By Rahul Chowdhri,

It is hard to believe that a social media creator sold more than a billion dollars’ worth of beauty products online in just 12 hours. While it seems surprising to most of us, for Li Jiaqi, a Chinese celebrity known for running marathon live streams, it was just a piece of cake. Can Indian influencers achieve the same feat?

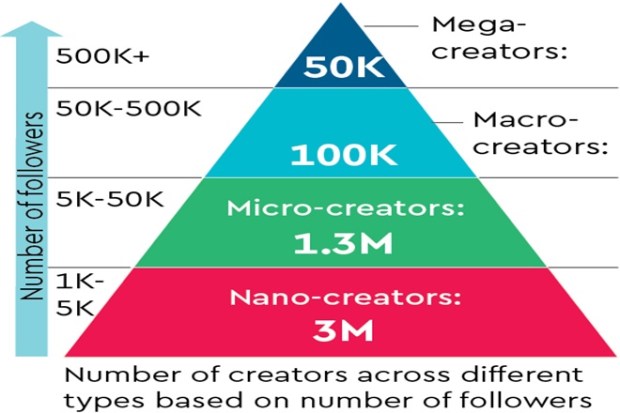

India has 4.5 million creators (1,000+ followers) across Instagram, Youtube, Josh, Sharechat, and this base grew by 100% last year. These creators monetise via brand sponsorships, ad-revenue sharing, subscription services, gifts/ tipping, and IP creation. However, only 150,000 influencers are able to make this their full-time profession. These mega and macro creators (50,000+ followers) rely on brand sponsorships for monetisation. Compared to them, the remaining 1.3 million micro (5,000-50,000 followers) and 3 million nano (1,000-5,000 followers) creators struggle to generate meaningful income .

Micro and nano creators struggle with monetisation due to their smaller follower base and brands’ inability to judge the RoI on them. Research shows that for driving sales, these influencers are more effective with a 2-5x engagement rate as compared to mega-influencers. Skyrocketing paid marketing costs have led brands to turn to influencer marketing in search for the next ‘unlock’. The ultimate holy grail for brands hence is a pay-for-performance model, where sales can be directly attributed to specific creators.

Also Read: A likely game-changer

But, are consumers willing to buy based on creator recommendations? With increasing propensity to buy on social media platforms led by the growth in video content consumption and affinity to “favourite influencers”, the consumer is indeed ready. To resolve these challenges faced by brands, creators and consumers, a variety of creator-commerce models are emerging.

Creator-powered consumer applications

Here, consumers shop for products recommended by creators. LTK, a leading influencer shopping app with over 150,000 creators, allows micro and nano influencers to make money commensurate with the sales they generate for the brands they love. This model is likely to be a winner-takes-all business, driven by strong network effects. A variation of this model can be seen at Shop My Shelf, a platform enabling creators to curate and share links of their personalised stores on social media.

Creator-owned brands

This model is driven by platforms offering services, right from manufacturing to supply chain, warehousing and fulfilment, enabling creators to become entrepreneurs. Such businesses will gain from economies of scale and back-end synergies. Spring, one such venture in the US, has 450,000 creators and is operating profitably in product categories such as apparel, accessories, digital lifestyle, etc. Similarly, Pietra, a US-based player, started with jewellery, and now operates in apparel, cosmetics, swimsuits etc.

B2B marketplace of creators

For brands looking to find the right set of creators, these solutions help with data-based discovery of creators and access to RoI measurement tools at scale. Creators, too, benefit as they get higher visibility and hassle-free payments. A marketplace solution will help accelerate creator-led marketing and commerce, especially for brands poised for growth-led influencer partnerships. One such promising example is Grin, a US-based platform-solution generating $75 million in revenue and differentiating itself by letting brands own direct relationships with creators.

Shopping cards

In this model, nano creators purchase products from brands they love using debit/credit cards and share their reviews on social media. Brands get scalable user-generated-content and creators receive a cashback depending on content performance which can be pegged to impressions or engagement rate. Players like Kale and Bounty are experimenting with this model in the US.

As consumers, the current shopping experience from discovery to purchase is broken. There is no seamless way to buy a product found on Instagram or search for a product showcased by favourite influencers.

Towards this, YouTube recently partnered with Shopify, allowing brands to pin products to their videos, making it seamlessly shoppable. TikTok also launched TikTok Shop earlier this year, allowing brands and small businesses to sell products via creators directly on its platform.

One of the early adopters and Indonesian creator Fredi Lugina Priadi has been using TikTok to showcase his handmade pet clothing. He garnered millions of views on TikTok, sold the products on Shopee and now sells on TikTok Shop. Merging of entertainment and shopping will propel the adoption of aforementioned emerging business models.

There is thus reason to believe that the next decade, a variety of business models will emerge in the creator-led commerce segment transforming consumers’ shopping experience, brands’ channel mix and creators’ monetisation potential.

The author is Partner, Stellaris Venture Partners