-

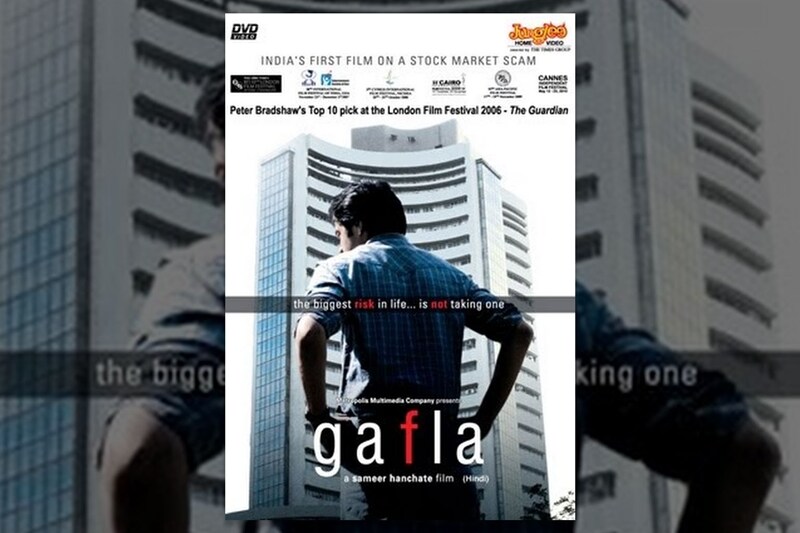

From recent memory, Sameer Hanchate-directed 'Gafla' is the only Indian movie which makes it to our list. Gafla is revolves around the rise and fall of a young man named Subodh Mehta, whose character is loosely based on the infamous Harshad Mehta, who became one of the biggest stock market operator on the Dalal Street in the early 1990s. Gafla is a gripping narrative and tells the tale of Mehta’s highly ambitious journey through India’s stock markets and his eventual fall into a web of a Rs-4999 crore scam on the Bombay Stock Exchange.

-

Mehta manipulated the stock market by buying heavily with borrowed money which was siphoned in through restricted route. Such was the magnitude of the scam that after it broke, BSE remain closed for a month. The movie doesn’t outright exonerate Mehta, but seeks to imply that he was a character in a larger scheme hatched by more influential people. A character, ostensibly inspired from Harshad Mehta’s protege Ketan Parekh also makes an appearance.

-

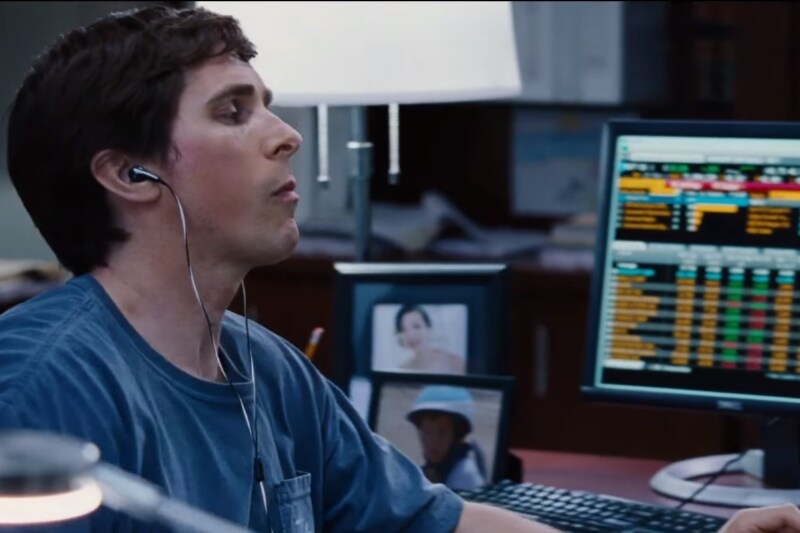

'The Big Short', based on Michael Lewis’ book of the same name, tells three parallel stories about few people in the world of high finance who predicted the credit and housing bubble collapse of the mid-2000s, and get on the other side of the crisis, eventually making tons of money while big banks get torn down. The story is based mostly on real events, with small divergences.

-

Only a very few movies on subjects as dry as CDOs securitisation have the kind of gripping narrative as 'The Big Short', which through its several witty and slick conversations builds the interest pretty early on and sustains it through the end. The movie seeks to portray the ill-effects of the greed on the Wall Street, but very cleverly avoids falling into the trap of becoming overly preachy.

-

'Inside Job' is one of the few documentaries which probably has more zing than most fictitious drama films. The movie provides a comprehensive analysis of the global financial crisis of 2008 which erased over $20 trillion of value from global assets; caused millions of people to lose their jobs and homes in the worst recession since the Great Depression; and nearly resulted in a global financial collapse.

-

Through exhaustive research and extensive interviews with key financial insiders, politicians, journalists, and academics, 'Inside Job' traces the rise of a rogue industry which has corrupted politics, regulation, and academia. India’s former celebrity-RBI governor Raghuram Rajan, who produced a paper on an impending crisis as early as in 2005, also makes an appearance. A must watch for anyone who wants to understand the origins of the financial crisis.

-

‘Margin Call’ weaves a story around the events at a fictitious financial services firm across the span of about 36 hours, during which a risk management executive discovers a massive financial crisis looming over, followed by the panicked management mobilising all the resources at their disposal to contain the situation in the middle of the night.

-

What follows is some tough calls by the management to save the firm even as a handful of conscientious comrades find themselves dragged along into the unethical abyss during the early stages of the 2008 financial crisis. The boardroom discussions are particularly gripping to watch and the story is slick, which only slowed down by occasional conversation among the characters discussing the futility of it all.

-

Based on the true story of Jordan Belfort, ‘The Wolf of Wall Street’ tells his story of his rise to become a wealthy stockbroker living the high life and then to his fall involving crime, corruption and the federal government. In the early 1990s, Jordan Belfort teamed with his partner Donny Azoff and started brokerage firm Stratford-Oakmont. Their company quickly grows from a staff of 20 to a staff of more than 250 and their status in the trading community and Wall Street grows exponentially.

-

As their status grows, so do the amount of substances they abuse, and so do their lies. They draw attention like no other, throwing lavish parties for their staff when they hit the jackpot on high trades. That ultimately leads to Belfort featured on the cover of Forbes Magazine, being called ‘The Wolf Of Wall Street’.

-

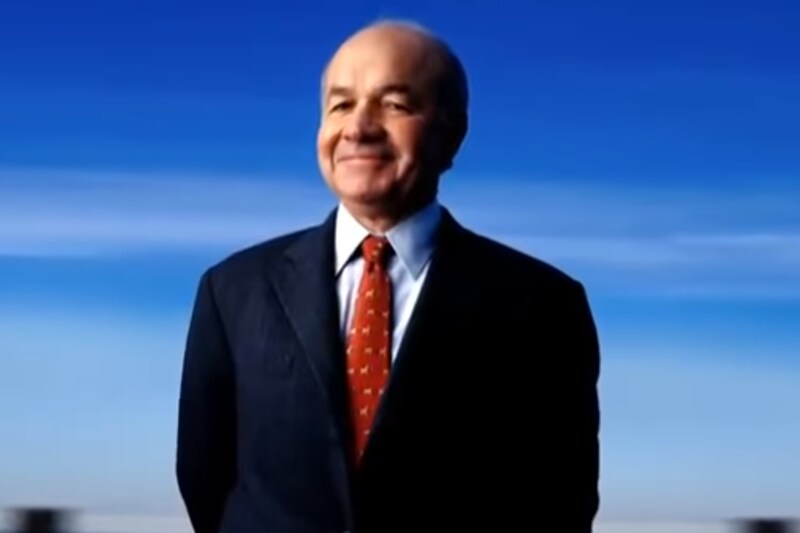

‘Enron – The Smartest Guys in the Room’ is a documentary about the Enron Corporation, its faulty and corrupt business practices, and how they led to its fall. The documentary portrays the company’s origins in the 1980s, how it was set up with energy deregulation in mind, and how it profited off the deregulation.

-

Further, the movie narrates how it took accounting practices to the extremes, to the point that the senior executives were cooking the books. There is also coverage of the unethical practices of Enron traders, particularly in the California electricity market. In the end it all comes crashing down, with law-abiding employees losing their jobs, savings and pensions.

-

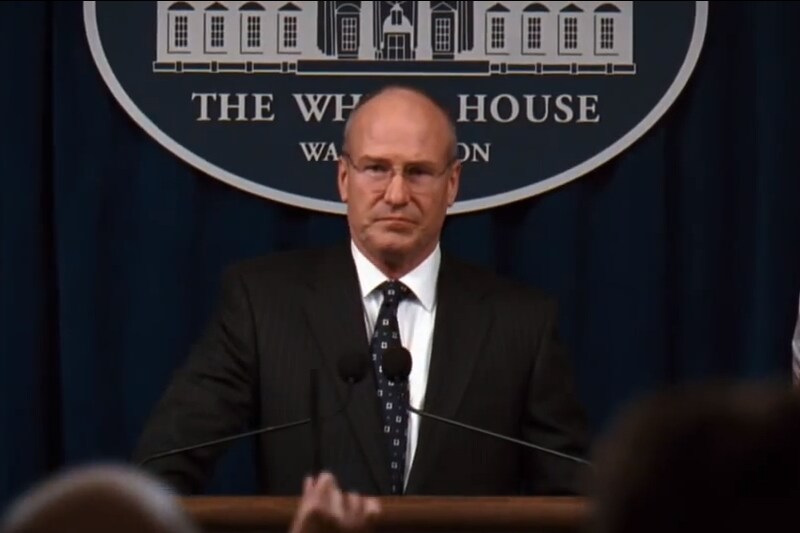

‘Too Big To Fail’ is a feature film based on a book of same name by Andrew Ross Sorkin. It offers a close look behind the scenes, between late March and mid-October, 2008 — the months leading up to the financial crisis and the hectic parlays in the corridors of power once it struck. An important aspect to note here is that the movie doesn’t delve so much into the technicalities of what caused the financial crisis; it portrays the actions of various parties involved during those crucial months, and there frantic efforts to salvage the situation.

-

In it, we see Richard Fuld's benighted attempt to save Lehman Brothers; conversations among Hank Paulson (the Secretary of the Treasury), Ben Bernanke (chair of the Federal Reserve), and Tim Geithner (president of the New York Fed) as they seek a private solution. It also shows back-channel negotiations among Paulson, Warren Buffett, investment bankers, a British regulator, and members of Congress as almost all work to save the US economy. The story portrays how the hands of the authorities were tied as the banks has simply become too big to fail.

-

‘Boiler Room’ is a story of a righteous college dropout who finds himself at loggerheads with his father – a harsh federal judge. He gets a job as a stockbroker and gets on the fast track to success.

-

Things take a turn for the worse when he learns that his job isn't what's it cracked up to be. Watch how Seth Davis, the college dropout, gets introduced to the potential wealth in stockbroking, and learns the craft of sales over the phone.

-

‘Wall Street’, a fictitious movie starring Michael Douglas and Charlie Sheen is sort of a cult movie that could be credited with having introduced many people to the cunning of the stock market investing. Gordon Gekko, one of the biggest stock speculators on Wall Street, manipulates the market using inside information and his motto best describes his approach: greed is good. Bud Fox is an ambitious stock trader who will do just about anything to get into the big league. He has been actively courting Gordon Gekko.

-

The movie, quite simply yet brilliantly narrates the story of a young and impatient stockbroker who is willing to do anything to get to the top, including trading on illegal inside information taken through a ruthless and greedy corporate raider who takes the youth under his wing.

-

‘Wall Street – Money Never Sleeps’ is a sequel to ‘Wall Street’, released more than 23 after the original. Corporate raider Gordon Gekko completes a prison sentence for money laundering but is disgraced by his peers. Shortly after, Gekko finds his feet again, and influences Jake Moore, a hot-shot Wall Street trader and his would-be son-in-law, to destroy an old enemy on the Wall Street and rebuild his empire.

-

As the global economy teeters on the brink of disaster, the young Wall Street trader partners with the disgraced former Wall Street corporate raider on a two-tiered mission: To alert the financial community to the coming doom, and to find out who was responsible for the death of the young trader's mentor. The sequel is not as gripping as the original and misses lets the narrative slip away out of control at times, but the movie is worth a watch nevertheless, if not for nothing else, then for Gordon Gekko’s sheer will to rebuild his position again.

-

‘Barbarians at the Gate’, based on a book of same name, follows the events leading up to a bidding war for the takeover of one of the biggest tobacco companies in the world, even as the company’s President attempts to buy it himself. The movie portrays the rich lifestyle of F Ross Johnson, and his getting caught in the web of leveraged financing. The takeover of RJR Nabisco and KKR’s role in making its bids for the firm is a perfect case study for getting introduced to the world of leveraged buyouts and junk bonds.

-

Based on true events, the movie is nowhere near as extensive as the book is, but that’s a futile comparison anyway. It is a must watch for anyone interested in finding out how little, or how much, does it take to make a bid for buying out a multi-billion dollar corporate behemoth.

74,000 Indians leave UK as net migration drops 80%, skilled worker visas plunge