By Shankar Sharma

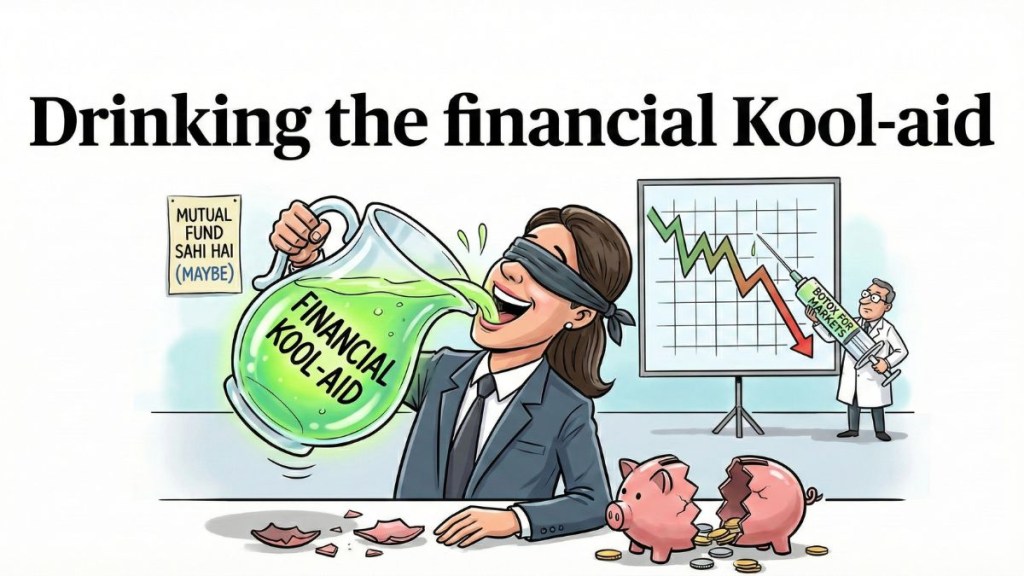

Dermatologists know many secrets. But the best one is that Botox has long-term effects which are not all good. You are never told that. You are always told to start early and continue for the rest of your life. If this sounds strangely and suspiciously like the “Mutual Fund Sahi Hai” campaign, it is merely a coincidence.

We have been told that mutual funds are right for you by many luminaries, in fact, by the biggest one: Sachin Tendulkar. The fact that he is probably not a registered investment advisor (RIA) to be dispensing out investment advice (lesser mortals are routinely handed out multiple-period bans and penalties for doing precisely this) is just a symptom of the problem—the present or the immediately-previous bull market is the first one which has been driven by social media and aggressive marketing by every interested party. Before 2020, our bull markets were largely incestuous love-fests—professionals transacted with each other and amateurs were excluded.

This time, due to public pressure, amateurs were included. Armed with less perspective than a drunk man at a Sunday sermon, the amateurs have convinced the prize fighters that the pros don’t understand this game. But us, old geezers—our cauliflower ears and smashed noses have muscle memory.

Stock market is no easy game

They tell a tale of the stock market being no easy game. It is a brutal bare-knuckle fight, with real blood and teeth on the canvas. The amateurs are now getting a bit of that treatment since 2024. What looked like a Round 3 KO up until 2023 has started looking like Tyson vs Douglas, Tokyo 1990. The numbers don’t lie—in 2025, India has finished in the bottom decile of cultured equity markets. Even a Dhurandhar can’t beat the searing pain of seeing Pakistan 10-12 places higher in the equity sweepstakes this year—in USD terms, that is.

Of course, the whole point of such articles is to sound like Robert Redford in The Horse Whisperer, to soothe the traumatised investors, so let’s get to work. Cyclically, Indian equities are due for something resembling a rally. We have had two terrible years and in a five-year market cycle, the third year can be somewhat of a hope brightener.

At least, we hope it is. The truth is that the Nifty/Sensex have dermatologists working overnight on them, injecting Botox so that the dowager looks decent, if not prom night material. But as Sherlock Holmes said, a pretty woman gives away her age at the knees. If you think of small caps and the broad market as the knees of the Indian stock market, those knees look like those of a slave.

Broad market

The broad market has been cut, lacerated with not even the condescension of a bandage, let alone Botox. Why so? As my very favourite self-created stock market saying goes “That which gives maximum pleasure gives maximum pain”. Small caps are doing what they are supposed to do. They give you pleasure which is largely paper and almost never real. But when they take it away, they take away real bits of skin via a thousand daily cuts to bring back Dhurandhar.

But this is also a good time to reflect if today’s generation is indeed capable of such emotion: Should equity markets even be relevant and important—or should they be—for Indian investors? The short answer is—probably not. While that’s an extreme answer, a more nuanced answer is that it should have nowhere close to the attention share, let alone wallet share, that it has right now. Equities are, ultimately, a capitalistic tool. Capitalism is Darwinian—it isn’t about equitable distribution of wealth, and it never was. So why expect equity markets to even out wealth gaps?

Truth be told, equity markets make the rich richer. But since we aren’t supposed to know this, we barrel along this highway, and each pothole is called “routine” by the collective cabal of finfluencers, TV anchors, asset managers, etc. But the data are discomforting in every way—if Indian nominal GDP growth is going to be between 9-10%, then equity market returns will pretty much follow this. Now, remove capital gains taxes—average 15%—you get around net 7-8% compound annual growth rate (CAGR). Now, adjust for volatility—say, 10% a year—and you get a return with less risk protection than a cardboard helmet. The point is that even fixed deposits are way better.

Now look at from a foreign institutional investor’s (FII) point of view—all the above data will apply. Add to that a 4% INR depreciation per annum, and they are left with something like 4% net after all the rigmarole of travelling to Hyderabad and Bengaluru. You have to be demented to be putting money with this kind of risk-return profile. But yet we ask why FIIs are pulling out. Well, because they are spent. But let’s also take hope in the fact that they still have $750 billion in India—they haven’t fully abandoned us, yet.

The rupee looks rather frail. That’s how a currency looks when the country it belongs to makes nothing that is relevant to the rest to the world. That is how the currency of a country looks when every company is busy playing the domestic consumer and is unable to sell even a pen into the neighbouring Bangladesh. That is how the currency of a country looks when the stock market dominates corporate decisions instead of the other way around. “Over financialisation”, I think, is the apt term.

There I go, sounding less Robert Redford, more Louise Fletcher’s Nurse Ratched—the one who traumatised patients instead of curing them—in One Flew Over the Cuckoo’s Nest. However, January is no time for immiseration. Let’s be optimistic. Let’s hope we finish in the top quartile of toilet-trained equity markets in 2026. Let’s even hope we beat Pakistan at equity markets in 2026. But if we don’t, we can always get our local Kool-aid, say, Dhurandhar’s South Indian remake to keep us giddy, giggly, and goofy. Permanently so.

The writer is the founder of GQ FinXRay/Gquant

Disclaimer: Views expressed are personal and do not reflect the official position or policy of FinancialExpress.com. Reproducing this content without permission is prohibited.