The Indian equity markets have been rather volatile of late due to a variety of factors in play – particularly the impact of Trump 2.0 protectionist policies, weak Indian rupee, FII selling Indian equities, slowdown in earnings, and stretched valuations.

In such times, instead of going gung-ho with only equities, following a hybrid approach, wherein a prudent mix of both equity and debt, may prove sensible.

The equity portion in a positive market condition may help push up returns, while the debt portion could offer some cushion when the market turns volatile.

If you prefer an aggressive investment approach, aggressive hybrid funds may be looked at for the satellite portion of the equity mutual fund portfolio, provided you have an investment horizon of 3-5 years or more.

Keep in mind the risk in aggressive hybrid funds is high because, as per the regulatory guidelines, they are mandated to invest 65-80% of total assets in equities and the remaining 20-35% in debt & money market instruments.

For this reason, aggressive hybrid funds are classified as equity-oriented hybrid funds.

In this editorial, we will take you through the top 3 aggressive hybrid funds that have fared well on 3-year and 5-year rolling returns, as well as risk ratios (3-year standard deviation, Sharpe ratio, Sortino ratio, and up/down capture ratio), which you could consider for SIPs.

#1 ICICI Prudential Equity & Debt Fund

Launched in November 1999 as ICICI Prudential Balanced Fund, this scheme, in April 2018, was renamed as ICICI Prudential Equity & Debt Fund to adhere to the capital market regulator’s categorisation and rationalisation norms.

With an established track record of over 25 years, this fund has the highest AUM in the category, about Rs 452 billion (bn). It is one of the most seasoned funds in the aggressive hybrid funds category.

It does not resist taking contrarian bets on beaten-down sectors and stocks to benefit from market anomalies. It follows a mix of top-down and bottom-up approaches to investing.

While the top-down approach enables the fund to select stocks from an array of industries that show promising opportunities, the bottom-up approach enables it to select individual companies with robust fundamentals.

While analysing the potential of every stock, the fund evaluates parameters such as long-term growth prospects, earnings potential, price-to-earnings, and dividend history, among others.

As regards style, the fund follows a blend of value and growth. For its equity portion, it lays emphasis on growth strategies and follows a buy-and-hold strategy to derive the full potential of stocks in the portfolio.

While following its asset allocation mandate, the fund holds a well-diversified portfolio. As per the August 2025 portfolio, there are 93 stocks in its portfolio, of which 63% are largecaps, nearly 4% midcaps, and about 5% smallcaps. Cash & cash equivalents are around 4% of the current total assets.

The top 10 stocks comprise 46.2% of the portfolio and include names such as ICICI Bank (5.6%), NTPC (5.4%), Reliance Industries (4.6%), etc.

Among a diverse range of sectors, the top 3 sectors are banks (20.5%), auto & ancillaries (10%), and crude oil (7.7%).

The fund does not churn its equity portfolio much, as its portfolio turnover in the last one year has ranged between 25% to 35%.

At present, a little over 20% of the fund’s assets are allocated to debt & money market instruments. As per its August 2025 portfolio, 8.4% of its assets are in corporate debt, 8.3% in government securities (G-secs), 3.5% in money market instruments (such as CDs and T-bills), and 1.7% in PTCs & securitised debt.

It takes exposure to well-researched corporate securities to earn reasonable interest income. It invests in a range of maturity profiles, but predominantly in the longer mature buckets (of 7 to 10 years and above 15 years).

A majority of the fund’s assets are in AAA & equivalent, AA & equivalent, and sovereign-rated papers.

The weighted average maturity of all the underlying debt securities held by the fund currently is 5.5 years, making it moderately sensitive to interest rate risk.

With this strategy followed, the fund has showcased impressive returns over the long term while keeping the risk low.

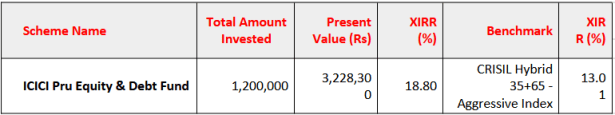

In the last 10 years, the fund has delivered an XIRR or SIP return of 18.8% compared to 13.01% by its benchmark, i.e. the CRISIL Hybrid 35+65 Aggressive Index (as of 26 September 2025).

ICICI Prudential Equity & Debt Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), would now be valued at Rs 3.23 m.

#2 Edelweiss Aggressive Hybrid Fund

Launched in August 2009, this scheme too has established a credible performance track record. Its AUM has increased over the years, and today it is over Rs 30 bn.

In line with its investment mandate, Edelweiss Aggressive Hybrid Fund invests 65% to 80% in equities for growth and 20% to 35% in debt for stability and income.

The fund follows an active strategy within equity and debt to take advantage of changing market scenarios.

Depending upon the market condition, it takes cues from seasonal patterns of global and domestic macroeconomic events and government policy, as well as central bank actions and decides on the asset allocation between asset classes.

This is recognising that individual asset classes behave differently at various times in a cycle.

For its equity portfolio, the fund follows a multi-cap approach (two-thirds largecaps and one-third midcaps and smallcaps).

It filters from the top 500 stocks by market cap for the investible universe using its proprietary model based on Growth, Quality, Value, and Momentum (GQVM).

To assess growth, the fund looks at sector growth, strong earnings growth, and competitive advantage as some of the factors.

Under the quality criteria, it looks for quality of management, free cash flow, return on equity, return on capital employed, and consistency among other factors.

Likewise, for value, it looks for attractive valuations (PE, PB, and dividend yield) and margin of safety. And for momentum, it looks at the price performance of the last 3 and 12 months.

For its debt portfolio, the fund focuses on accrual income and portfolio stability, with active duration management (1-5 years). It invests only in sovereign or AAA-rated corporate bonds, ensuring high-quality exposure.

This structured approach balances risk and reward, aiming for optimal returns with controlled volatility through a mix of equity growth and debt stability.

As per the August 2025 portfolio, the fund has 73% allocation to equities, 13% to debt, and 7% to others (which include units in domestic mutual funds, rights, and REITs & InvITs).

It usually holds 80-85 stocks in its equity portfolio. As per the August 2025 portfolio, there are 85 stocks in its portfolio, of which 51% are largecaps, 13% midcaps, and about 7% smallcaps. Cash & cash equivalents are currently around 7% of the total assets.

The top 10 stocks comprise 33.2% of the portfolio and include names such as ICICI Bank (6.3%), HDFC Bank (4.9%), Bharti Airtel (3.1%), etc.

The top 3 sectors of the fund are banks (22.7%), finance (10.8%), and healthcare (8%).

The debt portion currently comprises mainly corporate debt (12.9%) and G-secs. A predominant portion is in the 3 to 6 months maturity bucket and the 2 to 3 years bucket.

The weighted average maturity of the debt portfolio is currently less than a year, making it less sensitive to interest rate risk. It mainly holds AAA & equivalent-rated papers and sovereigns.

With this strategy, the fund has aligned with its objective, efficiently managed its risk and delivered optimal returns. However, the portfolio turnover ratio to deliver returns has been high, in the range of 110% to 150% over the last one year.

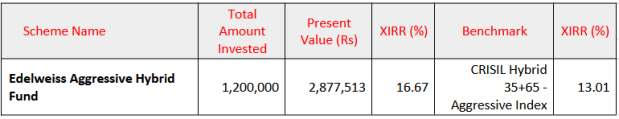

In the last 10 years, the fund has delivered an XIRR or SIP return of 16.67% compared to 13.01% by its benchmark, i.e. the CRISIL Hybrid 35+65 Aggressive Index (as of 26 September 2025).

Edelweiss Aggressive Hybrid Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), would now be valued at nearly Rs 2.88 m.

#3 UTI Aggressive Hybrid Fund

Launched in January 1995, this scheme has an over 3-decade-long performance track record.

It was previously known as UTI Balance Fund and UTI Equity Hybrid Fund and later renamed as UTI Aggressive Hybrid Fund to meet the capital market regulator’s categorisation and rationalisation norms. Today, the AUM of the fund is over Rs 63 bn.

While the fund invests in equity and debt as specified by the regulator, like its peers, the exact allocation varies based on market conditions and the fund manager’s outlook. The fund manager actively adjusts the mix to optimise risk and return. This approach has helped to balance growth potential with stability.

For equity, the fund adopts a bottom-up and top-down approach with emphasis on microeconomic factors of the underlying business.

The portfolio is managed with a distinct relative value philosophy underpinned by the idea of margin of safety. Also, it looks out for the growth-oriented companies if the valuations are in the comfort zone. It invests across market capitalisations following a blend of growth and value style of investing.

It evaluates companies based on, but not limited to, cash flow generation, ROCE/ ROEs and sound management track record. The emphasis is on investing in fundamentally strong companies and trading at attractive valuations compared to their history or peers, providing a margin of safety.

For debt, it focuses on high-quality, liquid issuers to provide stability and reduce risk. It keeps the flexibility to invest in the short end or long end of the curve based on the investment environment and market outlook. The duration of the debt portfolio is managed dynamically by investing across maturities of corporate bonds, G-secs and includes money market instruments.

As per the August 2025 portfolio, the fund has 66% allocation to equities, about 28% to debt, and nearly 4% to others (which include REITs & InvITs, rights, PTC & securitised debt, and units of domestic mutual funds).

The fund holds a fairly diversified portfolio of 50-60 stocks. As per the August 2025 portfolio, there are 62 stocks in its portfolio, of which 44% are largecaps, 13% midcaps, and about 10% smallcaps. The fund is almost fully invested, as cash & cash equivalents are only about 2% of the portfolio.

The top 10 stocks comprise 33.2% of the portfolio and include names such as HDFC Bank (6.5%), ICICI Bank (5.2%), Infosys (3.5%), etc.

The top 3 sectors of the fund are banks (19.5%), finance (12.6%), and IT (8.2%).

The equity portion is held with a buy-and-hold approach, as the portfolio turnover ratio has ranged between 30% to 36% in the last one year.

The debt portion is mainly of G-secs (16.6%) and corporate debt (11.3%). A predominant portion is in the 7 to 10 years maturity bucket and 1o to 15 years.

Thus, the weighted average maturity of the debt portfolio is currently 8.9 years (higher than its category peers), making it more sensitive to interest rate risk. A majority of the fund’s debt papers are sovereign and AAA & equivalent rated.

With this approach, the fund has managed its risk well and rewarded investors decently on a risk-adjusted basis.

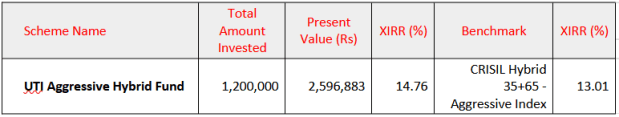

In the last 10 years, the fund has delivered an XIRR or SIP return of 14.76% compared to 13.01% by its benchmark, i.e. the CRISIL Hybrid 35+65 Aggressive Index (as of 26 September 2025).

UTI Aggressive Hybrid Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), would now be valued at nearly Rs 2.60 m.

Conclusion

These aggressive hybrid funds perhaps have the potential to deliver decent returns with a mix of equity and debt in their underlying holdings.

If you are a risk taker and have a long-term investment horizon, aggressive hybrid funds may be a meaningful choice in a volatile, yet upward-looking market supported by some positive undercurrents.

Taking the SIP route to invest in this category of hybrid funds may help minimise the impact of market volatility while you endeavour to compound wealth over the long run.

Invest sensibly.

Happy investing.

#Table Notes: Returns data as of 26 September 2025. Returns are XIRR in percentage. Monthly SIP of Rs 10,000 over a 10-year and 5-year period in the Direct plan – Growth option considered.

“Past performance is not an indicator of future returns. The securities quoted in the table are for illustration only and are not recommendatory.”

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.