-

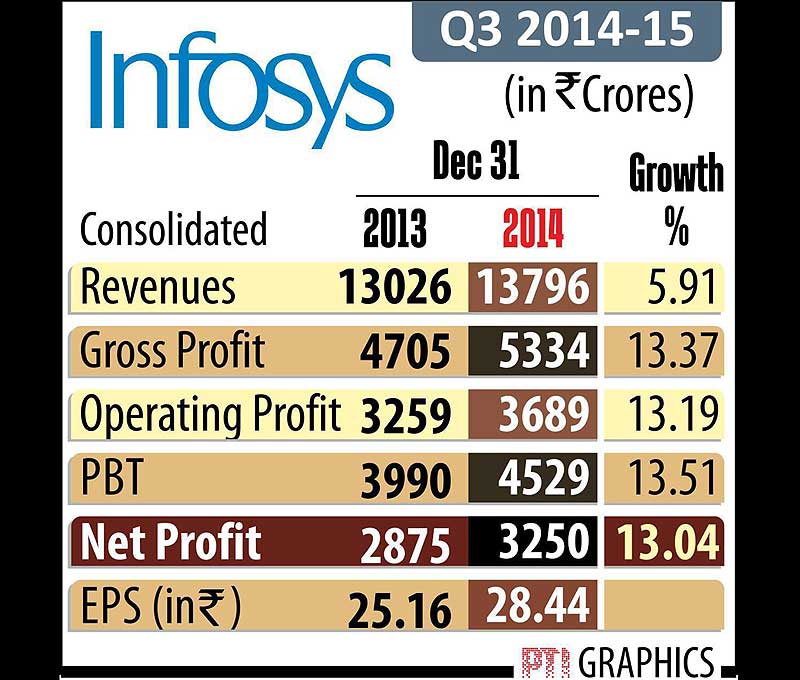

Infosys, India’s second largest IT services exporter on Friday reported a year-on-year rise of 13 per cent in consolidated net profit for the third quarter ended December 31, 2014. Graph: PTI

-

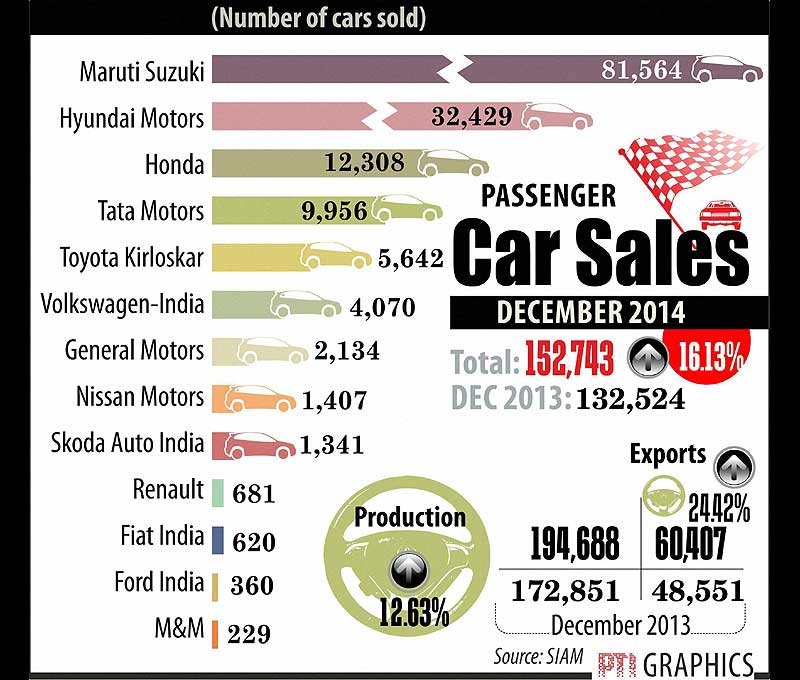

Car sales in India got back in positive territory in 2014 with a 2.46 per cent increase on excise duty reductions brought in by the government to propel the struggling industry. Graph: PTI

-

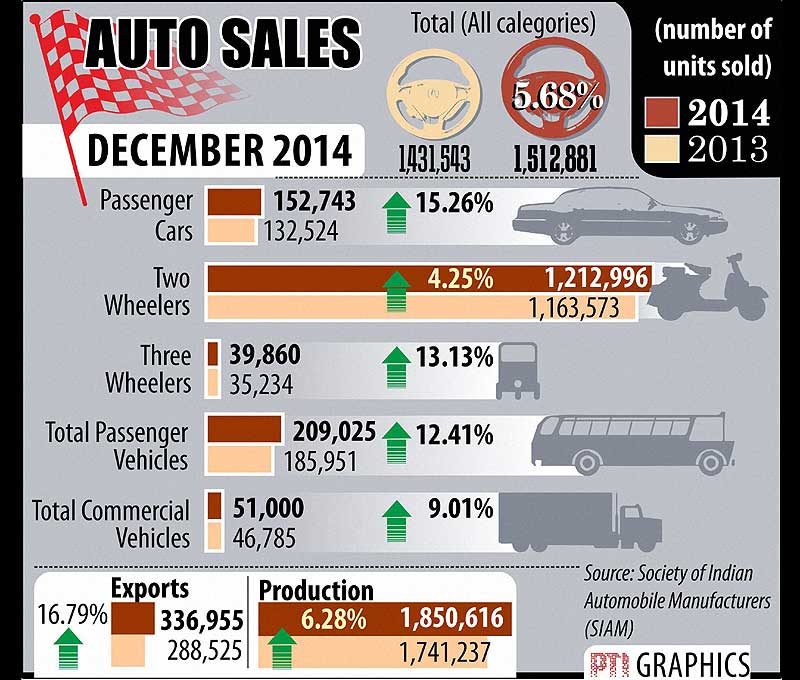

Domestic passenger car sales rose 15.26 per cent to 1,52,743 units in December 2014 as compared to 1,32,524 units in December 2013. Graph: PTI

-

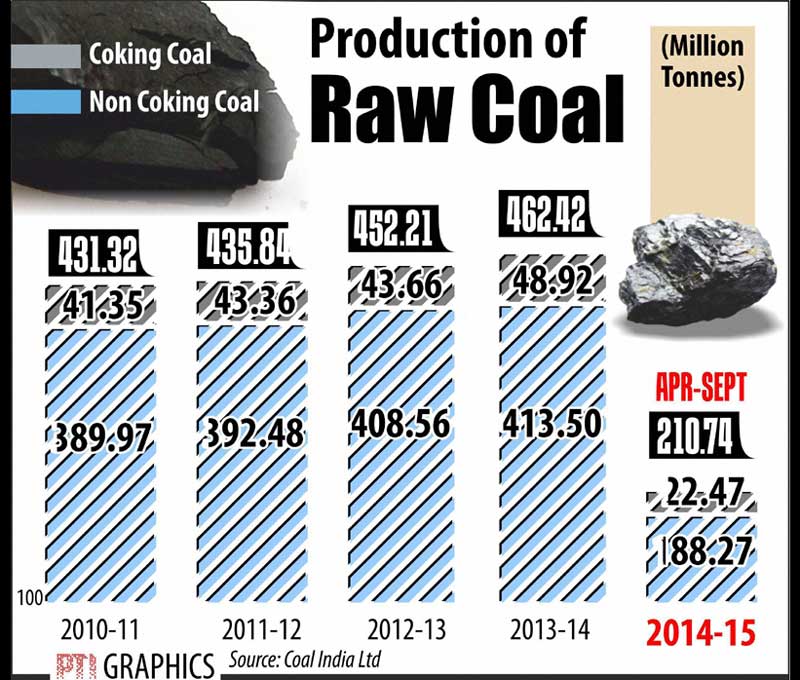

Production of raw coal. Graph: PTI

-

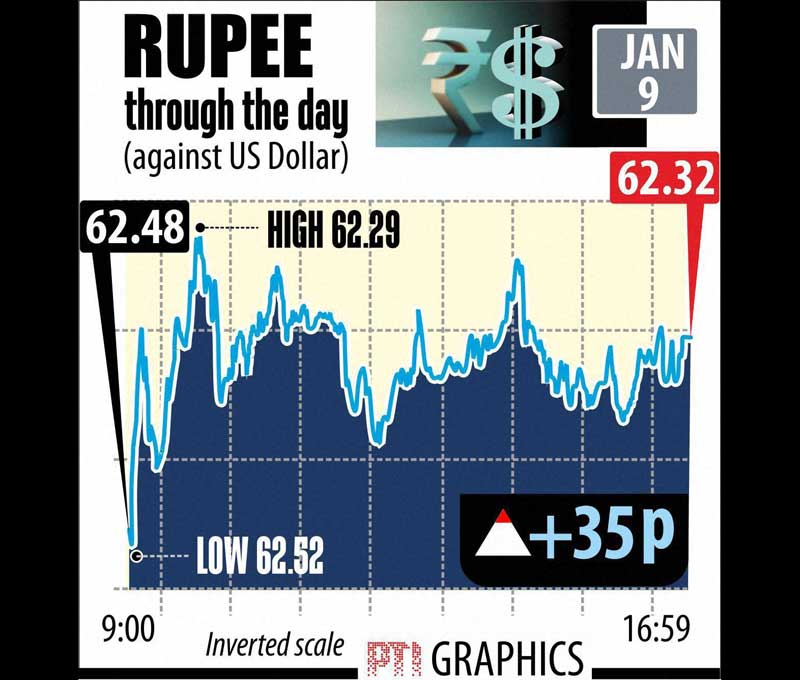

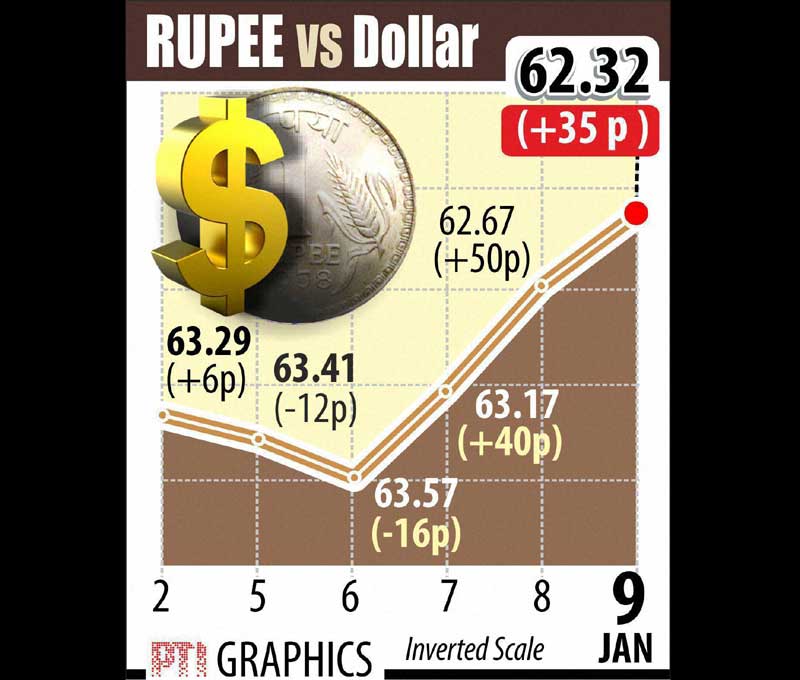

Indian rupee through the day against US dollar. Notching up gains for the third successive session, Indian rupee today surged 35 paise to end at four-week high of 62.32 against the greenback on persistent selling by participants and on continued optimism of inflows. Graph: PTI

-

Indian rupee vs US dollar. Weakness in the dollar in overseas markets also boosted the rupee value, forex dealers said. For the week, the local currency gained 97 paise, its biggest weekly rise since mid-May last year. Graph: PTI

-

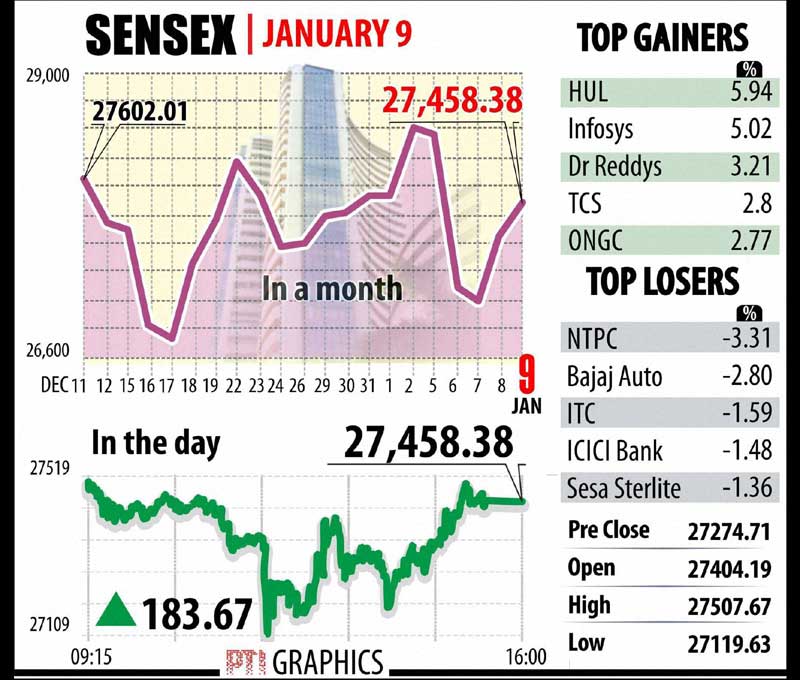

BSE Sensex Intraday Movement. Rising for the second session, the benchmark Sensex today jumped by about 184 points, driven by a sharp 5 per cent rally in Infosys shares after the IT major's December quarter earnings beat market expectations. Graph: PTI

-

BSE Sensex: Top Gainers, Top Losers. The NSE Nifty also rose 49.90 points to end at 8,284.50. Infosys, India's second-largest IT firm, reported 13 per cent jump in consolidated net profit for the third quarter and maintained revenue outlook for the entire fiscal ending March. Gains in Infosys (5.02 pc) and TCS (2.80 pc) shares contributed to over 140-points to Sensex's 183.67 point rise. Graph: PTI

-

BSE Sensex and NSE Nifty throughout the day. The 30-share barometer resumed higher at 27,404.19 and shot up further to 27,507.67 on initial strong buying on the back of higher global cues. However, it declined to 27,119.63 during mid-day on profit-booking in select counters. Graph: PTI

-

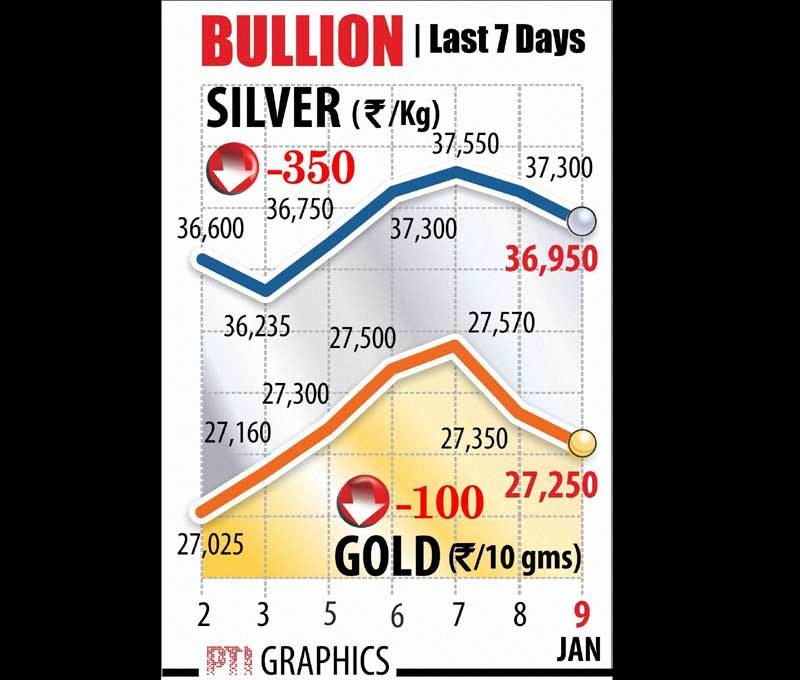

Gold and silver prices. Notwithstanding firm overseas trend, gold prices continued their slide for the third day at the domestic bullion market here due to lack of demand from jewellery stockists and retail consumers. Graph: PTI

‘India in a bubble of epic proportions’: Siddharth Bhaiya