With forward premiums having fallen over the past several months, companies who followed a policy of hedging imports at inception are feeling rather pleased with themselves; indeed, some companies who followed other processes—hedge partially, use options, stay unhedged and pray—are thinking about switching to a full hedge strategy.

While there is certainly some value in that approach—zero risk—I believe it is important, before taking (or confirming) any hedge strategy, to assess what you are giving up.

We all know that there have been (and will be) many occasions when the rupee strengthens over a, say, 6-month tenor, rendering a Day 1 hedge unprofitable; again, there are (and will be) times when the rupee appreciates for part of the tenor, providing an excellent import cost, but then again weakens to a level that is sometimes still cheaper than the Day 1 forward.

Also read: Dealing with the smuggling menace

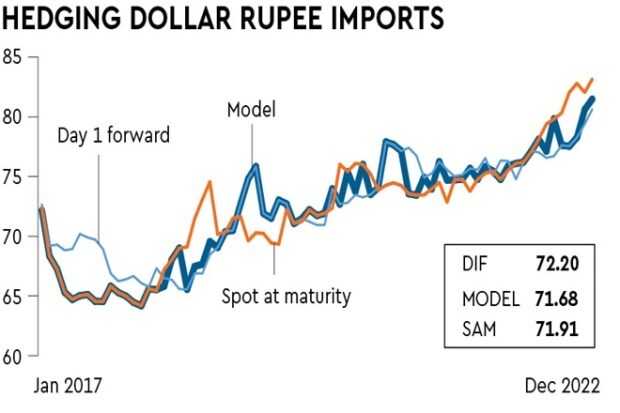

To estimate the possible opportunity forsaken with a 100% hedge, we studied the movements of spot USD-INR over the period Jan 2017 to Dec 2022, and found that a Day 1 hedge would have delivered an average cost of 72.20. Then we attempted to find what was the best possible rate that was available—the MAGIC rate, so to speak. We did this by going through the data over each 6-month period and found, to our amazement, that the “best possible” average cost worked out to 70.77, a huge savings of nearly 2%.

Of course, you can only see this number after the fact, assuming you have a magic wand. While we have no magic wand, we have developed a process that uses a combination of three different hedge strategies—100% hedge, zero hedge and a trailing risk limit (TRL) approach we have developed, and two different triggers to select between the strategies. One of the triggers is based on spot USD-INR volatility and the other on USD-INR momentum.

Running this approach over the test period (2017 to 2022) would have hedged on Day 1 a little over a third of the time (26 times out of 72 months), stayed unhedged for spot spot 32 times, and following the trailing stop loss model 14 times. The risk carried would be relatively modest—a little more than 40% of the risk on a completely unhedged exposure; the TRL model carried no risk over the period (actually, it carried negative risk since the trailing risk limit ended up better than the Day 1 forward).

The return on this risk was an average cost of 71.68, equivalent to around 35% of the maximum (MAGIC) possible savings; in rupee terms, it would have worked out to 52 paise better than the Day 1 forward—that’s more than Rs 50 lakh for each $10 million of imports. A completely unhedged exposure would have also resulted in a cost of 71.91, again higher than our approach. Thus, our combination strategy outperforms both a zero hedge and a 100% hedge while carrying modest risk—an excellent performance in any book!

Also read: The EU’s carbon tax: What India must do

We also ran the approach assuming the same USD-INR movements over the period but with sharply lower premiums (2.2% pa), as compared to the average over the test period (4.2% pa). Again, the combination strategy produced better results than either a zero or 100% hedge; however, the results were somewhat attenuated since all the rates were lower.

The Day 1 hedge came down to 71.51 from 72.20 that prevailed in reality, a nearly 1% savings. Our combination strategy would deliver a rate of 71.31, better than zero risk by 20 paise—equivalent to Rs 20 lakh for each $10 million of imports.

It was, of course, again, better than the zero hedge rate, which remained at 71.91—again, beating both sides of the market.

The writer is CEO, Mecklai Financial

http://www.mecklai.com