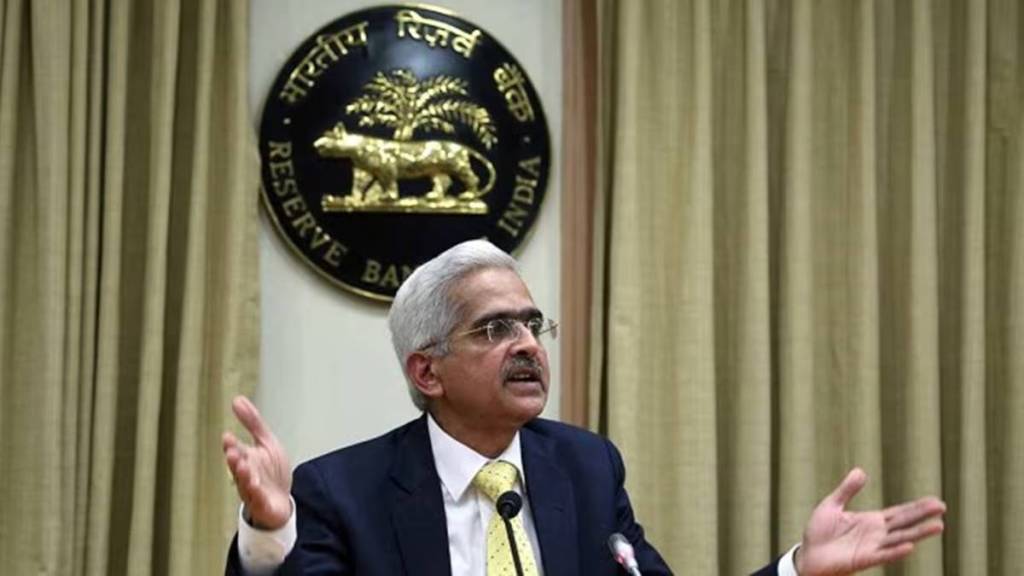

The priority of monetary policy should be on restoring the inflation-growth balance and aligning inflation to the apex bank’s target of 4%, said Shaktikanta Das, former governor, Reserve Bank of India (RBI), in the minutes of his last monetary policy committee (MPC) meeting, released on Friday. Lower inflation will enhance households’ disposable income and increase their purchasing power and this approach would support consumption and investment demand, Das said.

“The policy priority at this critical juncture has to be on restoring the inflation growth balance,” said Das while voting for a status quo on the short-term lending rate earlier this month. “The biggest support for higher growth would come from price stability,” he said.

In its December bi-monthly monetary policy, the RBI kept repo rate unchanged but cut the cash reserve ratio that banks are required to park with the central bank, as it did a balancing act between inflation management and supporting economic growth.

Four of the six MPC members voted to keep the repo rate on hold but two external members – Nagesh Kumar and Ram Singh – had voted for a 25 basis points reduction. “The gains achieved so far in the broad direction of disinflation need to be preserved, while closely monitoring the evolving outlook of both inflation and growth,” said Das. “The flexibility inherent in the neutral stance of monetary policy gives us the space to monitor the incoming data and assess the outlook for confirmation of our expectations on the fronts of inflation and growth,” he added.

It was the last meeting of the MPC under Das, who demitted office earlier this month after completing an extended six-year tenure. RBI deputy governor Michael Patra said private investment will want to see a robust revival of domestic demand to draw in the slack that it is now experiencing. The monetary policy stance, is open to support growth, but it must await the ebbing of inflation on a durable basis or else the uneven progress made so far in disinflation will get dissipated, he added.

GDP growth rate fell to 5.4% in the July-September quarter, its slowest pace in seven quarters, while inflation remains well over 4%.

“I believe that a rate cut would help in reviving economic growth without worsening the inflationary situation, which may soften with seasonal correction in prices,” said Kumar, who voted for a rate cut at a second straight meeting.

Both Kumar and Singh highlighted the limited impact monetary policy has on food inflation alongside the sharp slowdown in growth as reasons to shift policy gears. They also support a rate cut to avoid the risk of sharp currency appreciation if the country does not normalise interest rates when most other global central banks have already embarked on an easing cycle.

“When the correlation between food prices and core inflation is weak at best and the share of items contributing to inflation has come down, keeping interest rates elevated to keep overall inflation closer to the target imposes growth costs that are disproportionate to the gains on the prices front,” Singh said.

External member Saugata Bhattacharya said both growth and inflation have worsened, and the risk of making a policy error was higher now compared to the October policy. “This is now apposite for guiding policy decisions. I had earlier noted the risk of making a ‘policy error’ in my October ’24 statement; if anything, this risk has now increased,” Bhattacharya said.

RBI executive director Ranjan said amidst difficult policy trade-offs, the cautious and calibrated approach has kept the economy in good stead. “The need of the hour is to be watchful of the forthcoming data to ascertain the projected improvement in the balance between inflation and growth outlook” he said.