In the last Budget, Finance Minister Nirmala Sitharaman had proposed a New Income Tax Regime with more income tax slabs and having lower tax rates than the Old Income Tax Regime for income up to Rs 15 lakh, but with no deduction benefits. The Old Regime has however not been scrapped and taxpayers have an option to opt for any of the two Tax Regimes.

While the Old Income Tax Regime has 4 income tax slabs, 0 per cent on income up to Rs 2,50,000, 5 per cent between income of Rs 2,50,001 to Rs 5,00,000, 20 per cent on income between Rs 5,00,001 and Rs 10,00,000 and 30 per cent on income above Rs 10,00,000, the New Income Tax Regime has 7 slabs, as given below:

Up to Rs 2,50,000 – Nil

From Rs 2,50,001 to Rs 5,00,000 – 5 per cent

From Rs 5,00,001 to Rs 7,50,000 – 10 per cent

From Rs 7,50,001 to Rs 10,00,000 – 15 per cent

From Rs 10,00,001 to Rs 12,50,000 – 20 per cent

From Rs 12,50,001 to Rs 15,00,000 – 25 per cent

Above Rs 15 lakh – 30 per cent

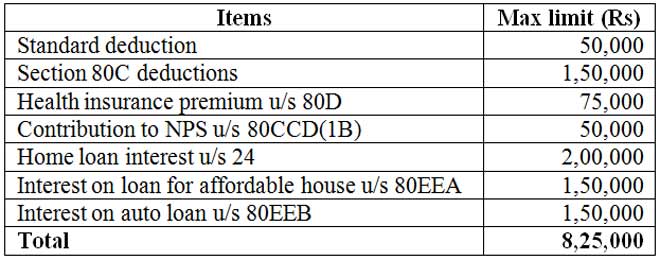

In her first Budget, promoting electric vehicles and affordable houses, Sitharaman had announced some new and additional deductions on interest paid on auto and home loans, subject to some conditions.

Additional deduction on home loan interest paid up to Rs 1.5 lakh was announced u/s 80EEA for buying an affordable house of value up to Rs 45 lakh, along with the provision of existing deduction limit of Rs 2 lakh u/s 24 of the Income Tax Act, provided that the assessee doesn’t own any residential house property on the date of sanction of the loan by a financial institution during the period beginning the April 1, 2019 to March 31, 2020.

Similarly, new deduction u/s 80EEB up to Rs 1.5 lakh was announced on interest paid on an auto loan taken for buying an electric vehicle, provided that the loan has been sanctioned during the period beginning on April 1, 2019 to March 31, 2023 and the assessee shouldn’t have another electric vehicle on the date the loan was sanctioned by a financial institution, including an NBFC.

Apart from the above new sections, the existing renowned and popular sections for deductions are, up to Rs 1.5 lakh u/s 80C, up to Rs 50,000 u/s 80CCD(1B) on voluntary contribution to Tier 1 Account of National Pension System (NPS), up to Rs 75,000 u/s 80D on health insurance premium (Rs 25,000 for self and family and Rs 50,000 for senior citizen parents), up to Rs 2 lakh u/s 24 on interest paid on home loan.

While there are more deductions available under various other sections for assessees with special needs, but using all the options, a normal salaried taxpayer may avail deductions up to Rs 8,25,000 as given below.

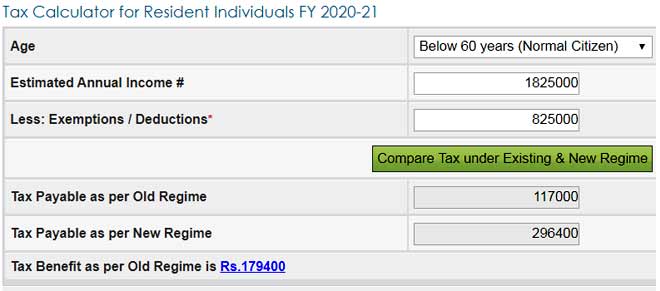

By investing the amount, the salaried taxpayer may save Rs 1,79,400 more tax under Old Income Tax Regime over the New Regime on gross income of Rs 18,25,000 and above.

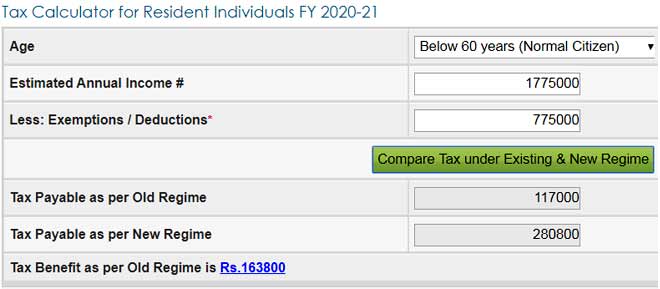

Non salaried assessees won’t get the standard deduction of Rs 50,000 available on salary, but may save Rs 1,63,800 more tax under Old Income Tax Regime over the New Regime by availing other tax-saving options up to Rs 7,75,000 on gross income of Rs 17,75,000 and above.

So, keep in mind the prospect of saving higher tax under the Old Income Tax Regime, before you shift to the New Regime.