Reserve Bank of India’s bi-monthly consumer confidence survey (CCS) survey showed confidence continues to recover from the historic low recorded in mid-2021, although it remained in the pessimistic zone. Households’ overall outlook for the year ahead remained in positive terrain despite marginally lower optimism.

The current situation index rose by 2.2 points to 87 from 84.8 on account of improved perception on general economic situation, employment, and household income. The latest round of the survey was conducted during March 2-11, 2023, covering 6,075 respondents.

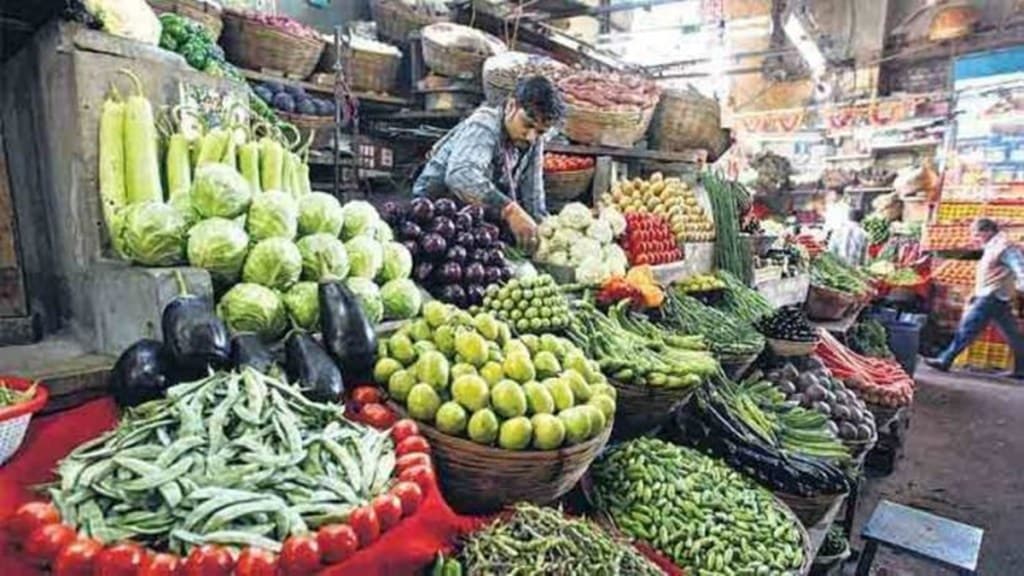

Household assessment of inflation conditions improved for the current period reflecting more confidence on economic conditions; notwithstanding a marginal uptick in the latest round, inflationary expectations improved over their average level since September 2021.

Also read: Jan Dhan account balance nudging Rs 2 trillion

Households’ perception for the current inflation declined by 70 basis points (bps) to 8.9% in the latest survey round [Charts 1a and 1b; Table 3]. ii. Both three months and one year ahead inflation expectations moderated by 30 bps each to 10.2% and 10.5%, respectively, as compared to that in January 2023.Though the expectations on general prices and inflation remained elevated, relatively lower share of households expect prices to rise, when compared to the previous survey round. Households’ expectations on overall prices were generally aligned to their perception on prices of food and non-food items, and cost of services.

With an uptick in current perception, the sentiments on employment are nearing the levels seen around mid-2019; consumers are also optimistic about the employment outlook as more than half of the respondents expect employment scenario to improve over the next one year. Household spending was buoyant on the back of higher essential and non-essential spending; more than a third of the households expect a rise in non-essential outlay over the next year.

Also read: Risk of new coronavirus variants in upcoming days: Expert

The survey obtains current perceptions (vis-à-vis a year ago) and one year ahead expectations on general economic situation, employment scenario, overall price situation and own income and spending across 19 major cities.

Though the expectations on general prices and inflation remained elevated, relatively lower share of households expect prices to rise, when compared to the previous survey round. Households’ expectations on overall prices were generally aligned to their perception on prices of food and non-food items, and cost of services