A lot of ink has been spilled since March 24 this year, when the amended Finance Bill 2023 removed the benefits of indexation and long-term capital gains for fixed-income mutual funds (FI MFs) irrespective of the holding period.

The change in taxation reduced the overall post-tax returns of these products for investors in higher tax brackets, one of the most marketed features of debt MFs given they were inherently volatile compared to traditional investment instruments such as deposits, small savings or direct bonds due to their mark-to-market nature (i.e., daily valuation of the portfolio).

Due to the historical prominence given to the tax benefit, it may prima facie appear that all that fixed-income MFs had to offer was a tax arbitrage. However, MFs offer a multitude of added benefits that continue to make them attractive investment options. These are further discussed below:

1. Mark-to-market pass-through

While most investors prefer the certainty of assured returns in a fixed deposit/direct bond over the mark-to-market (MTM) volatility of mutual funds, the MTM nature can turn out to be an advantage for patient investors.

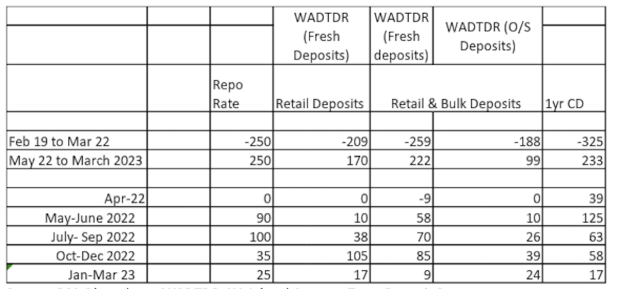

The below table presents the change in repo rate since 2019 and comparable changes in fixed deposit rates and marketable instruments like the one-year CD.

(Bonds have been excluded, as benchmark government bonds like 5 and 10-year are not comparable with the maturity of typical fixed deposits or are comparable in credit quality)

Table 1:

As can be seen from Table 1 above, market instruments transmit rate changes more efficiently than fixed deposits. Marketable instruments benefit from forward pricing mechanisms i.e., changes in their secondary price due to expected future market outlook. For example, bond prices not only react to the current rate action but also the price in future rate trajectory, depending on the market expectations of key variables such as inflation, growth, central bank’s forward guidance, system liquidity, etc. Of course, as expectations change, prices also change on a regular basis. But even these fluctuations can even out over a period of time.

Also Read: Debt funds still offer advantage of real-time liquidity

(a) Transmission in periods of interest rate decline

In the previous period of interest rate decline (Feb’19 to Mar’22) against the repo rate cut of 250bps, one-year CD levels reacted more sharply, falling by 325bps compared to retail deposits of 209 bps.

Thus, an investor who would have invested in a portfolio of marketable securities could have also benefited from capital gains, although future accrual would partially reduce by the degree of capital gains.

(b) Transmission in periods of interest rate increase

Marketable instruments also transmit hikes faster than traditional deposits, thus enabling investors to lock in rates early at higher levels in periods of interest rate hikes.

During the period of May-Mar ‘23, when repo rate was hiked cumulatively by 250bps, fresh retail deposits went up by 170bps, while one-year CD levels went up by 233bps. The forward pricing mechanism even during the initial phase of rate hikes with one-year CD levels rising by 125bps compared to 10bps for fresh retail deposits during the initial rate hike period of May-June 2022. While the mark-to-market volatility will be higher in market-linked strategies, such volatility can be better managed by matching an investor’s risk appetite and investment horizon with the duration risk of the scheme.

2. Liquidity and diversification

Mutual funds that do not have any exit load offer high liquidity i.e., the ability to redeem at demand without pre-mature penalty in fixed deposits.

Unlike direct bonds, redemptions from MF schemes do not involve meaningful impact cost (i.e., transactions at lower than fair price due to weak price discovery).

Mutual funds also offer a diversified portfolio of instruments across government bonds, T-bills, corporate securities with sectoral and issuer caps with schemes distinguished as per their duration/credit risk. This can provide more stability in stressful times compared to holding a concentrated bond portfolio directly.

Also Read: The sting in the tail: Debt mutual funds lose long-term tax advantage

3. Equitability of returns

Moreover, as seen in table 1, pass-through is not equal across all classes of depositors as the average change of bulk and retail deposit is much higher than the change in retail deposits.

For example, during the rate hike period of May-June ‘22, retail deposit rates increased by 10bps, whereas the average of retail/bulk deposits increased by 58bps reflecting dissimilar pass through across various categories of investors. However, returns are the same for all mutual fund investors of the same category (direct/regular) irrespective of their size of investment.

Conclusion: Remember the first principles

Despite the mark-to-market volatility, debt mutual funds score on better transmission, liquidity and benefit of a diversified portfolio.

While there is increased clamour for investors to consider higher risk categories such as credit risk funds or even hybrid funds to earn similar post-tax outcomes, investors should always consider the raison d’être of investing in fixed income i.e., capital preservation, income stability and liquidity. The purpose of investing in fixed income is to reduce the burden of risk. While they may appear attractive tactically, investors may experience significant volatility and illiquidity in these strategies over business cycles. Hence investors should ensure that their financial strategies are aligned with their goals, risk profile and investment horizon.

(By Anurag Mittal, Deputy Head – Fixed Income at UTI AMC)

Disclaimer: The views expressed are the author’s own views. The views are not investment advice and investors should obtain their own independent advice before taking a decision to invest in any asset class or instrument.