Among the global indices, the Nasdaq has exhibited a strong performance in 2025, clocking 22.1% absolute returns (as of 9 December 2025).

The US-based Nasdaq is the second-largest stock exchange in the world, with a wide range of companies, but technology stocks have a majority weight in the index.

The new age companies Nvidia, Tesla, Microsoft, Alphabet (Google), Apple, Meta (Facebook), and Amazon, popularly called the magnificent seven, are all a part of the Nasdaq 100 index, with over a 50% weightage.

Other tech companies, such as Netflix, Adobe, Qualcomm, Broadcom, Intel, Cisco, Micron Technology, Intuit, etc., are also a part of the Nasdaq 100 index.

Besides these, there are well-known consumer companies such as PepsiCo, Costco Wholesale, Starbucks, etc. Even pharma & healthcare companies like AstraZeneca, Amgen, and Regeneron, among others, are part of the Nasdaq 100 index.

Similarly, there are energy & utility companies such as Constellation Energy Corporation, Exelon Corporation, Baker Hughes Company, and others.

The Nasdaq 100 index gives you exposure to the 100 largest non-financial companies listed on the Nasdaq stock exchange.

If you are looking for geographical diversification, then Nasdaq mutual funds can be considered, particularly the passively managed index funds.

In this editorial, we will deep-dive into the ICICI Prudential Nasdaq 100 Index Fund.

Fund Overview

ICICI Prudential Nasdaq 100 Index Fund was launched in October 2021 amid the COVID-19 pandemic.

It’s an open-ended index fund replicating the Nasdaq 100 Index. With attractive returns clocked by this index attracting several investors, the assets under management (AUM) of the fund have increased over the years, and today, as of October 2025, it’s over Rs 26.24 billion (bn).

The fund mirrors the performance of this index by investing 95-100% of its total assets in companies constituting the underlying index. Within this allocation, the fund also invests up to 10% of its assets in equity derivatives.

Up to 5% its total assets, the fund invests in reverse repo, tri-party repo (or similar instruments) and units of debt schemes/ETFs for liquidity and redemption purposes.

Thus, the investment objective of the fund is to generate long-term capital appreciation to unit holders from a portfolio that seeks to track returns by investing in a basket of NASDAQ-100 Index® stocks and aims to achieve returns of the stated index, subject to tracking error.

However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

The fund is currently managed by Sharmila D’Silva (since April 2022) and Nitya Mishra (since November 2024). Before that, Priyanka Khandelwal managed the fund.

ICICI Prudential Nasdaq 100 Index Fund – Snapshot

| Inception Date | 18-Oct-21 | SI Return (CAGR) | 18.35% |

| Corpus (bn) | Rs 26.64 | Min. Lumpsum | SIP | Rs 1,000 | Rs 100 |

| Expense Ratio (Dir/Reg) | 0.61% / 1.07% | Exit Load | Nil |

Source: ACE MF

What is the Investment Strategy of ICICI Prudential Nasdaq 100 Index Fund?

To achieve its investment objective, the fund follows a passive investment strategy.

It invests in stocks constituting the benchmark and in exchange-traded derivatives on the Nasdaq 100 Index. The securities are held in the same proportion as in the underlying index.

The performance may not be commensurate with the performance of the respective benchmark on any given day or over any given period due to a tracking error.

That said, the intent of the fund is to maintain a low tracking error. For the same, the fund manager would monitor the tracking error on an ongoing basis, seeking to minimise tracking error to the maximum extent possible.

The stocks comprising the Nasdaq 100 Index are periodically reviewed. A particular stock may be dropped, or new securities may be included as a constituent of the index. The portfolio shall be rebalanced within 7 days to ensure adherence to the asset allocation norms of the scheme.

Similarly, in the event of a constituent stock being demerged/merged/delisted from the exchange, the fund reallocates the portfolio and seeks to minimise the variation from the index.

What is the Portfolio of ICICI Prudential Nasdaq 100 Index Fund?

The fund holds the same securities as in the Nasdaq 100 index with the aim of maintaining the same proportion or weight as in the underlying index.

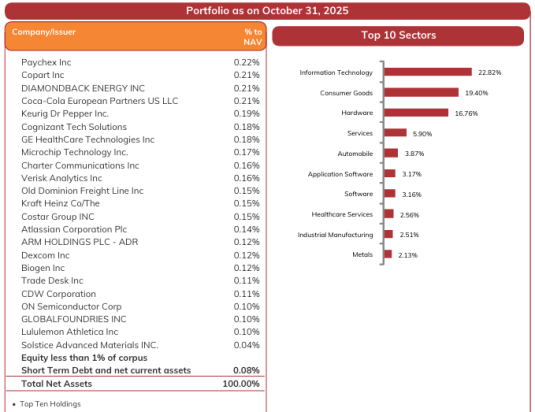

As per the October 2025 portfolio, the fund has 99.1% exposure to overseas equities and 0.8% to ADRs and GDRs.

Source: https://www.icicipruamc.com

The top seven groups or companies the fund has exposure to are Nvidia, Apple, Microsoft, Alphabet, Broadcom, Amazon, and Tesla, as per the October 2025 portfolio.

The highest exposure of the fund is to the IT sector (22.8%), followed by consumer goods (19.4%) and hardware (16.7%), among others.

Currently, the cash & cash equivalents in the portfolio are 0.08%.

The tracking error of the fund in the last one year has been -0.9% as per the October 2025 portfolio.

What Are the Historical Returns of ICICI Prudential Nasdaq 100 Index Fund?

Since inception, the fund has clocked a compounded average growth rate (CAGR) of 18.3% under the direct plan.

Over the last 1 year, the absolute return is 27.2% whereas over 3 years, an appealing 34.5% CAGR. These returns are a tad higher than the Nasdaq 100, which clocked 19.7% in 1 year and 30.4% CAGR in 3 years. This is because of the tracking error.

What is the Risk Profile of ICICI Prudential Nasdaq 100 Index Fund?

The fund commands very high risk on the risk-o-meter. Over the last 3 years, the standard deviation of the fund is 17.80 (as of 9 December 2025).

However, on a risk-adjusted basis, the fund has rewarded its investors well (sharpe and sortino ratios of 0.41 and 0.78, respectively).

Should You Add ICICI Prudential Nasdaq 100 Index Fund to Your Watchlist?

Last month, i.e. in November 2025, the ICICI Prudential Mutual Fund house has temporarily suspended fresh lump sum and new SIP as well as STP investments in this fund.

Whenever this suspension is lifted, and if you wish to invest, keep in mind that the fortunes of the fund will be closely linked to how the constituents of the Nasdaq 100 index fare.

The magnificent seven companies, which have over 50% weightage in the benchmark index, have already run up significantly in the last couple of years.

If these mega-cap stocks fail to generate returns to justify their current lofty valuations, it could weigh down on the performance of ICICI Prudential Nasdaq 100 Index Fund as well, although it has exposure to other index constituents as well.

As per the IMF staff model valuation models, risk asset prices are already well above fundamentals, and there is an increasing probability of disorderly corrections when adverse shocks occur.

Hence, don’t get carried away only by the past returns, which may or may not repeat in the future.

Be a thoughtful investor. Invest sensibly, considering your risk profile, investment objective, time horizon, and the asset allocation best suited for you.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary