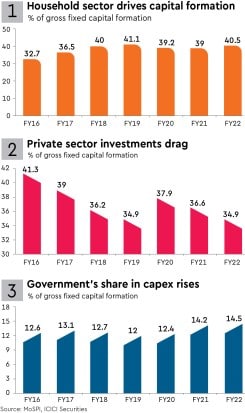

The household sector is the largest contributor to gross fixed capital formation (GFCF) in the country—its share rose to 40.5% in FY22 from 32.7% in FY16.

In contrast, the share of the private sector slipped to 34.9% from 41.3% during the same period.

The government’s share in GFCF rose to 14.5% from 12.6% as public sector spending led by both the Centre and the state governments had supported infrastructure spending, offsetting the slowdown in the private sector.