I have often heard this from some of the most seasoned financial planners that when it comes to large cap funds, just pick one.

Their logic sounds simple.

Large cap funds mostly invest in the same set of companies. So whether you choose Fund A or Fund B, it does not make much of a difference.

And to be fair, this advice has a certain appeal.

Why overthink it? They all hold the biggest names anyway such as Reliance, HDFC Bank, Infosys, ICICI. How different can they be?

Midcap or smallcap funds… sure, that is where people diversify, compare multiple options, spread across fund houses. But large caps? “Just go with one. All the same.”

Except, they are not.

Even within this one category, the differences can be sharper than most people imagine.

Some large cap funds chase high-growth stocks. Some lean towards undervalued companies. Some stick to index-like exposure. Others take active sector bets.

And over time, those decisions show up in your returns and in your experience as an investor.

Let me break it down.

Same Label, Different Behaviour

As an example take four large cap mutual funds by four different fund houses.

These four mutual funds, Nippon India Large Cap, SBI Large Cap, ICICI Prudential Large Cap, and Quant Large Cap all belong to the same category.

They are all equity funds focused on large cap companies. They all invest in well-established businesses. They all include names like HDFC Bank, ICICI Bank, Reliance Industries, or Larsen & Toubro. The fund labels, even the brochures, may look similar.

But once you look inside, the similarity fades quickly.

Each of these funds has a different personality. And that shows up in both the way they are built, and the way they perform.

Four Funds, Four Distinct Approaches

Start with Nippon India Large Cap Fund.

This fund has been around for more than 15 years, and has shown a tendency to take a slightly broader approach to stock selection. It holds dominant names from banking and energy, but also allocates meaningfully to services, a category that does not feature as prominently in most large cap funds.

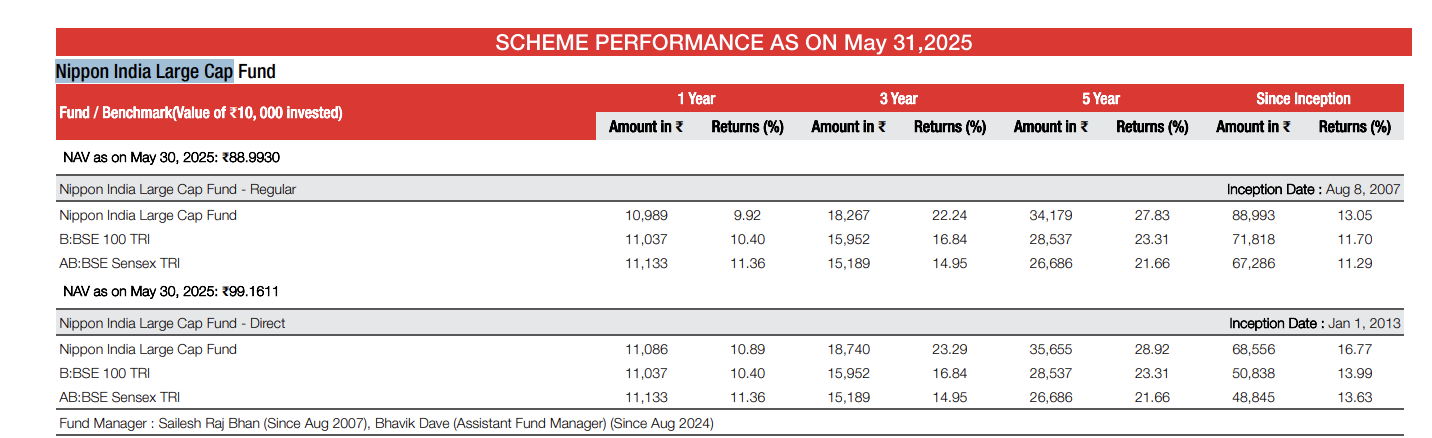

Over the last five years, it has delivered 28.92 per cent annualised returns and since inception it is 16.77 per cent annualised returns, which is among the better outcomes in the segment.

The fund appears to carry a wider lens combining traditional large cap allocations with exposure to emerging themes. It does not behave like an index tracker. It participates in the core but looks beyond it too. That mix may explain its performance during certain market cycles, especially those driven by newer sectors or underappreciated names.

Then there is the SBI Large Cap Fund, which also has a long history and a large asset base.

Its portfolio feels more traditional, a heavier tilt to financials, energy, and consumer staples. The top holdings include the usual private banks and Reliance, but the overall sector weights suggest a more benchmark-aware approach.

Over the last five years, its annualised return has been 21.53 per cent and since inception it is 12.26 per cent annualised returns, noticeably lower than Nippon’s.

This could be intentional. The fund seems to follow a more stable, index-adjacent strategy, one that does not drift far from the comfort of large, proven companies. The reward is a lower level of volatility. But the trade-off is visible in the return gap over longer timeframes.

Now look at the ICICI Prudential Large Cap Fund.

This fund stands somewhere in the middle. It maintains exposure to core sectors like financials, but with added allocation to cyclicals such as automobiles and industrials. The portfolio data shows a more flexible stance, and the fund manager has a reputation for making tactical shifts based on valuation and macro signals.

That approach has helped the fund deliver 23.99 per cent annualised over five years, and since inception it is around 15.14 per cent, possibly one of the best in the category. It is a fund that participates across market styles, without being locked into one particular playbook. That flexibility may suit investors who are comfortable with moderate movement across sectors.

Finally, there is the Quant Large Cap Fund, which is the youngest of the four and also the smallest in size. It has a more concentrated and dynamic approach. Its top sector allocation includes PSU (16.0 per cent) and healthcare (11.3 per cent), higher than most peers. The portfolio features names like Jio Financial, Adani Enterprises, and DLF Ltd., which are not top holdings in the other funds.

This signals a very active and high-conviction strategy. The fund is not afraid to move into less-crowded positions. But that also means it will experience sharper swings. The one-year return for the fund is negative 5.71 per cent, which reflects the risk of such concentrated exposures not playing out as expected in certain market phases.

What These Differences Mean

The key takeaway here is not about picking winners or avoiding laggards. It is about understanding that style matters even within a category as commonly used as large cap.

These four funds (taken for study purposes) show that investment strategy, sector positioning, and manager conviction can lead to very different outcomes, both in performance and investor experience.

Someone who prefers stability and predictability may feel more aligned with a fund like SBI. Someone who wants active participation in market trends may relate better to Nippon or ICICI. And someone who is comfortable with deeper bets and bigger moves might find Quant more appealing, although that comes with sharper fluctuations.

In other words, the category tells you where the fund is allowed to invest. But it does not tell you how the fund will behave once it gets there.

And that behaviour, over time, can matter more than the label.

How to Think About Picking the Right Fund

I do not believe there is such a thing as a “best” large cap fund. That word only makes sense in hindsight, once the returns are in.

In real time, what matters far more is whether the fund you have chosen behaves in a way that you understand and are comfortable with.

Over the years, I have realised that even when people ask about “top-performing funds,” what they are really looking for is confidence. A sense that they are not making a mistake. That their money is doing what it should be doing.

But the trouble is, that confidence does not always come from performance alone. It comes from clarity. And clarity comes from knowing what kind of fund you are holding.

Some funds are designed to stay close to the index. They rarely take strong positions and tend to reflect the mood of the market. These may not impress you during bull runs, but they also do not have massive volatility during corrections. If you are someone who values predictability and prefers not to be surprised by short-term swings, this approach usually works better.

Other funds are more active. They carry the manager’s view. They shift gears based on valuation, momentum, or even sector rotation. These funds may not move in line with the index every month. But over longer cycles, they may outperform or at least behave differently enough to add value when other parts of your portfolio are quiet.

I know people who get anxious if their fund underperforms for even two quarters. For them, holding a tactical or high-conviction fund becomes emotionally difficult, even if the logic is strong.

On the other hand, there are investors who are very comfortable holding aggressive funds because they have already accepted that short-term discomfort is part of the journey. They give the fund space to do what it was designed to do.

This is why I believe the right fund is the one whose behaviour matches your own. Not your goals on paper, but your response to stress, your ability to stay the course, your comfort with waiting. These things are harder to measure, but they show up in real life. When markets fall. When returns go flat. When you check the app and feel unsure.

What worked for someone else might not work for you. And that is not because the fund is wrong. It is because the match was off.

This is also why fund selection should not be based only on one-year charts or rankings. Those numbers change. What stays is how the fund behaves. What it invests in. How concentrated or balanced it is. Whether it plays it safe or tries to do something different. That behaviour stays more stable across cycles, and that is what shapes your experience.

If a fund helps you stay invested, if it lets you sleep well, if you understand what it is trying to do and why then that is already a good fund for you.

And sometimes, that matters more than whether it is on top this year or not.

Author Note

Note: This article relies on data from fund reports, index history, and public disclosures. We have used our own assumptions for analysis and illustrations.

The purpose of this article is to share insights, data points, and thought-provoking perspectives on investing. It is not investment advice. If you wish to act on any investment idea, you are strongly advised to consult a qualified advisor. This article is strictly for educational purposes. The views expressed are personal and do not reflect those of my current or past employers.

Parth Parikh has over a decade of experience in finance and research. He currently heads growth and content strategy at Finsire, where he works on investor education initiatives and products like Loan Against Mutual Funds (LAMF) and financial data solutions for banks and fintechs.