-

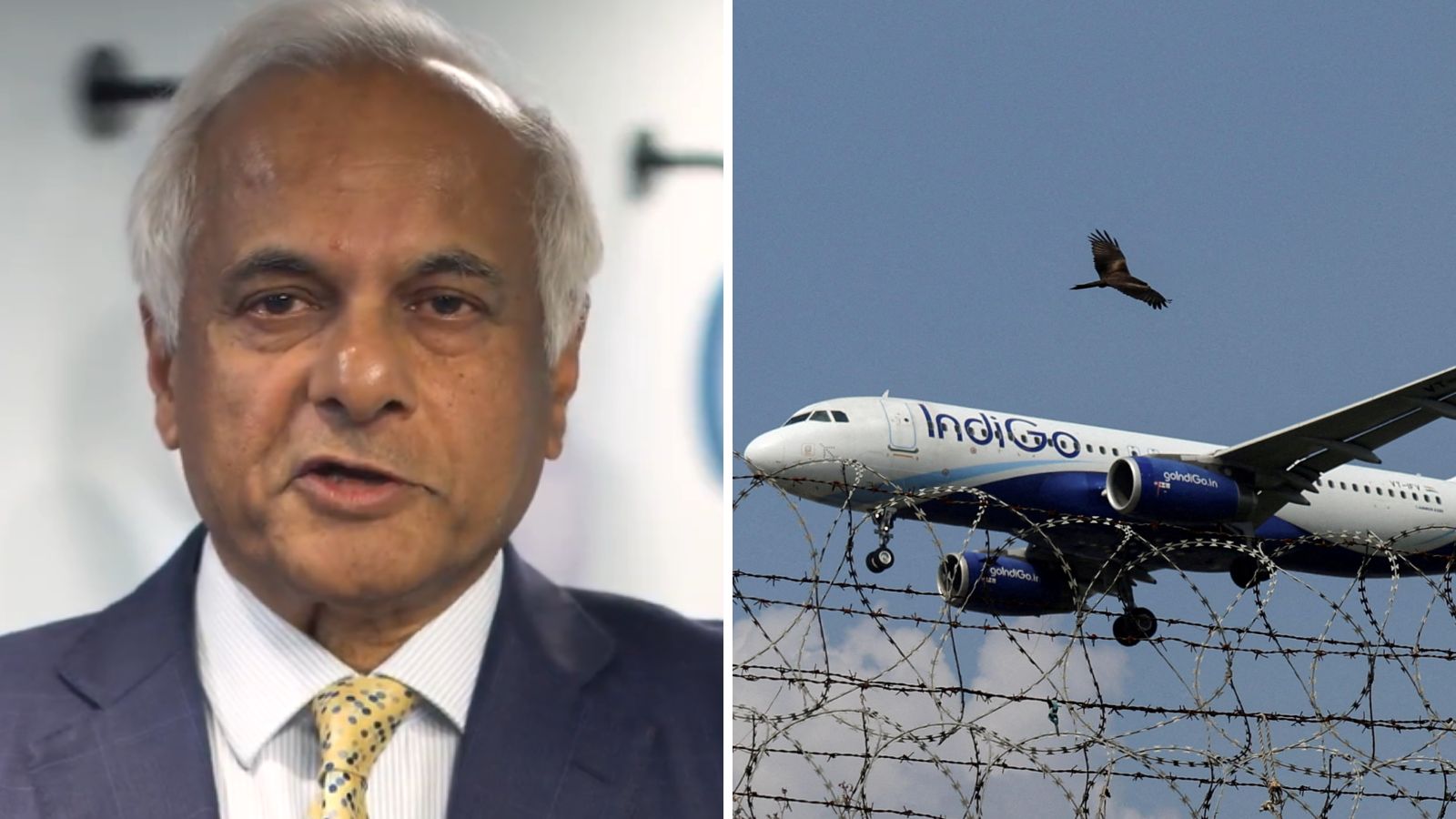

Five Indian-Americans are among the richest in the US, according to a Forbes list of 400 people. (PTI)

-

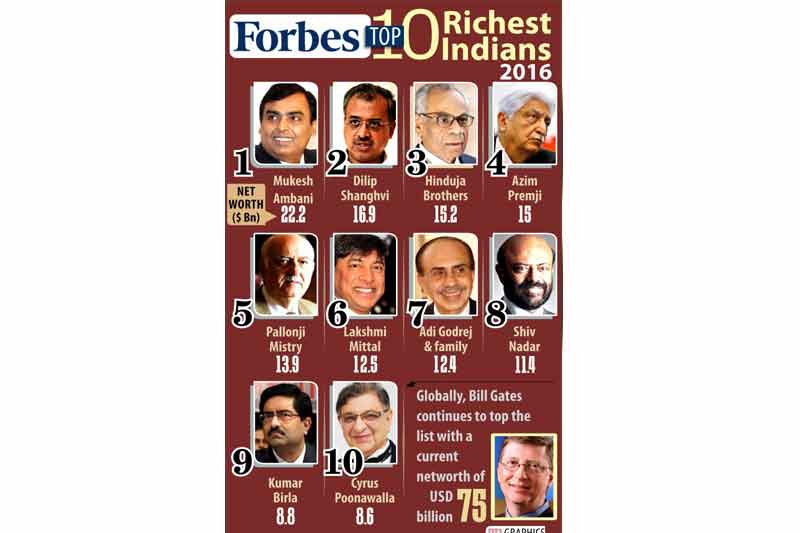

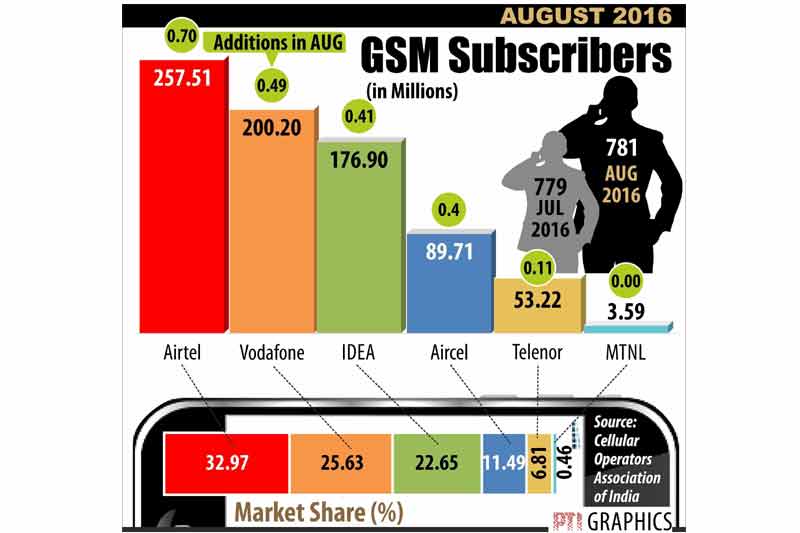

GSM Subscribers. (Image Source: PTI)

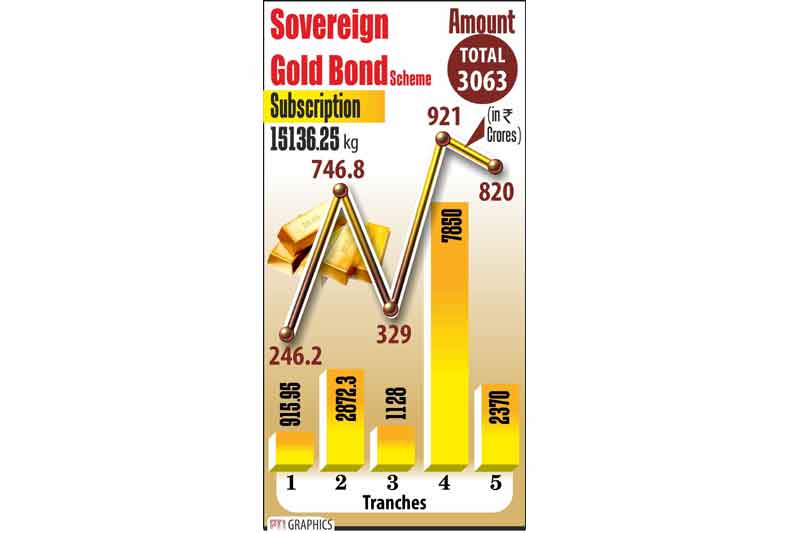

Gold was little changed early Friday, but remained set for the biggest weekly gain in nearly two months after rising to a two-week high in the previous session. Analysts said that apart from a weak trend in overseas markets, profit-booking by traders mainly influenced gold prices at futures trade here. Meanwhile, the yellow metal fell 0.21 per cent to USD 1,333.90 an ounce in Singapore. It has climbed 1.9 per cent this week, the most since the period to July 29, as the dollar fell and investors boosted holdings in bullion-backed exchange-traded funds. (Image Source: PTI)

The rupee weakened by 7 paise to 66.73 against the dollar in early trade today at the Interbank Foreign Exchange market on fresh demand for the American currency from importers. Forex dealers said the strength in dollar against some other currencies overseas and a lower opening in the domestic equity market weighed on the rupee. The rupee had soared by 36 paise, its biggest single-day gain in four months, to close at a two-week high of 66.66 a dollar in yesterday's trade on easing worries of foreign fund outflows and narrowing of the country's current account deficit (CAD). (Image Source: PTI)

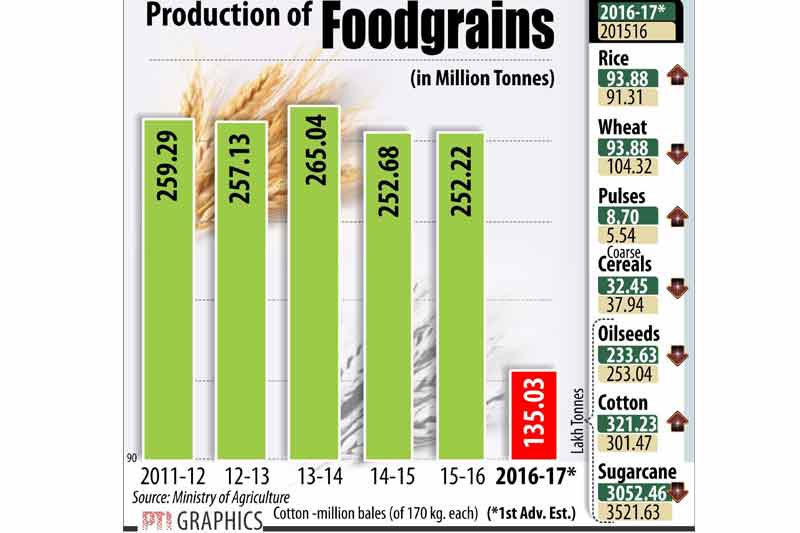

Prices of urad dal, moong dal and maida moved down, while sugar moved up in the wholesale foodgrains market here today. All other commodities remained unaltered. Urad dal and moong dal declined by Rs 700 and Rs 200 each to Rs 11,500 and Rs 7,500 from yesterday's rate of Rs 12,200 and Rs 7,700 respectively. Likewise, Maida (90 kg) went down by 100 to Rs 2,600 from yesterday's rate of Rs 2,700. In contrast, sugar went up by Rs 50 to Rs 3,900 from Rs 3,850. (Image Source: PTI)

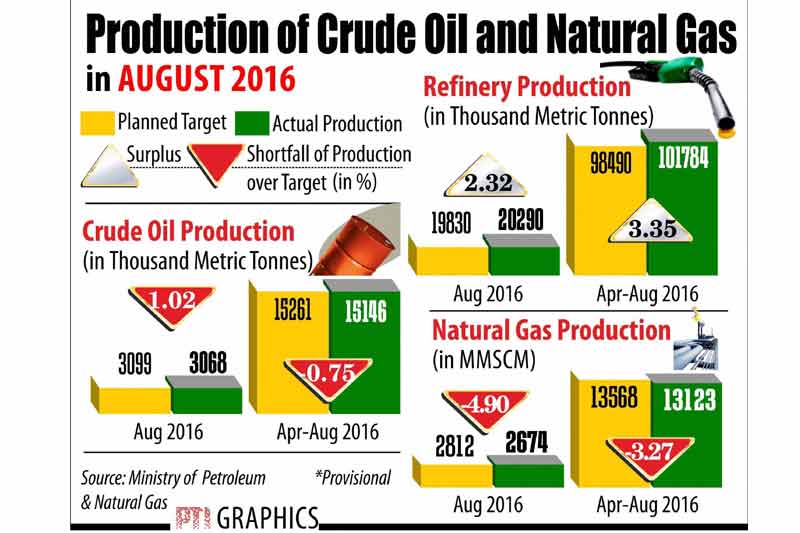

Oil prices eased in Asian trade today on profit-taking following two days of solid gains as traders turned their attention to next week's planned meeting of key producers. At around 0850 IST, the US benchmark West Texas Intermediate (WTI) was down 50 cents at USD 45.82 and Brent dropped 37 cents to USD 47.28. Both contracts booked solid gains over the previous two days — WTI surged 6.6 per cent and Brent gained 3.9 per cent — on data showing US commercial crude inventories fell more than six million barrels last week, indicating strong strong demand in the world's top oil consumer. (Image Source: PTI)

e-Passport launched in India: Who can apply, how to apply, application fee, benefits, key security upgrades and more