I remember reading a man’s confession on Reddit.

He had just taken a home loan, and the EMI was nearly 40 percent of his salary. In the first month, he was proud to pay it.

By the third month, he wrote that the EMI had started to feel like a shadow that followed him everywhere. Each time he opened his wallet, he could hear the number in his head.

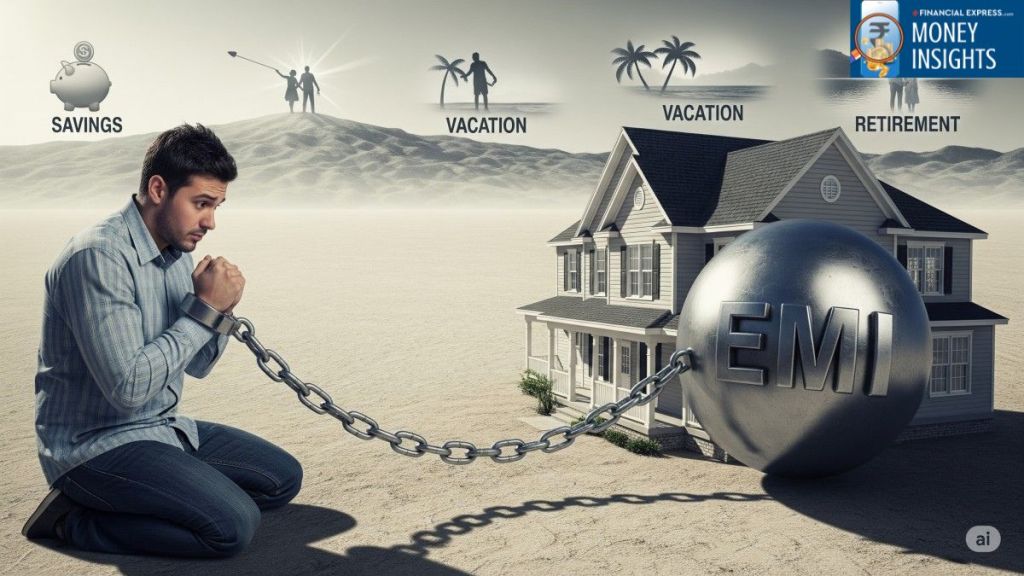

Vacations were cancelled. Investments stopped. Even simple family outings felt like luxuries he could no longer justify.

This is the part no one talks about.

Banks will clear you for an EMI that eats up almost half your income, but they do not live with the pressure that comes after. The real test is not whether you can pay the EMI today. It is whether you can still save for tomorrow without guilt, without fear, without sacrificing every other plan you had for your life.

An EMI that silences your savings and chokes your choices is not affordable. It is a loan that owns you, long before you own the house or the car.

Stress, Guilt and Regret

What a large EMI really takes away a lot of options. Over the years, you begin to notice the trade-offs.

Retirement contributions shrink. Investments are skipped. The dream of sending your children abroad for studies fades. Even health insurance or building an emergency fund gets delayed because the EMI already claims the first and biggest share of your salary.

This is the part few people calculate when they sign up for a loan. A bank will never ask you if your child’s education plan will survive after you commit to an EMI. They will never ask if you can still build a retirement corpus or invest for your future goals. But these are the choices that get silently pushed aside.

The result is that many households look secure from the outside as they own property, they make EMI payments on time but inside, they are running with no cushion.

One job loss, one medical emergency, one interest rate hike, and the entire structure begins to shake. The EMI may give you an asset today, but it can also leave you without the very safety nets that protect your tomorrow.

The Real Affordability Test

This is why the true test of affordability is not what the bank says you can borrow. It is what you can live with after the borrowing. The question to ask yourself is brutally simple:

After paying my EMI, can I still save and invest at least 20 to 30 percent of my income every month?

If the answer is yes, then the loan is helping you grow while keeping your future safe. If the answer is no, then the EMI is not affordable, no matter what the bank’s approval letter says. Because without savings, you are only repaying the past while sacrificing the future.

How to Avoid the Trap

There are ways to avoid falling into this cycle:

- Borrow less than your eligibility. Just because the bank says you qualify for an EMI of ₹40,000 does not mean you should take it. Choosing a smaller EMI can give you breathing space.

- Prioritise saving before spending. Treat your savings and investments like a non-negotiable EMI. Pay yourself first, at least 20 to 30 percent of your income and then fit the loan into what remains.

- Prepare for shocks. Jobs can be lost, expenses can rise, interest rates can climb. If your EMI leaves no space for an emergency fund, then you are one event away from a financial crisis.

- Think in decades, not months. A house or a car lasts years. Your loan will too. Ask yourself: if I have to live with this EMI for the next 10 or 15 years, what will I be giving up along the way?

The goal is not to avoid loans. Loans can be useful. The goal is to take them on terms that allow you to live without fear. An EMI should be a bridge to your future, not a chain around your present.

A Mirror for You

Before you sign your next loan paper, ask yourself these questions honestly:

- After paying my EMI, how much of my income is left for savings and investments? Is it at least 20 to 30 percent?

- Do I have an emergency fund that can cover six months of EMI if my income stops?

- If interest rates rise by 1 or 2 percent, can I still manage the EMI without stress?\

- Am I cutting back on essential goals like retirement or children’s education just to keep this EMI running?

- Will this EMI allow me to live, or will it silently control every financial choice I make?

Your answers to these questions will tell you more about your real affordability than any approval letter from a bank.

So before you celebrate the loan approval, pause. Ask yourself whether this EMI will allow you to live fully, or whether it will quietly control every financial choice you make. Because money borrowed can always be repaid, but time lost to fear, anxiety and missed opportunities will never come back.

Author Note

Note: This article relies on data from fund reports, index history, and public disclosures. We have used our own assumptions for analysis and illustrations.

The purpose of this article is to share insights, data points, and thought-provoking perspectives on investing. It is not investment advice. If you wish to act on any investment idea, you are strongly advised to consult a qualified advisor. This article is strictly for educational purposes. The views expressed are personal and do not reflect those of my current or past employers.

Parth Parikh has over a decade of experience in finance and research. He currently heads growth and content strategy at Finsire, where he works on investor education initiatives and products like Loan Against Mutual Funds (LAMF) and financial data solutions for banks and fintechs.