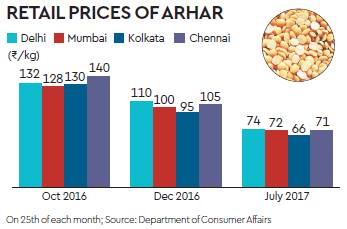

Substantial stocks available with the government agencies, traders and farmers, because of a record output last year, has pulled down prices of tur or arhar sharply in the last couple of months. As a result, there has been growing demand for allowing export of pulses which may boost prices. The ban on pulses exports, with the exception of organic variety, has been in place for around a decade. Traders said allowing pulses exports would somewhat ease the market which has witnessed a glut because of a bumper production in 2016-17. Traders and processors across key arhar producing states of Maharashtra, Gujarat and Madhya Pradesh said that with the kharif sowing for 2017 season already underway, the new crop is expected to arrive in the market by around November and December and the prices are unlikely to rise. Thanks to bumper pulses output in 2016-17 crop year (July-June), the government agencies — farmers cooperative Nafed, Food Corporation of India and Small Farmers’ Agri Consortium — had, for the first time, purchased 1.9 million tonne (MT) of pulses. Out of this, 1.1 MT is arhar and traders are still holding on to around a MT of it.

In anticipation of a price rise, even farmers are holding on to around 0.5 MT or arhar. “Thus we have sufficient stocks for meeting the consumers’ demand in the next six months or so,” an official said. According to ongoing kharif sowing data so far, arhar has been sown in an area of 2.93 million hectares, which is about 20% less than the same period last year. However, traders say that last year more farmers opted for arhar as retail prices rose sharply to around `180 per kg a year ago. “Overall sowing of arhar may not decline sharply from last year, thus ensuring sufficient stocks in the market,” Nitin Kalantri, a Latur (Maharashtra) based trader and processor of pulses told FE. The total production of pulses in 2016-17 (based on the third advance estimates) is 22.40 MT, up from 16.35 MT in 2015-16 crop year (July-June). The arhar production rose by more than 80% to 4.6 MT from a year ago period. Even if the arhar output in 2017-18 crop year declines, there will be still sufficient stocks to curb any spike in prices.

“The government must step in to stop further fall in prices of arhar,” a trader from Gujarat said. Meanwhile, Nafed which is holding on to around a MT of arhar, has been negotiating with states to clear the stocks so that space would be created for new crop. Karnataka government has agreed to lift one lakh tonne of arhar while army, para-millitary forces have requirement of another lakh tonne.