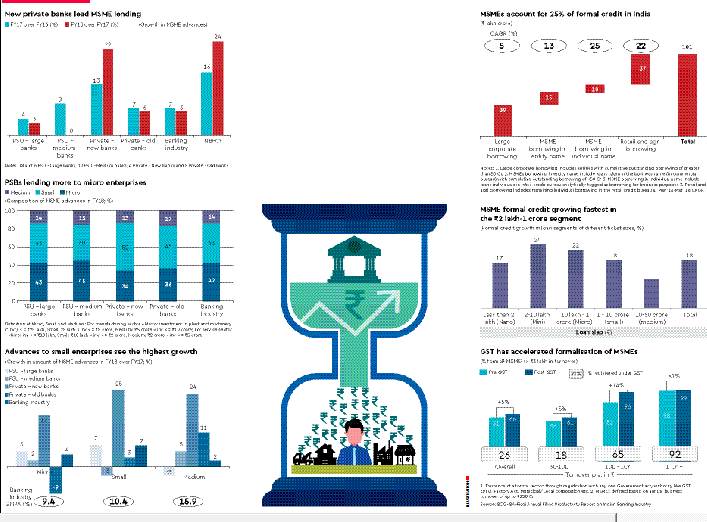

With the introduction of the GST, micro, small & medium enterprises (MSMEs) are increasingly getting formalised as well as digitised, a trend that will boost lending to the segment. Lending from new private banks to MSMEs has grown at an impressive rate of 22% in FY18 and the total value of MSME digital lending is likely to touch $250 billion in next five years, according to the BCG-IBA-Ficci Annual FIBAC Productivity Report on Indian Banking Industry 2018.

Advances to small enterprises are currently witnessing the highest growth among sub-segments. The percentage of MSMEs using digital channels has increased to 47% after GST, as compared with 41% before the introduction of GST. At present, digital lending accounts for only 4% of total MSME lending. According to the report, it is expected to rise to 21% over the next five years. This significant jump will close the gap with digital retail lending, which is expected to reach around 48% of total retail lending in five years.

The report underlines that with a high degree of variability in the quality of assets in the MSME segment and the small ticket-size of advances, success in this market will belong to players who have the resources and capabilities for reliable credit underwriting, and a comparative cost advantage through end-to-end digitisation.

Public sector banks are showing a much higher exposure to micro enterprises, as compared to private sector banks. In MSME advances, loans to medium-sized enterprises have highest gross NPA of 16%. Despite high NPAs, banks continue to increase lending to medium enterprises. The report cautions there is a need to be vigilant in this segment.