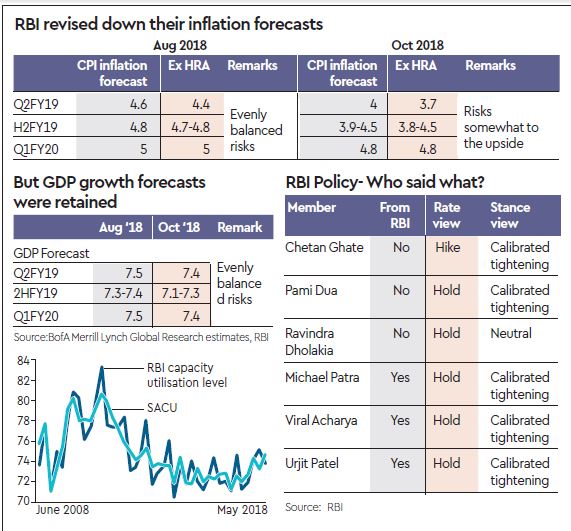

RBI MPC did the right thing in holding policy rates and changing the stance to ‘calibrated tightening’ in a 5-1 vote. Inflation is also expectedly peaking off with September set to print at 4%. While depreciation poses a risk, NRI bonds, raising $30-35 billion, would be far more effective than rate hikes in defending INR. Looking ahead, expect RBI to be on long hold, although another unsuccessful July 2013-type rate defence of the INR cannot be ruled out. BofA’s liquidity model estimates that it will have to OMO another $35+ billion by March, atop the $5 billion announced for October even if FPI flows end FY19 flat ($10 billion outflow FYTD) NRI bonds would be far more effective than RBI rate hikes in supporting INR.

Continue to expect the MoF/RBI to raise NRI bonds (of $30-35 billion) with MofA’s Asia FX strategists now expecting Rs 75/USD by June with their oil strategists seeing $95/bbl then. All 3 previous NRI bond issuances—1998, 2000, 2013—were able to help fend off contagion. Experience shows that only one of the 3 rate hikes—1998—had even partial success. This is because FPI investment in equities ($500 billion+), that chase the India growth story, is almost 8x that in bonds.

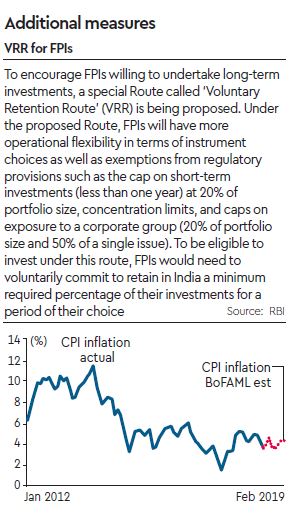

Continue to expect inflation to peak off. September’s inflation should be at 4% (and the recent excise cut on petrol and diesel should damp October inflation by ~10 bps). RBI has cut H2FY19 inflation by 60 bps. BofA disagrees with RBI’s view that the output gap is closing as base effects buoying June’s 8.2% growth are reversing. Seasonally adjusted capacity utilisation levels are still weak.

RBI has brought out an OMO calendar committing Rs 360 billion/$5 billion in October to modulate tight liquidity. Our liquidity model estimates that it will have to OMO another $35+ billion between November-March even if FPI flows end FY19 flat ($10 billion outflow FYTD). RBI should inject $33 billion of reserve money/durable liquidity in FY19. BoP forecasts suggest that it needs to sell about $24 billion ($20 billion spot FYTD, $6+ billion forward) to fund our estimated current account deficit of 2.8% of GDP. Proposed liberalisation of FPI limits is not going to move the needle.

-Edited excerpts from BofAML’s India Economic Watch (Oct 10)

Co-authored by Aastha Gudwani