Many people envision a wealth journey as a fun, steady upward climb — invest, watch your money grow and one day arrive at the “large” number everybody is talking about. Real life seldom works that way.

For some, the figures may remain small for years; it can seem like your efforts are having no impact; and the idea of continuing to make an effort can become frustrating. This is not failure. It is something else – something nobody has ever told you about.

The illusion of stagnation

For instance, picture yourself setting aside a portion of your income each month for years watching your savings go from thousands into hundreds of thousands of rupees. From a logical standpoint, you have to believe that you are getting better off. Emotionally, however, nothing has changed. There are still bills to pay; there is still pressure on your finances; and a nagging question begins to form in your head: Is anything happening here?

This is the first question of a very unique and powerful phase of the journey, which most people do not comprehend or endure long enough to experience the results of.

1 You are working hard, but there is nothing to show for it yet

You are using actual time, energy and money toward a goal of growing wealth. You are actually setting money aside each month through savings and investments. You are tracking where your money is going by recording your monthly expenses. You are also much more conscious of your spending habits and therefore likely more fiscally responsible than at any other point in your history.

On the flip side, your external world has not changed; you are still living in the home you have always lived in, worried about the very same bills as before. It’s clear to you there isn’t a visual result or reward from all the effort you put into becoming better off.

That’s because the most important changes are invisible. It is not that nothing is happening.

2 Your progress is real, but it does not feel like much progress

It is true that your progress has been tremendous as you went from ₹0 to ₹5 lakhs, and it is also true that going from ₹5 lakhs to ₹15 lakhs represents real progress; however, when compared to your dreams of reaching ₹1 crore, or even ₹5 crores, the two previous amounts do not seem to be much.

One of the main reasons people get discouraged with their progress is because they are comparing what they have accomplished at the beginning stages of their journey to what they want to achieve by the end of their journey. In most cases when you make this comparison, you will realise that the progress you made was minimal.

However, this is the point in time you build your base for the rest of your journey. And if you do not have a solid base, you will never have success with the large numbers you are dreaming about.

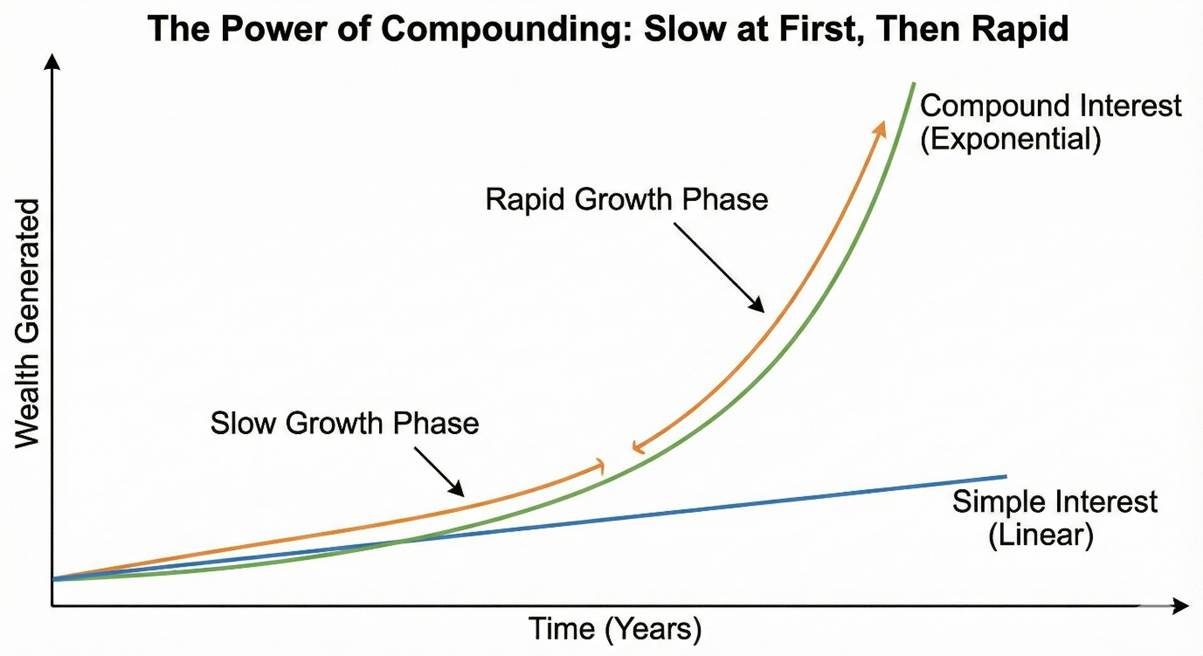

3 Compounding is still “warming up”

The majority of the gains from this stage will still come from your own contributions, and not from those contributions gaining value through your investments. Your contributions will do all the work to generate wealth; meanwhile, compounding will be quietly building momentum in the background.

It is discouraging since you think your money should be generating wealth on its own by now; however, your money still feels as though you are generating wealth on your own. What you do not realise yet, is that compounding is not linear. It is slow at first and then, very rapidly; however, only if you allow it enough time.

4 This is where self-doubt really begins

It’s easy to be motivated at the start of anything; everything is new and exciting, and you can feel good about having started something. It’s also relatively easy to continue being motivated at the end; by that time your portfolio is substantial enough to make you excited.

However, the most difficult phase is somewhere in between – once you have lost that initial enthusiasm, and the ultimate “big payoff” is still a long way off. During this stage, self-doubt creeps in (often with negative consequences):

“Should I quit now?”

“Am I going too slow?”

“I probably should have started earlier.”

“There may be an easier way.”

While these thoughts are natural, it is when they begin to dictate how you act that they become dangerous.

5 Most people quit in this exact phase

This is a harsh reality to face. Most people do not fail by making poor investment decisions. Most people fail as they lose patience and stop their SIPs. Or worse, redeem their SIPs. Most people abandon their long term financial planning for temporary comfort. Most people tell themselves they will “go back” to investing once things have stabilised and they earn more money or feel better about themselves, and the markets.

In many cases that time never arrives. The silent period weeds out all those who are looking for fast returns; it quietly eliminates the impatient.

6 This phase isn’t building your bank balance. It’s building you.

This is the true ROI (Return On Investment) of the investments you make during this phase. Not in rupees, but in who you are becoming. The numerous times each month that you have to force yourself to be consistent. The many times each day you will have to suppress your impulses.

Each time you say “no” to something that you don’t need. Each time you delay gratification. Each time you see your progress as slow; these are all things that build character. These are the very same attributes that are required to maintain and grow wealth. A large portfolio can lose value at a rapid pace without the right temperament. With the right temperament an average income can produce extraordinary results.

This is the “Invisible Phase.” In this phase you are being shaped into the type of individual that does not only acquire wealth but also has the ability to retain it.

7 One day, the numbers stop crawling and start compounding

Nothing feels like it has changed at first. There is no big announcement, no dramatic moment. And then, over time, you are able to feel a new dynamic emerging; your returns on investment start to grow much faster than your investments. The portfolio that grew so slowly before (and had taken years to grow by 1 crore) starts to gain momentum.

What took years now happens in months. The distance between 40 lakhs and 50 lakhs of rupees will have seemed to happen far more quickly as compared to the journey from 0 to 10 lakhs. That was no coincidence and no instant flash of genius. The real payoff of being consistent for years is just starting to appear, but you will be the only one who knows that.

8 By the time the world notices, the real work is already done

When the world finally starts inquiring as to how you were able to achieve such success they are only looking at the visible results (the financial gains, the comfort level, the confidence) but will not be aware of all the years of quiet discipline, self-doubts, and small sacrifices that allowed for your success.

It is ironic that the phase of your life that had a greater impact on who you are today was the one where no one was paying attention, and there was no applause or validation just continued persistence. That is why it was so successful.

The invisible phase is where real wealth is born — not in numbers, but in habits, mindset, and consistency. Most people leave too early. Stay long enough, and one day the results won’t just be visible… they’ll be undeniable.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Please consult a qualified professional before making investment decisions.