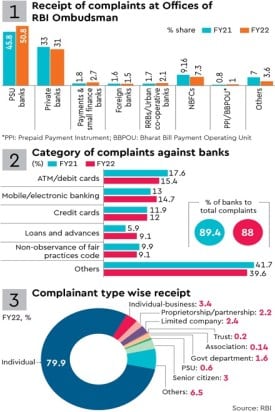

State-owned banks account for half of the customer complaints as registered at Offices of the RBI Ombudsman during FY22.

Complaints related to ATM services and debit cards top the list with a 15.4% share, followed by mobile and electronic banking at 14.7%, and credit cards at 12%.

Also read: After telcos, Google turns to startups

In case of non-banking finance companies (NBFCs), over half of the complaints were related to loans and advances and non-adherence to fair practices code.