Investors should focus on prospective NRI bond issuances rather than the expected RBI MPC’s terminal 25 bps repo rate hike to support the INR in this Friday’s policy. There is a small probability of a shift to a hawkish stance with a pause. Inflation is expectedly peaking off with September set to print at 3.9%. While depreciation poses a risk, NRI bonds, which could raise $30-35 billion if issued, would be far more effective than rate hikes in defending the INR.

High rates actually end up hurting INR as FPI equity investments, which tend to chase growth, are 8x that of debt investments. It is RBI OMO, rather than rate hikes, that will drive yields/lending rates. It is positive that RBI has finally brought out a OMO calendar for $5 billion in October. Our liquidity model estimates that it will have to OMO another $35+ billion by March even if FPI flows in FY19 end flat ($10 billion outflow FYTD).

NRI bonds would be far more effective than the expected RBI rate hike later today in supporting the INR. Expect the MoF/RBI to raise NRI bonds (of $30-35 billion) with BofA Asia FX strategists now expecting Rs 75/USD by June and their oil strategists seeing $95/bbl then. All 3 previous NRI bond issuances—1998, 2000, 2013—were able to help fend off contagion. Experience shows that only one of the 3 monetary actions—1998—had even partial success. This is because FPI investment in equities ($500 billion), that chase the India growth story, is almost 8x of that in bonds.

Expect RBI MPC to hike rates to combat ‘imported’ inflation. 1% depreciation impacts inflation by 20 bps with 33% of CPI being sensitive to the INR. At the same time, it is only by raising NRI bonds that RBI will be able to contain depreciation and ‘imported’ inflation when political uncertainty is drying up FPI flows. Domestic inflation pressures remain contained, with September set to print at 3.9%. While RBI states that the output gap is closing with June growth hitting 8.2%, this essentially reflects that base effects are now fading. RBI has finally brought out an OMO calendar committing Rs 360 billion/$5 billion in October to modulate tight liquidity.

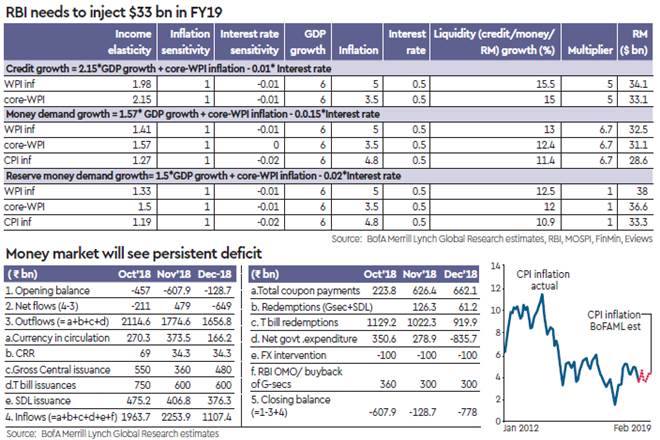

BofA’s liquidity model estimates that it will have to OMO another $35+ billion between November-March. RBI will have to inject $33 billion of reserve money/durable liquidity in FY19. BoP forecasts suggest that it would have to sell about $24 billion ($20 billion spot FYTD, $6+ billion forward) to fund estimated current account deficit of 2.8% of GDP. Money markets will see an average deficit of Rs 500 billion in the December quarter despite Rs 900 billion of RBI OMO, after incorporating the H2FY19 borrowing calendar.

Edited excerpts from BofAML’s India Economic Watch (Oct 3) Co-authored by Aastha Gudwani.