-

Budget 2016: Arun Jaitley has given relief to individual income tax payers and increased the tax deduction limit to Rs 60,000 per annum from the current Rs 24,000 on the housing rent. "I propose to increase the limit of deduction of rent paid under 80 GG from Rs 24,000 per annum to Rs 60,000 to provide relief to those who live in rented houses," he said while presenting the Budget for 2016-17 in the Lok Sabha. (AP)

-

Budget 2016: Arun Jaitley also announced an additional tax relief of Rs 50,000 per annum on a loan of Rs 35 lakh in 2016-17 for the first-time home buyers, provided the house cost does not exceed Rs 50 lakh. FM also proposed to raise the ceiling of tax rebate under 87A from Rs 2,000 to Rs 5,000.

-

Budget 2016: Arun Jaitley's largesse means that individuals with income up to Rs 5 lakh will get a relief of Rs 3,000 in their tax liability, he said. The government has also proposed to increase the turnover limit under presumptive taxation scheme under 44 AD of the Income Tax Act to Rs 2 crore from existing limit of Rs 1 crore, which will benefit more than 30 lakh small business people. (Reuters)

-

4. EPF tax in Budget 2016: "There is no change in the status of public provident fund (PPF). EEE (tax exempt at the time of contribution, tax exempt on returns and tax exempt on withdrawals) scheme will continue for PPF," he said. "There is no 40 per cent limit on PPF. It will be 100 per cent exempt". Adhia said out of the 3.7 crore active contributors in EPF, about 70 lakh corporate sector employees with high salary would be impacted by the proposed taxation of EPF interest on withdrawal.

-

Budget 2016: Arun Jaitley has something for too. For non residents, he said alternative documents to PAN Card will be allowed and TDS provisions for Income Tax will be rationalised, he said. A facility for revision of return will also be extended to Central Excise Assesses, he added. (Reuters)

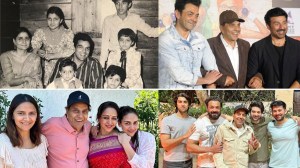

Meet Prakash Kaur: Dharmendra’s first wife who stood by him through every phase of his life