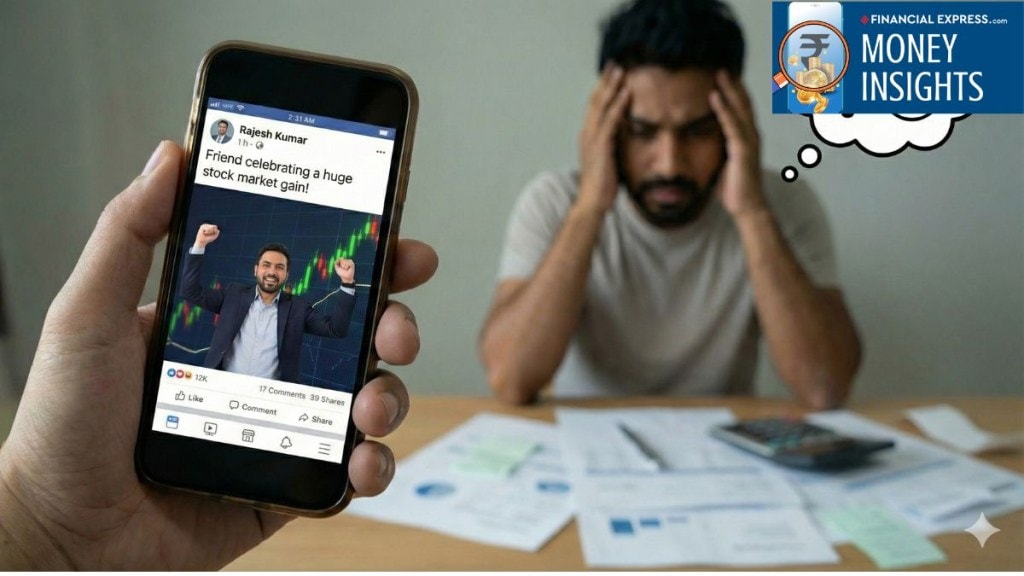

There is a moment that almost every new investor experiences. It arrives quietly and catches people off guard. It might be during a late evening scroll or a quick glance at social media between tasks.

You scroll for a moment and see the usual things. A friend has posted a profit snapshot. Someone is celebrating a sharp jump in a stock they bought. Another person says the market is buzzing and seems thrilled about it.

The first feeling is curiosity. The second is disbelief. The third is a slow, tightening sense of being behind. It is not jealousy. It is something more subtle. It is the fear that everyone else has figured out something before you did. It is the suspicion that the market is handing out rewards, and you are arriving after the distribution.

Most investors never admit this feeling out loud. Yet this moment is where many losses begin long before money is ever placed in a stock.

The comparison trap: How your brain betrays you

Behavioural science calls this upward social comparison. It is a natural response that activates when people observe someone within their peer group doing better. The emotional system treats it like a personal setback. This happens instantly. Logic does not have time to intervene.

The feeling seems harmless, but it alters the investor’s internal calculations. What was once optional now feels essential. A choice that could have waited now feels risky to postpone. The investments you would usually research start to feel like opportunities you must act on immediately. This is the earliest stage of the FOMO impulse, and it is powerful enough to disrupt analytical thinking.

Once the comparison settles in, a second bias emerges. The investor begins to assume that others have superior timing or knowledge. This assumption is rarely questioned. It feels true because the evidence, in the form of someone else’s success, is visible. The result is a shift from independent judgment to reactive behaviour.

At the same time, herd dynamics intensify. The more a stock appears in conversations, posts or group chats, the more legitimate it feels. Popularity starts to resemble safety. Emotional comfort replaces rational assessment. The investor is no longer evaluating the opportunity. They are trying to relieve the discomfort of feeling left behind.

This psychological chain reaction is what sets the stage for the decisions that follow.

The ‘late entrant’ cycle: Buying the top

When urgency takes hold, the investor looks for the source of others’ success. It often leads to a fast-moving small-cap. These stocks attract attention because their price swings are dramatic. Their volatility creates stories that travel quickly.

The challenge is that social networks rarely surface these stocks at the beginning of their move. The early phase is quiet and unremarkable. There is nothing dramatic for people to share. The posts begin only after the surge has already taken place. By the time it reaches the broader audience, the trend is often well advanced.

This is where the narrative fallacy misleads investors. The sequence of gains appears orderly and inevitable when retold. The rough periods, the doubts, and the earlier volatility are removed. What remains is a simplified story that gives the impression of fresh momentum.

As a result, the investor feels they are entering something new. In reality, they are walking into the final stage of a trend that began long before it became visible. The apparent opportunity is actually a delayed signal created by the way information spreads.

Once the trade is in place, the feeling changes quickly. What looked exciting from a distance now feels uncertain. A small dip that would not have mattered earlier suddenly feels like a warning. Because there was no clear reason for buying in the first place, the investor cannot tell whether the move is normal volatility or the start of something worse.

Selling becomes an attempt to regain control. The loss becomes a private disappointment. The lesson becomes blurred. And the next cycle begins in exactly the same way.

The Instagram Illusion: Why Everyone Looks Richer Than You

It is natural to assume that everyone else is progressing more smoothly. But what people see online is not a balanced record of outcomes. Gains are displayed. Losses are hidden. Wins are explained confidently. Mistakes are framed as exceptions or forgotten entirely. This is self-attribution bias, and it shapes the way investors present themselves.

Group chats or social feeds filter market updates through this bias. Only the parts that support personal narratives tend to appear. The result is a distorted environment where success seems common and setbacks seem rare.

In a bull run, this imbalance gets worse. Wins are everywhere, losses go quiet, and the version of the market you see online looks nothing like the one investors actually experience.

Against this backdrop, personal losses feel heavier. They are visible and undeniable. Other people’s losses remain invisible. This contrast makes many investors feel like they are alone in their struggles, but the patterns they face are actually quite common.

The issue is not that others are consistently winning. The issue is that you are comparing your complete reality to their edited version.

Building a system that replaces emotional decisions with clarity

Avoiding emotionally driven mistakes does not require extraordinary discipline. It requires a system that absorbs uncertainty so the investor does not have to. A system creates stability while emotions fluctuate. It turns reactive behaviour into intentional behaviour.

1. Define your rules before you enter the market

Most retail investors operate without structure. A simple one-page personal rule can transform decision-making. It should list your risk tolerance, preferred instruments, holding periods, and max position sizes. This document acts as a shield against emotional urges. It clearly outlines what you will and won’t do before pressure hits.

When temptation appears, the policy provides an objective reference. It gives you a way to evaluate a trade against your own rules rather than against someone else’s gain. Create one-pagers and refer to them periodically. Consider their experiences when you’re thinking about investing, especially if a friend has seen significant gains.

2. Strengthen asset allocation through periodic review

Asset allocation is not just a set of percentages on a page. It is what keeps your portfolio steady when your emotions are not. When your allocation drifts too far from what you intended, every move in the market starts to feel bigger than it is. Hype feels more tempting. Volatility feels more threatening.

A simple quarterly review can correct this. It brings your exposure back to levels you are comfortable with and stops you from sliding into concentrated, high-risk positions without realising it.

When your allocation is in place, you feel less pressure to chase what others are buying. And that alone reduces the chances of getting pulled into hype-driven decisions.

3. Use valuation and risk filters as a first line of defense

Before adding a new investment to your portfolio, use some basic checks. Start with historical valuation ranges, earnings visibility, cash flow strength, and balance sheet stability. Then, consider broader risk factors. Look at liquidity, recent volatility, and whether the stock has had a sharp increase that might affect your entry point.

If an idea fails any of these filters, the signal is clear. Enthusiasm should not replace caution. Filters turn vague impressions into measurable criteria. They ensure that a stock earns its place in your portfolio based on fundamentals and risk control, not momentum or popularity.

4. Introduce a mandatory waiting period

A waiting period can be transformative. For example, an investor might decide to wait 24 or 48 hours before acting on any idea influenced by social exposure. This pause reduces impulsive entries and gives the rational mind time to respond. Studies indicate that even brief breaks can help minimize decisions made out of regret.

If an idea remains compelling after the waiting period, it is more likely to be grounded in reasoning rather than emotional urgency.

5. Use scenario planning for potential losses

Before making a purchase, write down what you would do if the investment were to fall by 10%, 15%, or 20%. This forces you to confront risk before it materializes. It also helps you distinguish between volatility you can tolerate and volatility that would force you out. Investors who plan ahead are less likely to panic in downturns. They know their limits.

6. Automate recurring investments to reduce timing anxiety

Automation removes the pressure of choosing the perfect moment to invest. It builds consistency and keeps investors safe from the emotional highs and lows of watching the market. This is especially valuable for those prone to reacting to online enthusiasm.

7. Establish a rule that emotional triggers cannot be decision triggers

If the impulse to buy comes from seeing others gain, the rule is simple. Do not buy. If the impulse to sell comes from fear alone, the rule is just as clear. Do not sell until a fundamental review validates the choice.

This separation between emotion and action is what turns a reactive investor into an intentional one.

A more grounded path forward

The way out of FOMO driven mistakes is not optimism; it is structure. A clear investing framework, smart allocation, and a simple checklist can stop most timing errors driven by emotions.

Nothing in the markets is guaranteed, and no system can remove uncertainty. What these habits do is lower the odds of avoidable mistakes, especially the ones triggered by watching others appear to succeed with ease.

The market tends to reward clarity and punish comparison. So the real question is whether your decisions are coming from your own process or from reactions to what you see around you.

Are you following a plan or following the crowd? And when pressure builds, do you rely on your rules or on the confidence of others?

These are the questions that decide whether you stay grounded or get pulled back into the same cycle again.

Chinmayee P Kumar is a finance-focused content professional with a sharp eye for investor communication and storytelling. She specializes in simplifying complex investment topics across equity research, personal finance, and wealth management for a diverse audience from first-time investors to seasoned market participants.

Disclaimer: The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is not a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.