-

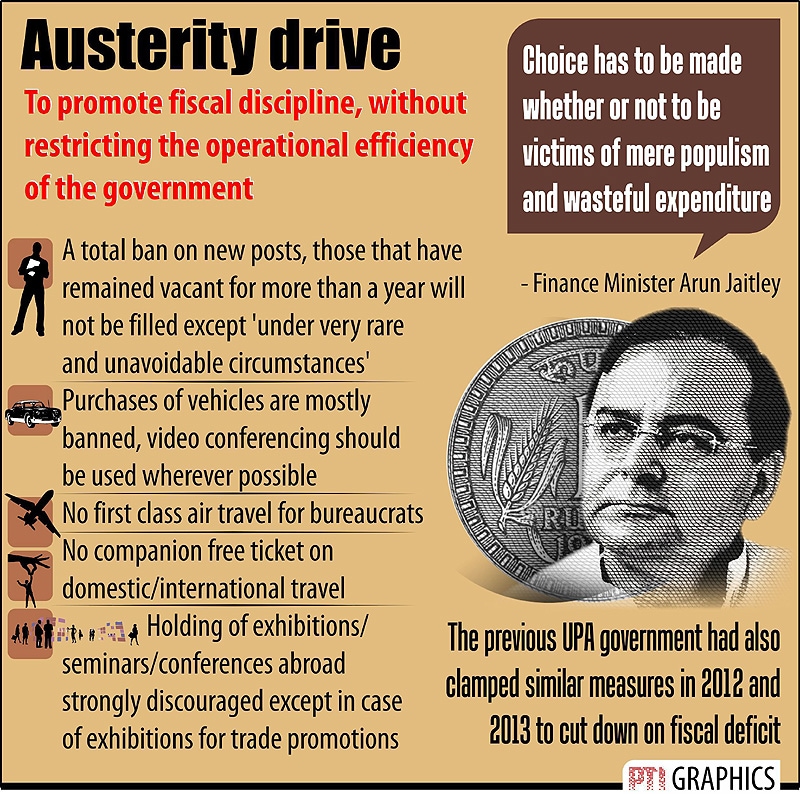

Unveiling an austerity drive to cut non-plan expenditure by 10 per cent, government has barred bureaucrats from travelling First Class on overseas visits and have been asked to use video conferencing as much as possible. Graph: PTI

-

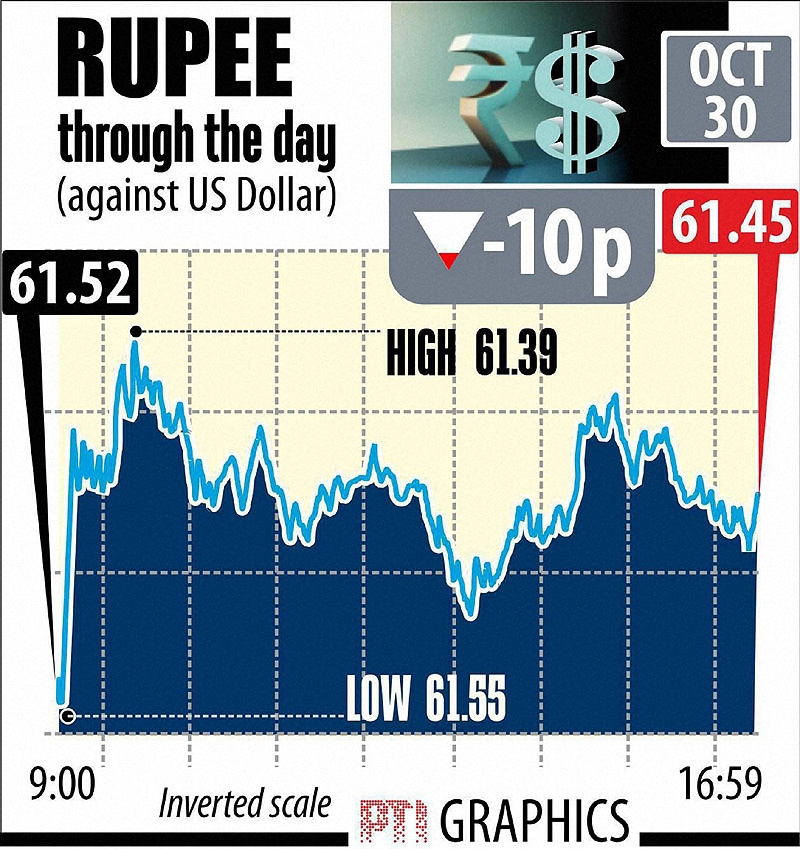

Indian rupee through the day against US dollar. Moving in opposite direction to stocks, the rupee today fell for the fourth day, dipping 10 paise to close at two-week low of 61.45 against the Greenback after US Federal Reserve kept in place its plans to maintain record low interest rate for some more time. Graph: PTI

-

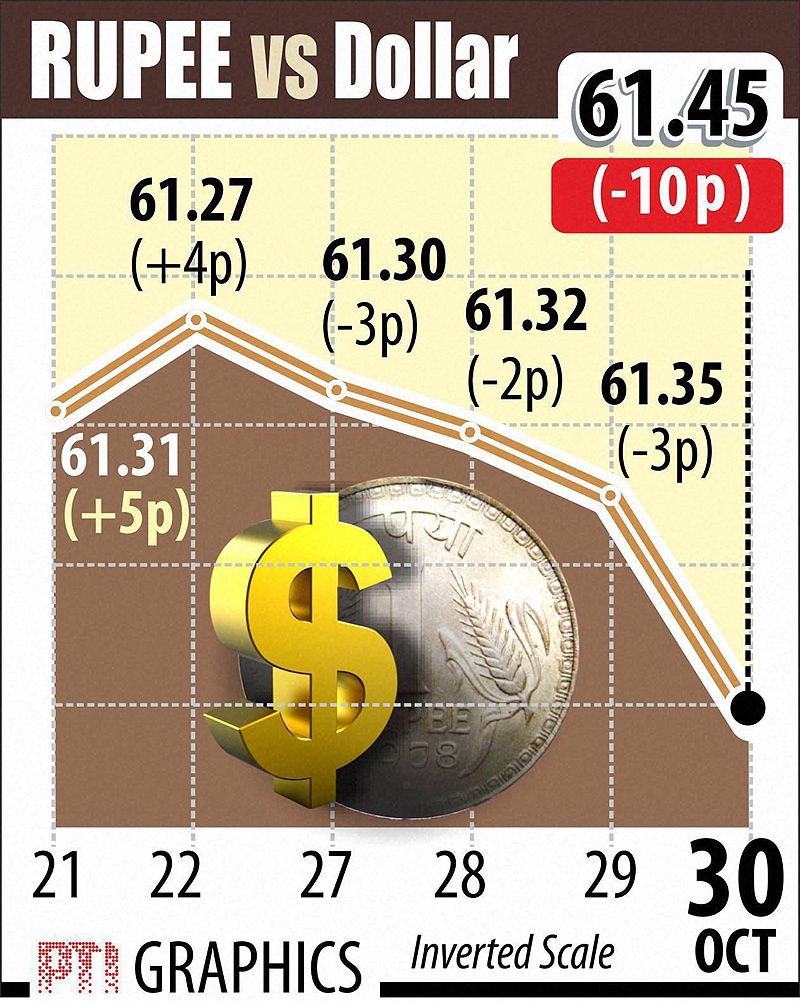

Indian rupee vs US dollar. While the Fed's bond buying programme came to an end as expected, the continuation of ultra low interest rate regime lifted the dollar overseas against major currencies, thereby keeping the rupee under pressure, a forex dealer said. Graph: PTI

-

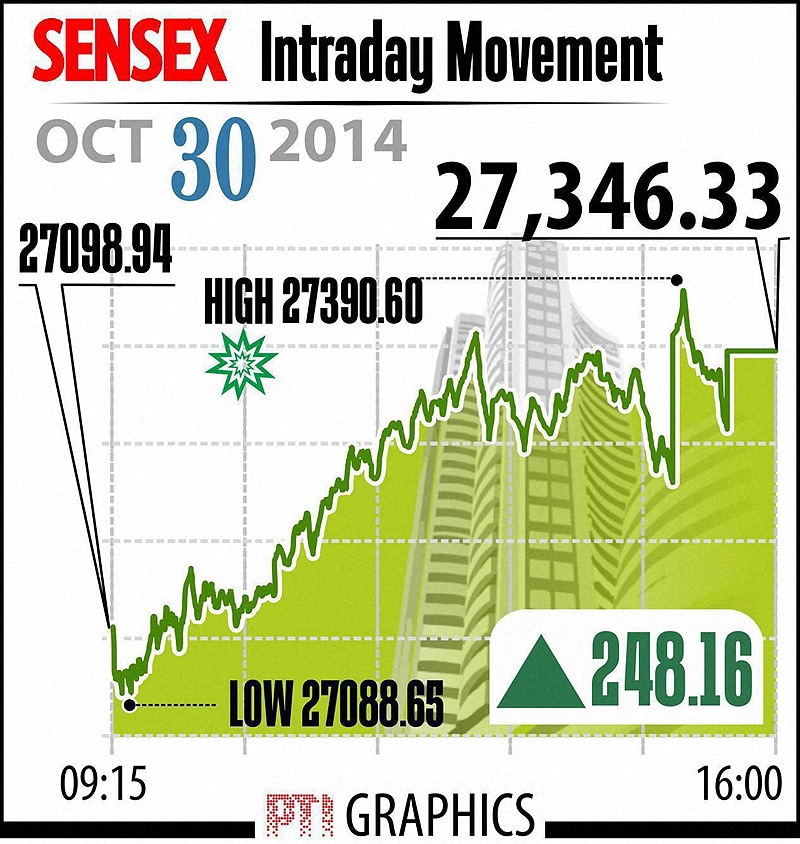

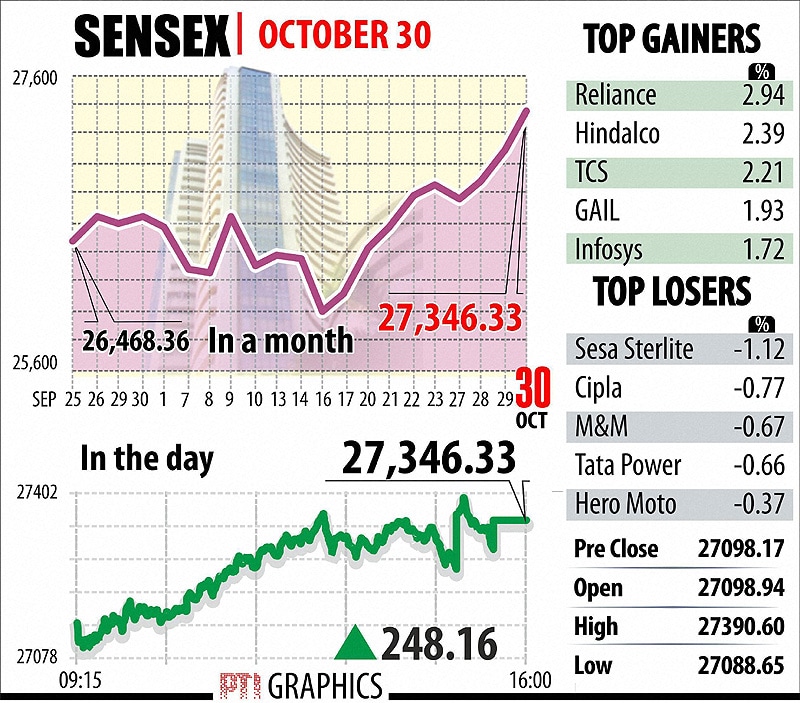

BSE Sensex Intraday Movement. Indian markets today cheered Modi government's move to ease FDI rules in construction sector and the Federal Reserve sticking to its stance of low US interest rates with benchmark Sensex surging about 248 points to end at new peak of 27,346.33, extending gains for the third day. Graph: PTI

-

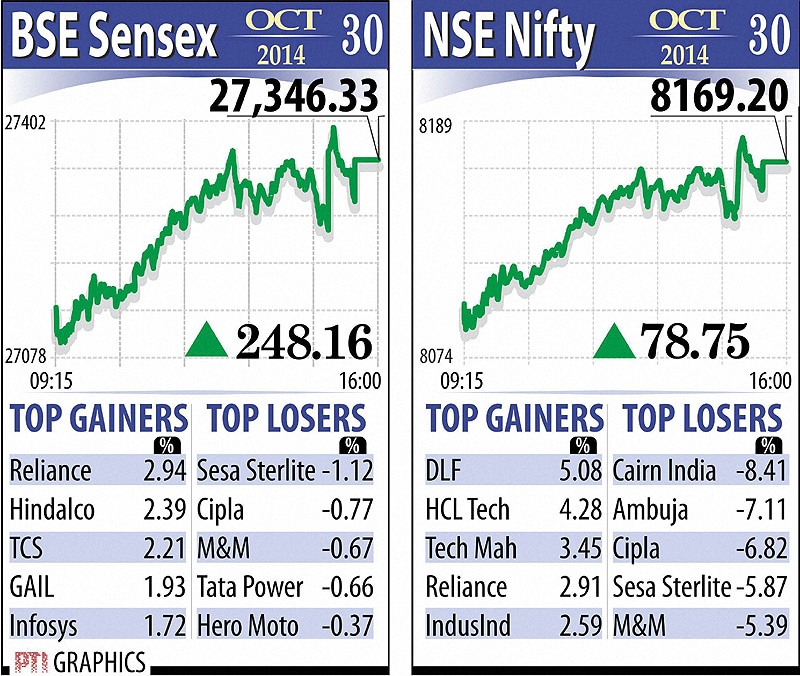

BSE Sensex: Top Gainers, Top Losers. The NSE 50-share Nifty index also ended higher by 78.75 points, or 0.97 per cent, at 8,169.20 after hitting an all-time intra-day high of 8,181.55 during the day. Graph: PTI

-

BSE Sensex and NSE Nifty throughout the day. Brokers said fresh dose of capital inflows, good corporate earnings and rating agency Moody's favourable report on rating profile of India also boosted buying as investors bought shares across-the-board. Gains were led by Realty, IT, Teck and Consumer Durables as 1,586 shares ended higher on BSE, pushing up investor wealth to over Rs 95.35 lakh crore. Graph: PTI

-

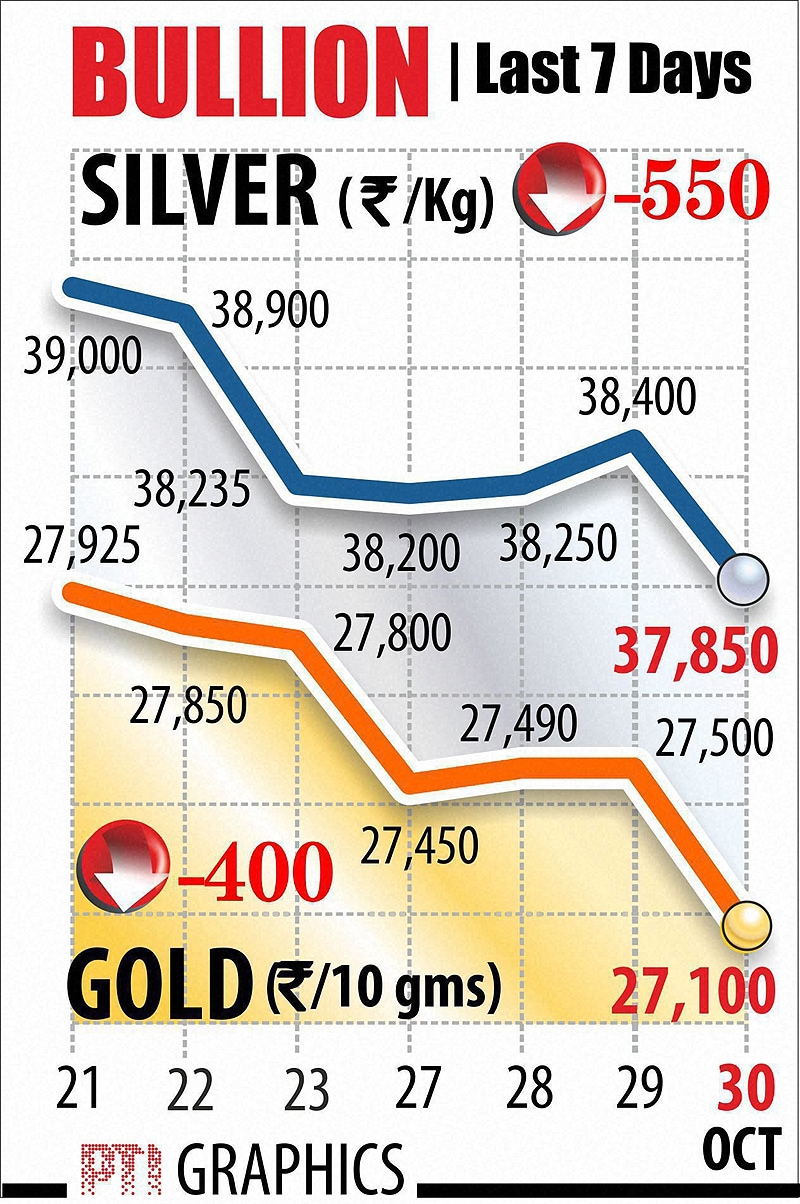

Gold and silver prices. Gold prices fell sharply to a three-week low at the domestic bullion market here today following heavy profit-taking from stockists and speculators spooked by a sharp overseas fall. Graph: PTI

OnePlus 15R, OnePlus Pad Go 2 launch LIVE updates: Check prices in India, specifications, offers, and more here