Timing the market for starting a mutual fund SIP may not be beneficial for investors in the long run. While the annualised percentage return may be higher in a case where SIP has been started at the bottom of the market cycle, the absolute gain in rupee term may be higher for SIPs started at the top of the market cycle, according to an analysis by WhiteOak Capital AMC. Further, investors have to suffer a significant “cost of delay” if they try to time the market to enter at the bottom.

In continuation to WhiteOak Capital AMC’s earlier SIP report titled, ‘SIP Analysis Report’, the company has come up with further insights on “Which is better, starting SIP at the Top or Bottom?”

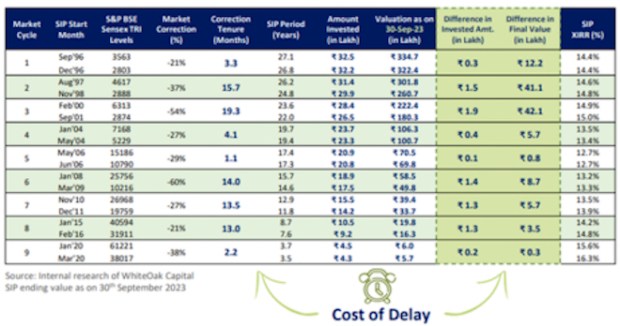

The report is based on a detailed analysis using long-period data of S&P BSE Sensex TRI (last 27 years) and considers all those periods when equity market has fallen more than 20% from its Top. The below table refers investment summary of two investors, one who started a Rs. 10,000 monthly SIP at the Top of various market cycles and the other at the Bottom:

How to read the above table: For example, if someone would have started a monthly SIP of Rs. 10,000 in S&P BSE Sensex TRI during January 2008 (at the peak of market cycle six as per the above table), as of 30th September 2023, they would have invested Rs. 18.9 Lakh and the current value of this investment would have been Rs. 58.5 Lakh at an XIRR of 13.2%.

Similarly, if somebody had started this SIP in March 2009 (at the bottom of market cycle six as per the above table), as of September 2023, they would have invested Rs. 17.5 Lakh (Rs. 1.4 Lakh less than earlier investor) and the current value of this investment would have been Rs. 49.8 Lakh (Rs. 8.7 Lakh less than earlier investor) at an XIRR of 13.3%.

Also Read: Want to make the most of Small Cap Funds now? Here’s an ‘ideal’ strategy you can follow

Some key findings from the report:

1. It is interesting to note that while the % return is marginally higher for SIPs started at the bottom of the market cycle, the absolute gain in rupee term (wealth creation) is far higher for SIPs that began at the top.

2. The “Cost of Delay” of starting SIP late can be huge over the long term. The longer the market takes to reach the bottom, the higher the “Cost of Delay,” keeping all other things constant.

3. Even the marginal difference of % return goes away over the long-term, irrespective of whether you started at the top or bottom (refer to the return difference for SIPs during the first 6 Market Cycles, i.e. in long-term).

Disclaimer: The above content is for informational purposes only, based on a press release by WhiteOak Capital AMC. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.