In today’s uncertain market, investors often find themselves torn between chasing growth and protecting their capital.

Equity markets offer inflation-beating returns, but volatility can quickly unsettle even seasoned investors. Debt instruments, on the other hand, provide stability but limit upside potential.

But what if you can invest in both through a single vehicle?

This is where a multi-asset strategy steps in, aiming to strike the right balance between risk and reward. Multi-asset schemes dynamically adjust allocations based on market trends and valuations.

Within this space, ICICI Prudential Multi Asset Fund stands out for its tactical allocation model that blends equities, debt, and commodities, particularly gold.

The fund seeks to reduce dependence on any single asset class while maintaining a disciplined, data-driven approach, which revolves around reducing concentration risk and capturing opportunities across cycles.

Let’s have a look…

What Makes ICICI Prudential Multi-Asset Fund Different?

Launched by ICICI Prudential Asset Management Company (AMC) in January 2013, the ICICI Prudential Multi-Asset Fund is an open-ended hybrid scheme. It invests in multiple asset classes, such as equity, debt, commodity, and gold exchange-traded funds.

The fund’s objective is to generate capital appreciation (through the equity allocation) while maintaining stability (through the debt portion).

The scheme also invests in commodities, including gold and silver exchange-traded funds, real estate investment and infrastructure investment trusts to diversify its portfolio.

This asset mix is then dynamically adjusted based on valuations, economic conditions, and outlook across asset classes. Its assets under management stand at Rs 647.77 billion (bn).

Since it invests across asset classes, the scheme is benchmarked against Nifty 200 Total Return Index (65%), Nifty Composite Debt Index (25%), Domestic Price of Gold (6%), MCX I-COMDEX Composite Index (3%), and Domestic Prices of Silver (1%).

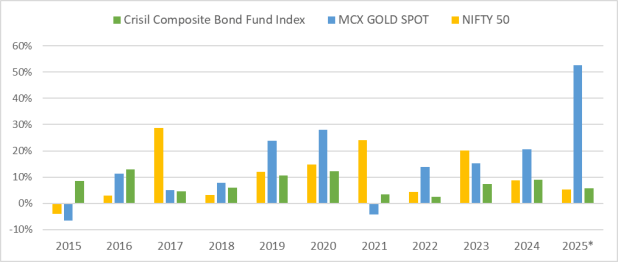

10-Year Performance of Gold, Equity, and Bonds

The expense ratio for this scheme is low at 0.68% (direct plan). The scheme’s turnover is 25%, which means it doesn’t churn its portfolio much.

However, if you sell 30% of your units within 365 days, 1% will be charged as an exit load.

How the Fund Allocates Across Equities, Debt, and Commodities

True to its nature, this scheme’s asset allocation is heavily skewed toward equities, with a 57.09% allocation, followed by debt (13.49%), commodities (10.45%), and real estate (1.36%).

Additionally, it holds 17.6% in cash and cash equivalents to meet redemption needs and invests when opportunities arise.

The market-cap portfolio weightage comprises 69.72% of giants, large-caps (12.57%), mid-caps (15.95%), and small-caps (1.7%).

Sector-wise, the top 3 sectors account for 29.46%, with 14.46% allocated to financial services, 7.54% to technology, and 7.46% to consumer discretionary.

In equities, the scheme has a diversified portfolio of 107 stocks, with the top 10 holdings accounting for 27.41% and the top 5 (15.83%).

Reliance Industries has the highest weight at 3.48%, followed by ICICI Bank (3.45%), Maruti Suzuki (3%), Axis Bank (2.84%), and Larsen & Toubro (2.58%). This equity portfolio has a price-to-earnings multiple of 22.39 times, almost in line with the Nifty 50.

Within its debt portion, the fund holds a highly diversified bond portfolio of 248 securities.

Sovereign debt accounts for 6.49% of the allocation, followed by AAA (4.6%), AA (2.61%), unrated (0.44%), and A and below (0.2%).

Other holdings include ICICI Gold ETF (3.06%), ICICI Silver ETF (2.81%), RBI T-Bills (91-D) (1.23%), GoI (0.75%), and Embassy Office (0.61%).

The average maturity of 2.72 years (versus 5.01 years of category average) shows that the scheme invests in short to medium-term bonds, which helps limit sensitivity to interest rate changes.

The yield to maturity (YTM) of the fund’s debt holdings stands at 6.2%, slightly lower than the category average of 6.56%. This reflects its preference for high-quality and lower-risk instruments.

This is evident from the fund’s average credit rating of AAA, which means it invests mostly in the safest debt instruments, minimizing default risk.

The Macaulay duration, which measures how much the bond prices may move with interest rate changes, is 1.29 years, much lower than the category’s 3.01 years.

In simpler terms, it means the fund’s debt investments are less affected by rising or falling interest rates, making it a more stable during periods of interest rate volatility.

Performance and Risk Metrics You Should Know

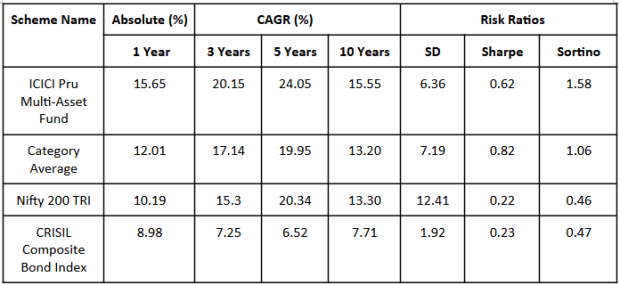

Despite market volatility and consolidation during the last one year, the scheme managed to deliver a 15.65% return, surpassing the performance of both its benchmark and peer category. In comparison, Nifty 200 TRI delivered a 10.19% return, Category average (12.01%).

Over a more extended period, the scheme also outperforms the benchmark.

The scheme has delivered a return at a 15.55% compounded annual growth rate (CAGR) during the last 10 years, against 13.3% of the benchmark.

But the scheme has outperformed with lower volatility (due to debt allocation) with a standard deviation of 6.36 compared to Nifty 200 TRI (12.41) and category average (7.19).

It mitigates the downside risk strongly, as indicated by the Sortino ratio of 1.58, which is much higher than the Nifty 200 (0.46) and category average (1.06).

It also outperforms the benchmark in risk-adjusted returns with a Sharpe ratio of 0.62, versus the Nifty 200 (0.22), and category average of 0.33.

Rolling period returns are calculated using the Direct Plan-Growth option.

Returns over 1 year are compounded annually.

Standard Deviation indicates the risk, while the Sharpe ratio and Sortino ratios measure the Risk-Adjusted Return.

They are calculated over 3 years, assuming a risk-free rate of 6% p.a.

The category average of all multi-asset mutual funds is considered.

Please note that returns here are historical returns.

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommended.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

Conclusion

ICICI Prudential Multi Asset Fund offers a structured solution for investors seeking diversification across equities, debt, and commodities in a single portfolio.

Its tactical allocation approach allows the fund to adapt to changing market conditions, balancing growth potential with downside protection.

The fund’s equity-heavy portfolio, combined with high-quality debt and commodity exposure, provides upside potential. Its short to medium-term debt strategy, strong credit quality, and lower interest rate sensitivity provides stability to the portfolio.

Historically, the scheme has delivered consistent performance, outperforming both its benchmark and category over one and ten-year, while maintaining lower volatility and superior risk-adjusted metrics.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.