-

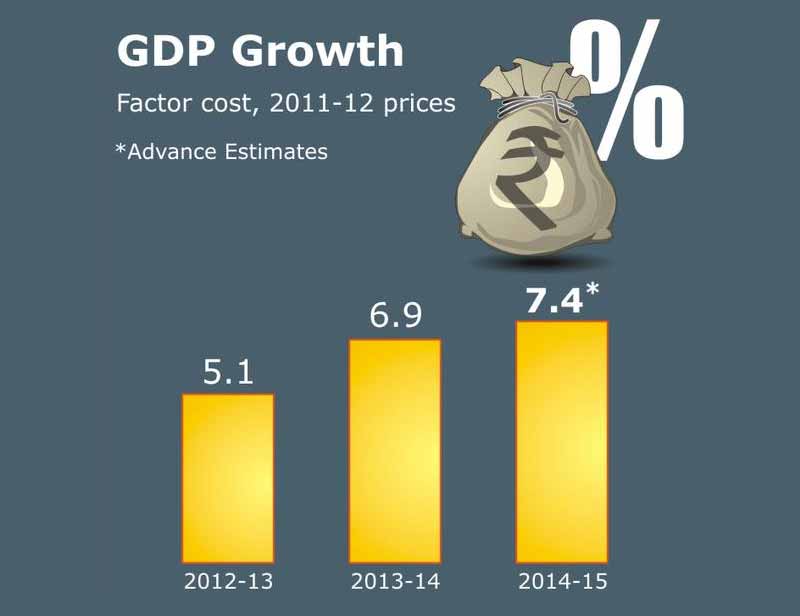

Ahead of presentation of Union Budget 2016 by FM Arun Jaitley on February 29th, 2016, here is a brief look about what Economic Survey 2015 report released in February 2015 had to say about the state of the Indian economy after 1 year of PM Narendra Modi led NDA government rule; economic growth in India was seen at 8.5 pct in 2015-16 – indicating scope for big bang reforms, but that did not actually transpire. Check out here what the situation was in 2015 and then compare with the data that is to come today afternoon (Thursday 26th February 2016). <br> <a href="https://www.financialexpress.com/article/budget-2016/economic-survey-2016-live-updates-fm-arun-jaitley-state-of-economy-union-budget-2016/216364/"><strong>Economic Survey 2016 tabled, LIVE updates; 7.6% GDP growth projected in 2015-16</strong></a></br>

-

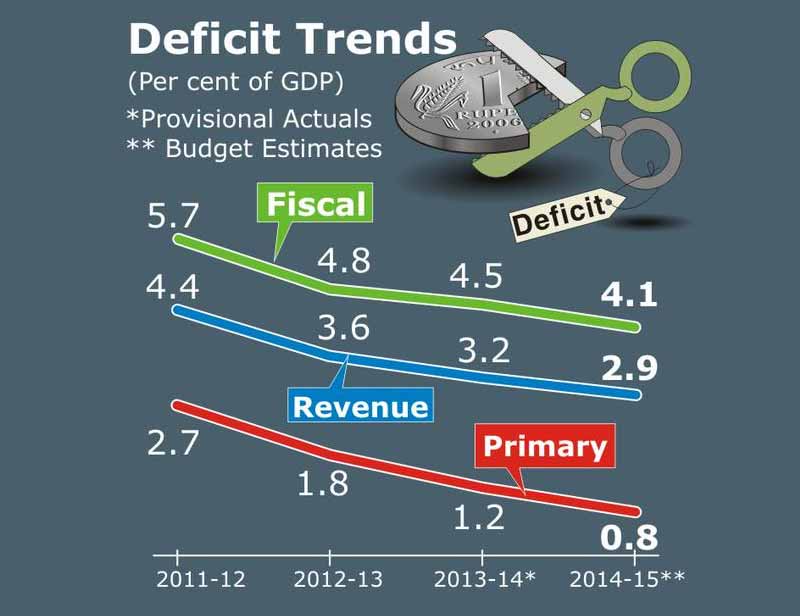

As per the Economic Survey 2015 tabled in Parliament, India must adhere to medium-term fiscal deficit target of 3 percent of the country’s gross domestic product (GDP). The government should ensure expenditure control to reduce fiscal deficit, the Economic Survey report suggests. The survey prepared by the finance ministry’s chief economic adviser Arvind Subramanian on the state of Asia’s third-largest economy was released ahead of the Budget 2015-16. <br><a href="https://www.financialexpress.com/article/budget-2016/economic-survey-2016-live-updates-fm-arun-jaitley-state-of-economy-union-budget-2016/216364/"><strong>Economic Survey 2016 tabled, LIVE updates; 7.6% GDP growth projected in 2015-16</strong></a></br>

-

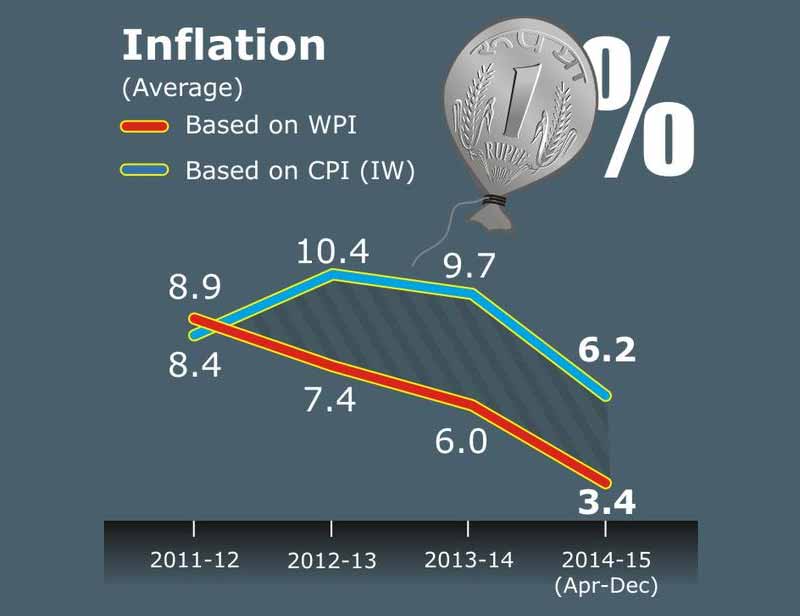

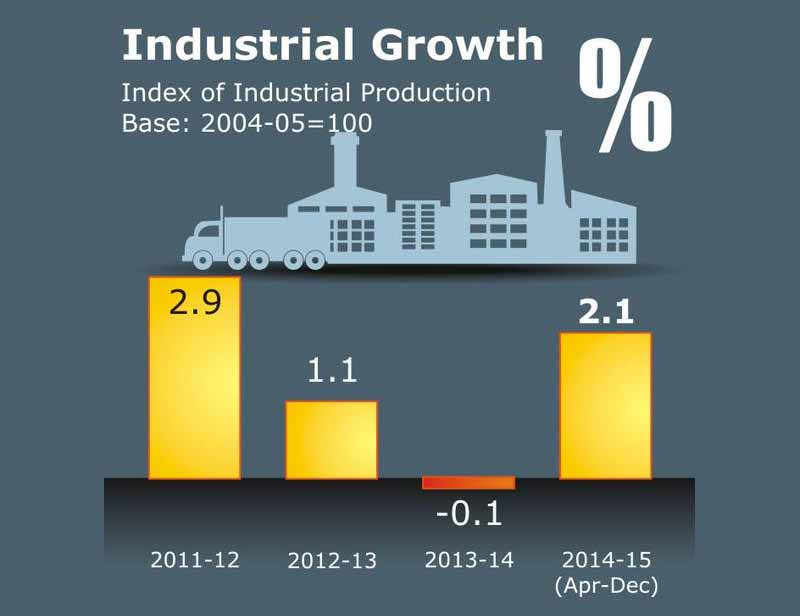

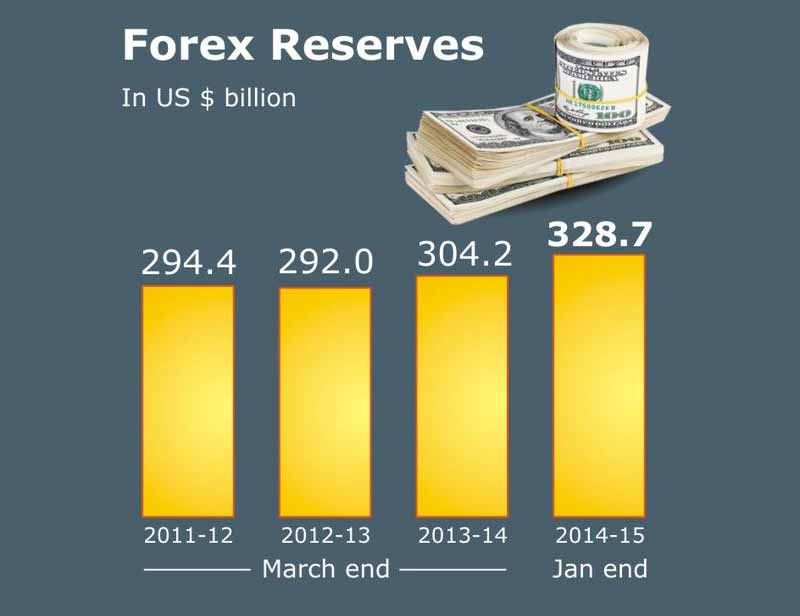

Economic Survey: Outlook and challenges; A) Macroeconomic fundamentals have dramatically improved in 2014-15: 1. Inflation has declined by over 6 percentage points since late 2013; . Current Account Deficit down from a peak of 6.7% of GDP (in Q3, 2012-13) to an estimated 1% in 2014-15; 3. Foreign portfolio flows have stabilized the rupee;

-

Economic Survey: B. Central Statistics Office; 5. Notwithstanding the new estimates, the balance of evidence suggests that India is a recovering, but not yet a surging economy; 6. Going forward inflation is likely to remain in the 5-5.5% range, creating space for easing of monetary conditions; 7. Using the new estimate for 2014-15 as the base, GDP growth at constant market prices is expected to accelerate to between 8.1 and 8.5% in 2015-16; 8. Private investment must be the engine of long-run growth; 9. There is a case for reviving targeted public investment as an engine of growth in the short run to complement and crowd-in private investment; 10. India faces an export challenge, reflected in the fact that the share of manufacturing and services exports in GDP has stagnated in the last five years.

-

Economic Survey: C. Fiscal Framework; 11. India must adhere to the medium-term fiscal deficit target of 3 percent of GDP; 12. India must move toward the golden rule of eliminating revenue deficits; 13. Expenditure control with growth recovery and GST will ensure that medium-term targets are met; 14. The quality of expenditure needs to be shifted from consumption to investment.

-

Economic Survey: D. Subsidies and the JAM Solution; 15. The direct fiscal cost of all the subsidies is roughly Rs. 378,000 crore or 4.2 percent of 2011-12 GDP; 16. 41% of PDS kerosene is lost as leakage and only 46% of the remaining 59% is consumed by poor; 17. The JAM Number Trinity – Jan DhanYojana, Aadhaar, Mobile – can eliminate leakages and distortion economic survey, economic survey of India, Deficit trends, Fiscal Deficit

-

Economic Survey: D. The Investment Challenge; 18. The stock of stalled projects stands at about 7% of GDP, accounted for mostly by the private sector; 19. Manufacturing and infrastructure account for most of the stalled projects; 20. This has weakened the balance sheets of the corporate sector and public sector banks; 21. Despite this, the stock market valuations of companies with stalled projects are quite robust, which is a puzzle; 22. Expectation that the private sector will drive investment needs to be moderated; 23. Public investment may need to step in to ramp up capital formation.

-

Economic Survey: E. The Banking Challenge; 24. Indian banking balance sheet is suffering from ‘double financial repression’; 25. Going forward, capital markets and bond-financing need to be given a boost; 26. Private sector banks did not partake in the biggest private-sector-fuelled growth episode in Indian history during 2005-2012

-

Economic Survey: F. The Rail Route to Higher Growth; 27. Econometric evidence suggests that the railways public investment multiplier — the effect of a Rs 1 increase in public investment in the railways on overall output — is around 5; 28. However, in the long run, the railways must be commercially viable and public support must be linked to railway reforms. (Express photo)

-

Economic Survey: G. A National Market for Agricultural Commodities; 29. India has not one, not 29, but thousands of agricultural markets; 30. APMCs levy multiple fees of substantial magnitude that are non-transparent; 31. The Model APMC Act, 2003 could benefit from drawing upon the ‘Karnataka Model’; 32. The key here is to remove the barriers that militate against the creation of choice for farmers and against the creation of marketing infrastructure by the private sector. (Reuters) <br><a href="https://www.financialexpress.com/article/budget-2016/economic-survey-2016-live-updates-fm-arun-jaitley-state-of-economy-union-budget-2016/216364/"><strong>Economic Survey 2016 tabled, LIVE updates; 7.6% GDP growth projected in 2015-16</strong></a></br>

US announces list of applicants that qualify for H-1B $100K fee exemption