Silver has made a seamless transition from being a precious metal to becoming an investment theme.

Although the recent years may have highlighted gold and equities as the major beneficiaries of hedge investing, silver has managed to make its own strong claim.

The sharp move in silver in 2025 is certainly a drawing card for investors. But it is not just a story based on past performance.

As investors move into 2026, they are now looking at silver not just as a tactical or speculative opportunity. Instead, there is growing interest in silver mutual funds as a systematic form of investment.

Due to the changing international dynamics, growing importance in industries, and increasing adoption of investments related to commodities, silver mutual funds are turning out to be a category to closely watch.

Silver’s Role is Changing

Traditionally, silver was viewed largely as a cheaper alternative to gold or a hedge against inflation.

But over the past few years, silver’s identity has expanded.

Today, silver sits at the intersection of:

- Precious metals

- Industrial commodities

- Future-focused technologies

This dual role is what makes silver structurally different and potentially more dynamic than many other commodities.

As the global economy adapts to energy transition, digitisation, and electrification, silver’s industrial relevance has become difficult to ignore.

Silver Price Rise Impact on Demand

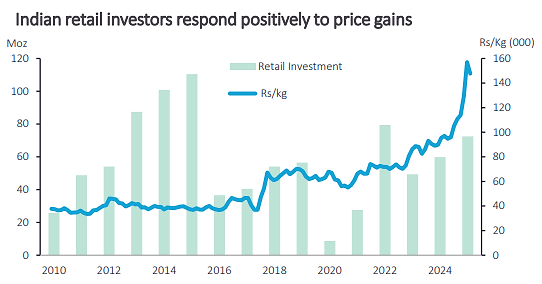

One of the more underappreciated aspects of the silver story is how Indian demand has responded to rising prices.

Traditionally, higher prices tend to dampen consumption for most commodities.

However, recent data from Metals Focus suggests that Indian silver demand has shown notable resilience even during periods of strong price appreciation.

What stands out is the growing commitment of Indian consumers to silver jewellery and investment products.

Periods of price gains have coincided with higher participation through ETFs, bars, coins, and regulated investment routes.

This behaviour suggests that silver demand in India is becoming less price-sensitive and more investment-driven, especially when supported by favourable global cues.

This evolving role forms the backbone of why silver mutual funds are being discussed as a potential theme for 2026.

Why Consider Silver Mutual Funds

What strengthens the case further is the way silver mutual funds are positioned to capture this shift more efficiently than traditional silver investment routes.

From a 2026 perspective, silver mutual funds offer investors structured exposure to a commodity that is transitioning from a cyclical trade to a structural allocation.

Unlike short-term positions in physical silver or tactical ETF trades, mutual funds enable investors to participate in silver’s long-term demand cycle while maintaining portfolio discipline.

| Parameter | Silver ETFs | Silver Mutual Funds / FoFs |

| Investment Structure | Track silver prices, backed by physical silver | Invest in silver ETFs or silver-linked instruments |

| Mode of Investment | Traded on stock exchanges | Bought and redeemed at NAV through AMC platforms |

| Demat Account | Required | Not required |

| Investment Approach | Tactical / price-driven | Strategic / allocation-driven |

| Suitability | Active investors comfortable with volatility | Long-term investors seeking diversification |

| SIP Facility | Not naturally available | Available |

| Portfolio Role (2026) | Short to medium-term exposure | Satellite allocation for portfolio diversification |

*This is for illustration purpose only

Silver mutual funds stand out for 2026 as they capture silver’s dual drivers industrial demand and investment appeal in a portfolio-friendly structure.

With rising usage in renewables and electronics, silver prices are increasingly driven by fundamentals, while mutual funds allow investors to stay invested without timing the cycle.

It also offers diversification beyond equity and debt, along with operational ease by eliminating storage, purity, and liquidity concerns associated with physical silver.

Taken together, these factors suggest that silver mutual funds are not merely riding a past rally. Instead, they are gradually aligning with long-term structural trends, portfolio diversification needs, and evolving investor preferences.

Silver: The Green Metal

Silver is increasingly being recognized as a ‘Green Metal’, thanks to its critical role in the renewable energy and clean technology revolution.

Unlike gold, silver’s industrial footprint is expanding in sectors aligned with the global push for sustainability.

1. Solar Energy and Photovoltaics

Silver is a key component in solar panels, accounting for roughly 20 grams of silver per panel. With India and the world ramping up solar energy capacity to meet renewable targets, industrial demand for silver is set to grow steadily.

This makes silver more than a speculative asset; it is a metal whose consumption is structurally linked to green energy adoption.

India’s solar capacity is now expected to grow by over 45 GW in the fiscal year 2026, which would lead to an even greater increase in silver demand than the previously estimated 150 tonnes.

Current forecasts suggest the silver demand for photovoltaic (PV) applications alone will continue to surge.

2. Electric Vehicles and Electronics

The transition to electric vehicles (EVs) is another long-term driver. Silver is used extensively in EV batteries, connectors, and electronics.

Similarly, high-tech electronics, 5G infrastructure, and semiconductor components rely on silver for its superior conductivity. These sectors are expected to expand in 2026 and beyond, providing a structural underpinning for silver prices.

Silver mutual funds, particularly funds-of-ETFs, allow investors to gain exposure to this green-metal theme without operational hassles like storage or purity concerns.

By investing in silver mutual funds, one participates not just in short-term price movements but in the long-term industrial adoption of silver.

This makes them more aligned with strategic portfolio thinking rather than tactical commodity trades.

With silver emerging as the green metal of choice for the renewable and high-tech sectors, the question investors may ask next is: How much of this metal should find a place in a well-structured 2026 portfolio?

How to allocate silver in your portfolio

Although Silver has proven its mettle, but its price volatility and cyclical nature asks for a disciplined allocation approach.

While silver has scaled a 13-year high, past performance does not guarantee future returns. Historical patterns show that major run-ups are often followed by sharp corrections, as observed in 2011 and 2021.

- Short-term volatility may persist.

- Mining supply improvements in 2026 could cap upside.

- Central bank activity (Russia, India, Saudi Arabia) may influence global pricing.

Allocation Framework

- For conservative portfolios, a 2–5% allocation to silver mutual funds can provide diversification benefits without excessive exposure to volatility.

- For moderate risk portfolios, 5–10% may be considered, balancing potential upside with cyclical risk.

- For aggressive or sector-focused portfolios, investors can consider slightly higher allocations, but only as part of a well-diversified investment strategy.

Thumb Rule: Treat silver mutual funds as a satellite allocation complementing equities, debt, and gold rather than a core portfolio driver.

Silver’s evolving narrative underscores a broader lesson for investors: markets are shaped as much by emerging trends and structural shifts as by past performance.

While silver mutual funds offer a way to participate in these shifts, their true value lies in being part of a dynamic, adaptable portfolio strategy.

In 2026, the focus should be less on chasing returns and more on observing how new investment themes unfold, learning from the market’s signals, and integrating opportunities with measured, long-term thinking.

Invest wisely.

Happy investing.

Table Note: The securities quoted are for illustration only and are not recommendatory

Past performance is not an indicator for future returns.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary