-

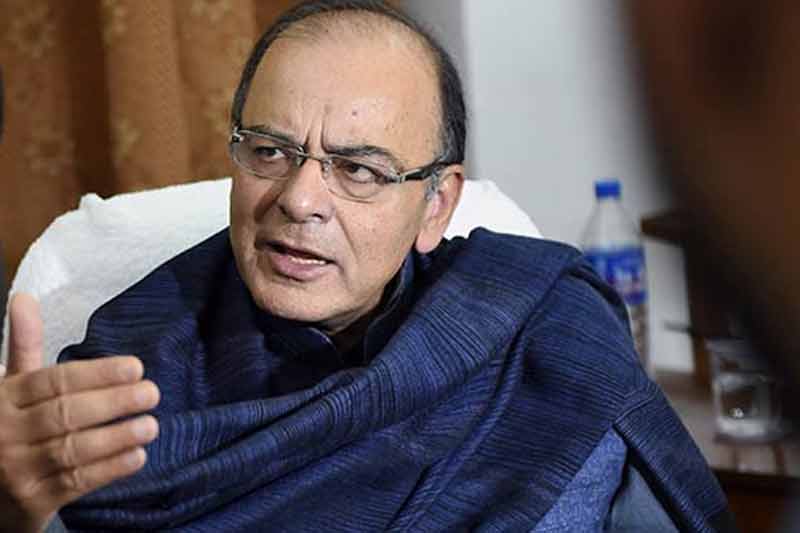

EPF tax withdrawn: After the withdrawal of a key proposal on the Employees' Provident Fund scheme by FM Arun Jaitley with the retention of a plan to tax just 60 percent of the corpus withdrawn from pension funds, India's social security schemes for the retired has become more attractive, experts said. (AP)

-

EPF tax withdrawn: "The employees' provident fund will hence continue to be an attractive investment option with exempt, exempt, exempt scheme," said Tapati Ghose, partner with Deloitte Haskins and Sells, referring to the tax exemptions on contributions, interest thereon and withdrawals. (PTI)

-

The government has taken a number of tax measures to broaden the personal income-tax base in line with the analysis in the Economic Survey. (AP)

-

3. Vijay Mallya loan issue: Finance Minister Arun Jaitley led the counterattack against the principal opposition party in Parliament against the grand old party, saying that it was under the UPA regime when Vijay Mallya went abroad and a case was registered under Foreign Exchange Management Act (FEMA). Speaking in the upper house, he said that the CBI is looking into the matter. (PTI)

-

EPF tax withdrawn: "Withdrawal of tax on provident fund withdrawals as stated by the finance minister in Parliament today would be welcome relief for the salaried class," said Parizad Sirwalla, partner with KPMG. The proposal on pension is also the right move towards a pension-based society, Sirwalla added. (AP)

Mark Zuckerberg’s Meta Superintelligence Lab goes global: Chief AI Officer Alexandr Wang announces new hiring in Singapore