Indranil Sen Gupta

It is very likely that Reserve Bank of India’s (RBI) rate decisions are to be driven by the Fed for now. It should raise by 25 bps on April 6 atop of today’s 25bps with the Fed likely to raise 50 bps by May. This is only natural: RBI under YV Reddy had also responded to Fed tightening in 2006, like every other central bank then and now. RBI can be expected to cut 100 bps in the second half of FY24 after the Fed pauses. While CLSA called for a cash reserve ratio (CRR) cut, RBI plans to manage liquidity with higher repo operations. The central bank could conduct open market operations (OMOs) of Rs 6 trillion ($73 billion) to provide liquidity and fund the fisc in FY24.

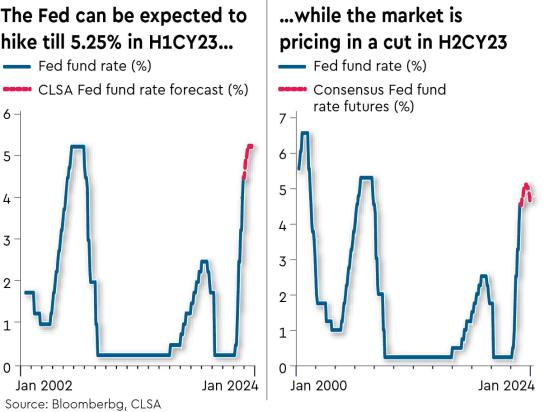

To reiterate CLSA’s call, the RBI monetary policy committee (MPC) will hike 25 bps (to 6.75% terminal repo rate) on April 6 after Wednesday’s 25 bps. Governor Das pointed out that “…further calibrated monetary policy action is warranted… to keep inflation expectations anchored…” The Fed can be expected to raise by 25 bps each on March 22 and May 3, and pause through 2023 thereafter. This was confirmed by Fed chair Jerome Powell on Tuesday night. If the Fed pauses at 5-5.25%, RBI will likely have to raise till 6.75%. If the Fed pauses at 5.5-5.75%, RBI will likely have to raise till 7%.

CLSA’s projection 100bps cut in H2FY24 is predicated on the Fed dot plot’s projection of 100bps cuts each in 2024 and 2025. The FY24 growth forecast, at 5.5%, is lower than RBI’s 6.4% and the government’s 6-6.8%. A combined recession can be expected in the US and Europe. CLSA estimates suggest that a US recession shaves off 100 bps of India’s real growth rate. And its FY24 inflation projections, at 5.5%, are aligned with RBI’s 5.3%. Needless to say, a possible El Nino, that drives away rain clouds from India, remains a risk. A 5% change in food prices can impact inflation by over 200bps.

MPC’s rate decisions are expected to be largely led by the Fed. RBI has already met its inflation imperative with the repo rate, at 6.5%, crossing the FY20-24 5.8% average. RBI will now try to maintain a 200bps differential between its repo rate and the Fed funds rate to support the rupee for as long as possible. Given that it will surely want to recoup forex reserves beyond $600 billion that is deemed ‘adequate’, RBI will not to take risks with the rupee. After all, rupee assets need to be at least as attractive as dollar assets at the short end. At a 6% call money rate, 2.3% premia is lower than 4.6% Fed funds rate; and a 4.6% Fed funds rate plus the 2.3% swap rate is higher than 6% call money rate.

CLSA is quite comfortable with 5.5% inflation, although the RBI’s official target is a lower 4±2%. After all, India’s growth maximising threshold inflation works out to 5.5-6%. Although RBI should ideally maintain a real policy rate of 1%, it should be sufficient to remain in positive territory if the US really faces a recession next year.

Do RBI rate hikes support or hurt the rupee? It supports the rupee when RBI is hiking rates to maintain a reasonable differential between the Fed funds rate and the RBI repo rate to discourage arbitrage, like in 1998 and 2006. In case it raises rates to expand the differential beyond that reasonable level, the rupee typically sells off, like in July 2013, as foreign portfolio investors’ (FPIs) investment in Indian equities, which is essentially driven by growth, is over 15x of FPI debt investment. RBI will need to inject ‘durable’ liquidity rather than temporise with repos, as it did today. With deposit growth lagging loan demand, CLSA was calling for a 1% of book cash reserve ratio (CRR) cut. This supports the call of lending rates rising 125bps (95bps done) by March when slowing global growth is impacting export demand.

RBI can be expected to conduct OMOs in FY24, especially if the 10-year crosses, say, 7.5%. To generate liquidity as well as fund the fisc, it is estimated that RBI will need to OMO `6 trillion ($73 billion/2% of GDP). After all, the government (the Centre and the states) will likely borrow `18 trillion (net). It is assessed that the market may not be able to subscribe to more than `12 trillion. A relief is that CLSA places the FY24 reserve money requirement (ie, durable liquidity to be infused by the RBI) at about `5 trillion. Given that CLSA’s balance of payments forecasts RBI forex intervention sales at $10 billion, RBI should be able to pick up about `6 trillion of government paper via OMO.

It can be expected that the 10-year will slip to 7% by March 2024 on the back of RBI rate cuts and OMOs. Still, the 10-year can spike to 7.5-7.75% if the US 10-year yield finally prices the Fed dot plot. After all, the US bond market is still expecting the Fed to cut 75 bps by December. It appears that market pricing is broadly driven by the experience of the last three bear markets. This time is different. In the past three episodes, the Fed was able to rush to the economy’s/market’s aid as inflation was not a problem. This time round, the Fed is still slated to hike another 50bps to cool inflation.

(The author is Head of India research at CLSA. Views are personal.)