In 2025, the Indian stock market faced challenging times amid high valuations, persistent selling by foreign investors, US tariffs, a depreciating rupee, and a global equity market rally driven by AI.

Notably, Foreign Institutional Investors (FIIs) have sold shares worth Rs 1.6 trillion (tn) i.e., Rs 1.6 lakh crore from the Indian equity market so far in 2025.

This year has been particularly challenging for stock-picking investors. This data illustrates the difficult market environment. According to a Moneycontrol analysis, 90% of the 2,667 listed companies are more than 20% below their 52-week highs. Another 413 stocks are down between 10% and 20%. A significant 1,532 stocks are down between 20% and 50%.

Furthermore, the total number of listed companies increased by 11% from 4,668 on 28 September 2024 to 5,185 on 20 December. However, despite this growth, the total market cap remained at Rs 4.7 lakh crore. This reflects broader market pain, which negatively impacts investors’ portfolios. To navigate this market uncertainty, investors should consider investing in mutual funds.

This is where Systematic Investment Plans (SIPs) quietly do their work. By spreading investments across market cycles, SIPs reduce the pressure of timing the market and instill discipline in building long-term wealth. However, volatility doesn’t disappear entirely. Markets will correct, recover, and sometimes consolidate, as is happening now.

The advantage of SIP investing is that you participate in all market phases, rather than trying to predict them. When the market falls, your SIP buys more units, and I consolidation, you accumulate units at lower prices. When the market rises, the same investment starts compounding in value. Over time, this balancing act helps mitigate the impact of short-term fluctuations.

This is why regular investing is more important than chasing market levels. Staying invested through both rallies and corrections averages out the cost of your investment over the market cycle. This is why SIP investing works better than lump-sum investing. The latter is highly dependent on market timing, while SIPs rely on patience and consistency over time.

Whichever method you choose, one question always arises: how is the investment actually performing? Returns matter but understanding how those returns are calculated is equally important. This becomes especially crucial with SIPs, where money is invested at different times and at varying Net Asset Values (NAVs).

Unlike a lump-sum investment, SIP investments are made on different dates and at different market levels. Therefore, measuring returns is not as simple as just looking at the initial and final values. The timing of each cash flow is crucial. This is where a mutual fund SIP calculator comes in handy.

It helps investors assess returns by accounting for investment patterns rather than treating them as a single lump sum. As SIPs involve multiple contributions spread over time, return calculations need to reflect both the amount invested and the duration for which each instalment remains in the market.

There are several ways to calculate mutual fund returns, such as absolute returns, CAGR, and XIRR. While absolute returns work for short-term or one-time investments and CAGR suits lump sum investments held for a fixed period, SIPs require a more precise approach. As SIP investments are staggered, XIRR offers the most realistic view of performance.

XIRR considers each SIP instalment as a separate cash flow and calculates an annualised return that reflects real-world investing conditions. This makes it especially relevant for investors who use SIPs as their primary investment mode. Over time, as earlier instalments stay invested longer, XIRR begins to capture the true compounding effect of disciplined investing.

For investors who regularly track their portfolios, a SIP calculator paired with XIRR provides clarity. It removes guesswork, sets realistic expectations, and helps investors judge whether their investment strategy is working as intended. Rather than reacting to short-term market noise, it keeps the focus on long-term outcomes.

What is XIRR in Mutual Funds?

Usually, your investments in mutual funds through a Systematic Investment Plan (SIP) don’t go in all at once.

Every month, a new instalment is added, markets move in between, and each contribution takes a different amount of time to grow. This is exactly where XIRR comes into the picture.

XIRR means Extended Internal Rate of Return. In simple terms, it tells you the annualised return on your mutual fund investment after considering when each investment was made and when the money came back to you.

It answers a very practical question investors often have: ‘What has my investment actually earned every year?’ Think of an SIP as a series of small investments rather than one lump sum.

Your first SIP might have been invested three years ago, the second two years and eleven months ago, and the most recent one just last month. Each instalment stays invested for a different period.

Thus, calculating returns using a simple average does not give a true picture.

XIRR solves this by looking at how much you invested and when you invested it. It then rolls all the cash flows into a single annual return figure that is easier to read and compare.

You can look at XIRR another way, too. If all your investments and withdrawals were part of a single journey, XIRR tells you the steady annual return. It is not influenced by how frequently you invest or redeem. It simply focuses on cash flows and time.

This also explains why XIRR can look lower in the early years of an SIP.

In the initial phase, most of your investment is still new and has not had enough time to compound. As an SIP runs longer, the older instalments get more time to compound, which is when XIRR usually starts looking better.

That is why, for SIPs or investments made at different points in time, XIRR gives the clearest view of how your investment approach is playing out.

However, calculating XIRR is relatively complex for many investors because it requires all investments and withdrawals, along with their respective dates. Also, not all investors are savvy with such complex calculations, nor do many have the time to derive the XIRR formula.

Thus, using an online Systematic Investment Plan (SIP) Calculator to calculate SIP returns could make this task less complex for you.

What is a SIP Calculator?

A SIP calculator, commonly known as a mutual fund SIP calculator, estimates returns on mutual fund investments made through the SIP method. This calculator will then show you the final amount you can expect to receive from your investment at the end of your journey, along with the investment amount.

SIP calculators are designed to help investors estimate the potential returns on their mutual fund investments. This calculator will also help you determine how much you need to invest through SIPs to achieve your financial goals.

However, the actual returns from a mutual fund scheme depend on several factors. The calculator also has limitations, as it does not account for expense ratios or exit loads.

This is not the only way to calculate SIP returns. Investors can create their own SIP calculator in MS Excel, but it’s easier to use the free SIP calculators available on almost all fund house portals and fintech applications. This saves time by eliminating the need to perform complex calculations.

How does the SIP Calculator work to assess your mutual fund SIP returns?

A SIP plan calculator works based on the values entered by the user. This calculator operates in a hassle-free and straightforward manner.

You simply need to enter the amount you wish to invest, the investment duration, and the expected percentage return on your investment. The SIP calculator will do the rest.

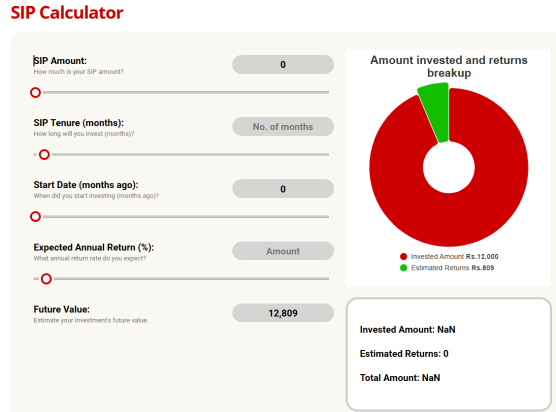

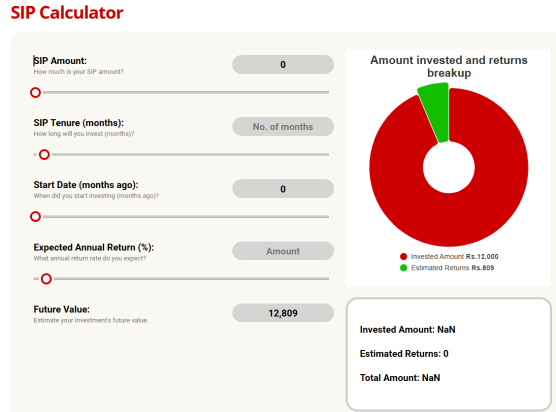

Here’s Equitymaster’s SIP Calculator…

As you can see in the image above, by entering a few details, this calculator can help you plan your financial goals, such as retirement, buying a car, financing your wedding, and more.

With just one click, the SIP calculator will instantly calculate the maturity amount of your investment.

To better understand how a SIP calculator calculates the future value of returns for your ongoing SIP, let’s look at an example.

At the age of 30, you plan to invest Rs 3,000 every month through a SIP until you turn 60, expecting an annual return of 12%. The mutual fund SIP calculator shows that by the time you are 60, you will receive Rs 105.89 lakhs.

The total return you will generate during your investment period is Rs 95.10 lakhs, while you invested Rs 10.80 lakhs over 360 months. Consequently, as an investor, you can use the SIP calculator to estimate the future value of returns on your SIP.

Conclusion

Investing in mutual funds through SIPs is a better approach than investing a lump sum.

This is because SIPs will average out your purchase cost, helping you navigate market volatility.

On the other hand, investing a lump sum carries the risk of losses during market corrections. By using SIPs, you can build substantial wealth with small, regular investments for important goals such as your child’s higher education, marriage, and even your retirement.

A SIP calculator will help you determine how much you need to invest to achieve your desired fund size.

However, remember that it is equally important to start by investing in suitable mutual funds that align with risk appetite, investment horizon, and goals. Only then will you be able to achieve better risk-adjusted SIP returns.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary