Large-cap equity funds are usually considered the backbone of many investors’ portfolios. These schemes invest primarily in the top 100 companies by market capitalisation and are often expected to deliver steady, market-linked growth. However, short-term numbers can sometimes distort the picture.

In the past one year, several large-cap schemes have delivered muted or even negative returns. While this may be a cause for concern for many investors, especially those new to investing, one needs to step back and take a look at the bigger picture.

You see, over the last few years, many investors have once again erred into believing that one can make quick money from the stock markets. They have poured money directly into stocks, and a large chunk of them have ventured into the markets via mutual funds.

Now that the stock markets have kind of disappointed over the last one year, many investors, including you perhaps, are starting to wonder what to do with your investments. Even if you were cautious and chose a large cap fund over say a small cap fund, even then returns over the last one year have been disappointing.

While that is true, one needs to evaluate such funds on the right metrics. And generally, irrespective of how a fund was sold, or why you purchased it, a five year horizon is the right time frame to assess performance.

And if you look at large cap funds from a five year period. A few of these funds have produced annualised returns above 20%. And that’s a solid return.

Why Good Funds Have Bad Years

The question that comes to mind is why “good” funds have bad year/s. While this requires one to deeply study each scheme, one specific broad pattern repeats more often than not. Some fund managers are not afraid to be contrarian. For instance, they may turn cautious in a bullish environment. This obviously impacts near term performance, but even out over time if their contrarian call plays out well. Perhaps this is a key reason for the current underperformance.

It’s important to note that there could be various reasons, and perhaps, we will delve into them at another time. Now, let’s get back to the schemes we selected.

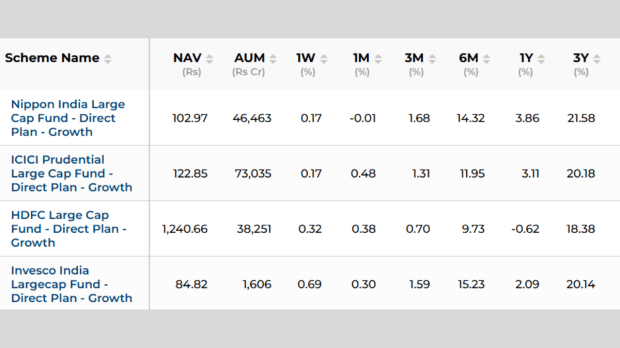

Based on data from the Financial Express Mutual Fund Screener, four large-cap schemes fit this category: ICICI Prudential Large Cap Fund, Nippon India Large Cap Fund, HDFC Large Cap Fund, and Invesco India Large Cap Fund.

While selecting these schemes, we considered three key factors: one-year return, five-year CAGR, and expense ratio.

Patience Personified: Four Case Studies in Long-Term Performance

#1 ICICI Prudential Large Cap: The Resilient Giant

ICICI Prudential Large Cap Fund is one of the oldest and largest schemes in the category. Its net asset value (NAV) stands at Rs 122.64, with assets under management (AUM) of Rs 71,840 crore. The fund’s expense ratio is 0.86%, and it falls under the “very high risk” category as per AMC disclosures.

In the past 12 months, the fund has returned just 3.80%, indicating a relatively quiet year compared to broader market indices. However, over a five-year period, its CAGR is recorded at 22.26%.

#2 Nippon India Large Cap: The Chart Topper

Nippon India Large Cap Fund has maintained a steady presence among large-cap offerings. The fund’s NAV is Rs 102.79, and it manages an AUM of Rs 45,012 crore. Per the screener, its expense ratio is recorded at 0.69%, and the fund is also classified under the “very high risk” category.

In the last one year, the fund has returned 5.53%, slightly ahead of some of its peers in the same category. However, the longer-term record stands out; its five-year CAGR is 25.83%, one of the highest in the large-cap universe.

#3 HDFC Large Cap: Awaiting a Turnaround

HDFC Large Cap Fund is another long-standing scheme in the category, with a NAV of Rs 1,236.65 and AUM of Rs 37,659 crore. The fund’s expense ratio is 0.99%, and it too falls under the “very high risk” classification.

Over the past 12 months, the scheme’s return has been marginally negative at –0.08%, indicating underperformance compared to the benchmark in the short term. But its long-term record remains intact, the five-year CAGR is 22.07%.

#4 Invesco India Large Cap: The Quiet Compounder

Invesco India Large Cap Fund is smaller in size compared to the others, with an AUM of Rs 1,555 crore. The NAV is Rs 84.24 and the expense ratio stands at 0.71%. The fund is marked under the “very high risk” category.

In the short term, the scheme’s one-year return stands at 3.99%, while its five-year CAGR is recorded at 20.28%.Even with moderate size and relatively muted near-term performance, it has maintained a consistent long-term record above 20% CAGR over the five-year period.

Here’s a snapshot from the Screener:

The Investor’s Takeaway: A Lesson in Time Horizon

In conclusion, it’s important to understand that equity funds by their very nature are long term instruments. Therefore before you commit money, you need to be sure that you are going to remain invested for a long period of time, allowing the fund manager to follow his process. Also, you need to avoid the impulse to evaluate short term returns for such funds and take arbitrary decisions.

Finally, investing in a mutual fund should in itself not be a solitary act. Be sure it fits your overall asset allocation.

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.