In my first two columns, I wrote about the Global Reset – How Trump’s Tantrums will lead to rebalance of global portfolios and how India can attract USD 200 billion in this reset.

In the next two, I set context to that flow by showing how foreign investors are anyways under invested by a trillion dollars in India. In that, of the investments they have made, I speculated that foreign investors are rolling the dice on their India investments.

Over the next two columns, I will address whether Foreign Investors are indeed exiting India. This so because we keep reading news about outflows from the Indian markets.

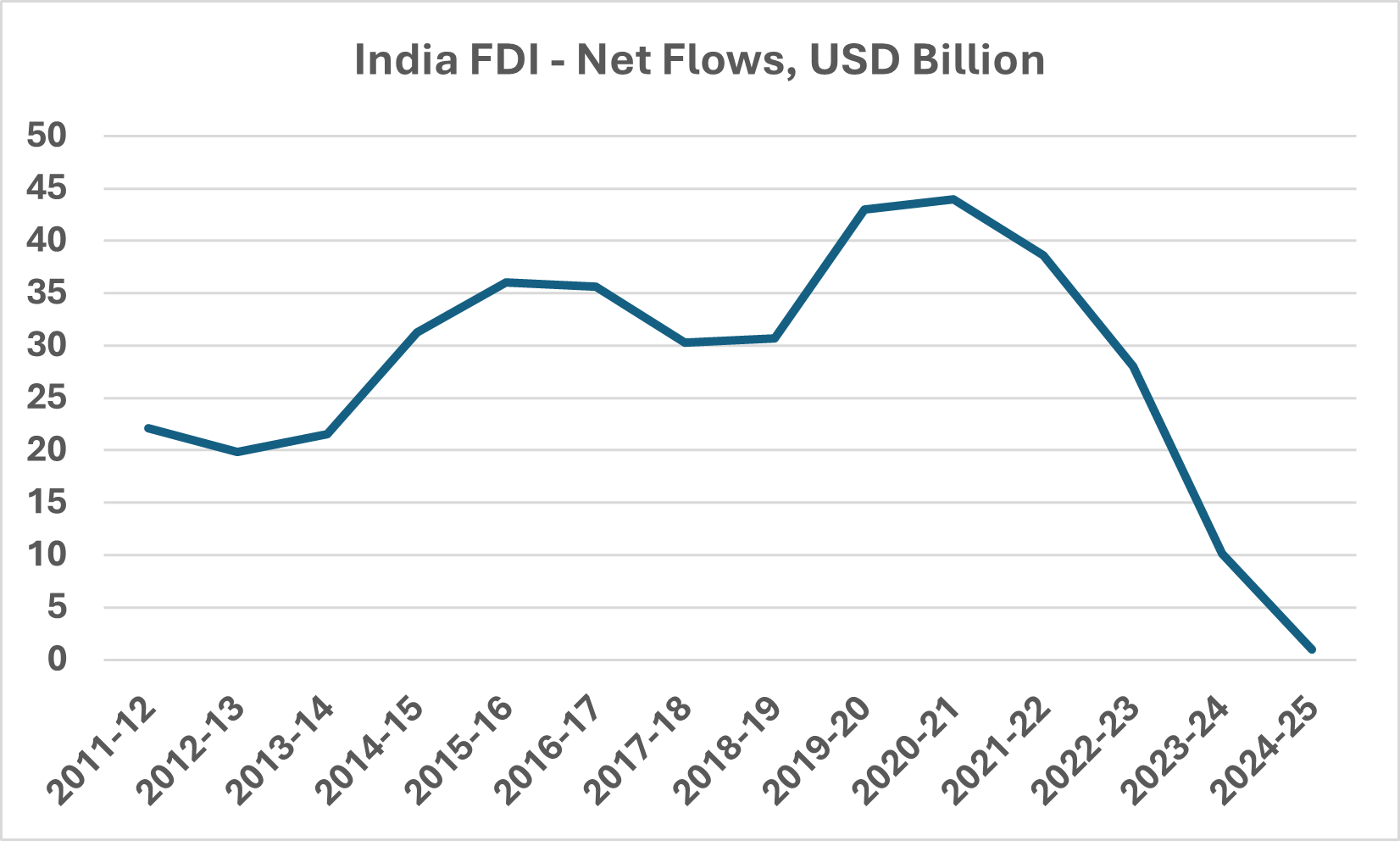

In this piece, I will specifically focus on the activity on Foreign Direct Investments (FDI). See the chart below, and you will know why you keep reading about Foreign Investors exiting India.

Chart 1: FDI Flows – wither away?

From a peak of ~USD 45 billion in annual flows, the net FDI flows has dropped to less than USD 1 billion for the fiscal year April to March 2025. This is the lowest on record in many years.

Although, there is nuance to this data as I explain below, it is still a shockingly small number for a growing economy like India which should be attracting way more capital than it gets currently.

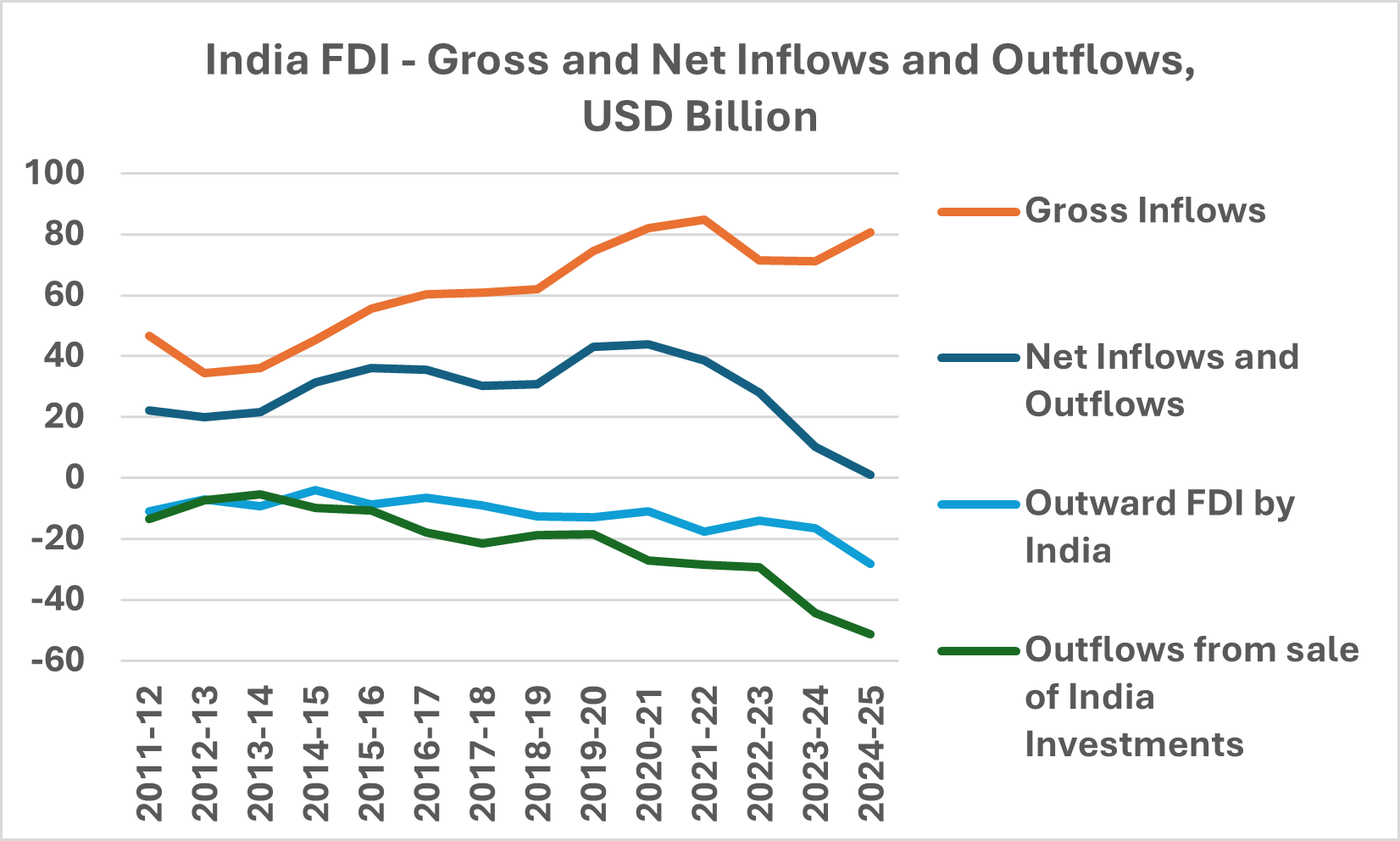

The Net FDI number though includes two large outflow items.

First, there has been an increase in foreign direct investments by Indian corporations, which is an FDI outflow and impacts the net number.

The other larger outflow has been exit/sale of existing investments by corporations and investors. As the public markets have remained buoyant, private equity, venture capital investors as well as global MNC corporations have reduced or exited their investments completely. This exit when the funds are repatriated out is also reported as outflows and impacts the net FDI number.

Chart 2: Outbound investments and exits from India drag Net FDI flows to record lows

Outward FDI by Indian corporations should rise as the Indian economy matures and companies become larger and have ambitions to cater to the global world. Indian companies will also acquire businesses, products, and services globally as they expand.

There would be questions on the need for Indian companies to invest outside given the demand and opportunity in the Indian markets. However, one should always keep in mind that the global opportunity is much larger. An Indian company investing outside will also likely benefit from technological expertise and an ability to compete in professional global markets.

For the fiscal year ended March 2025, such outbound FDI rose to ~USD 30 billion. Apart from the government checking if these outflows are not a means to take capital out of the country for non-productive or illicit transactions, the genuine transactions should be encouraged.

The other large outflow amounting to ~USD 50 billion in FY 2024-25 are the outflows from sale of Indian investments. This is a great sign. Especially for financial investors.

As I wrote in my ‘roll the dice’ column, foreign investors have invested two times more in private markets than in Indian public markets. The challenge in private markets remains the illiquidity, governance, and the fact that returns may not as good as those offered by public markets.

The robust performance of stock markets and the general increase in valuation of companies over the past 3-4 years, seems to have offered Private Equity and Venture capital investors and for founder/promoter of companies an opportunity to offload/ trim/exit their privately held investments in India.

Private market investors and corporations able to exit and at times by earning decent returns on their India investments is a great sign. This will hopefully increase the confidence of investors in investing in private markets and private market funds in the years to come.

The Net FDI flow number withering to zero is thus not the disaster that the chart makes it to be.

However, what should worry the government, policy makers and the investors is the fact that we are unable to attract large fresh capital into the country.

The gross inflows (orange line) of ~USD 80 billion in Chart 2 above and chart 3 below seems impressive.

However, for a ~USD 4 trillion economy, it remains below 2% of GDP. China at its peak and when it was ‘investable’ averaged 4-5% of GDP in gross FDI flows. Vietnam, a relevant competitor for India gets such high similar levels of FDI.

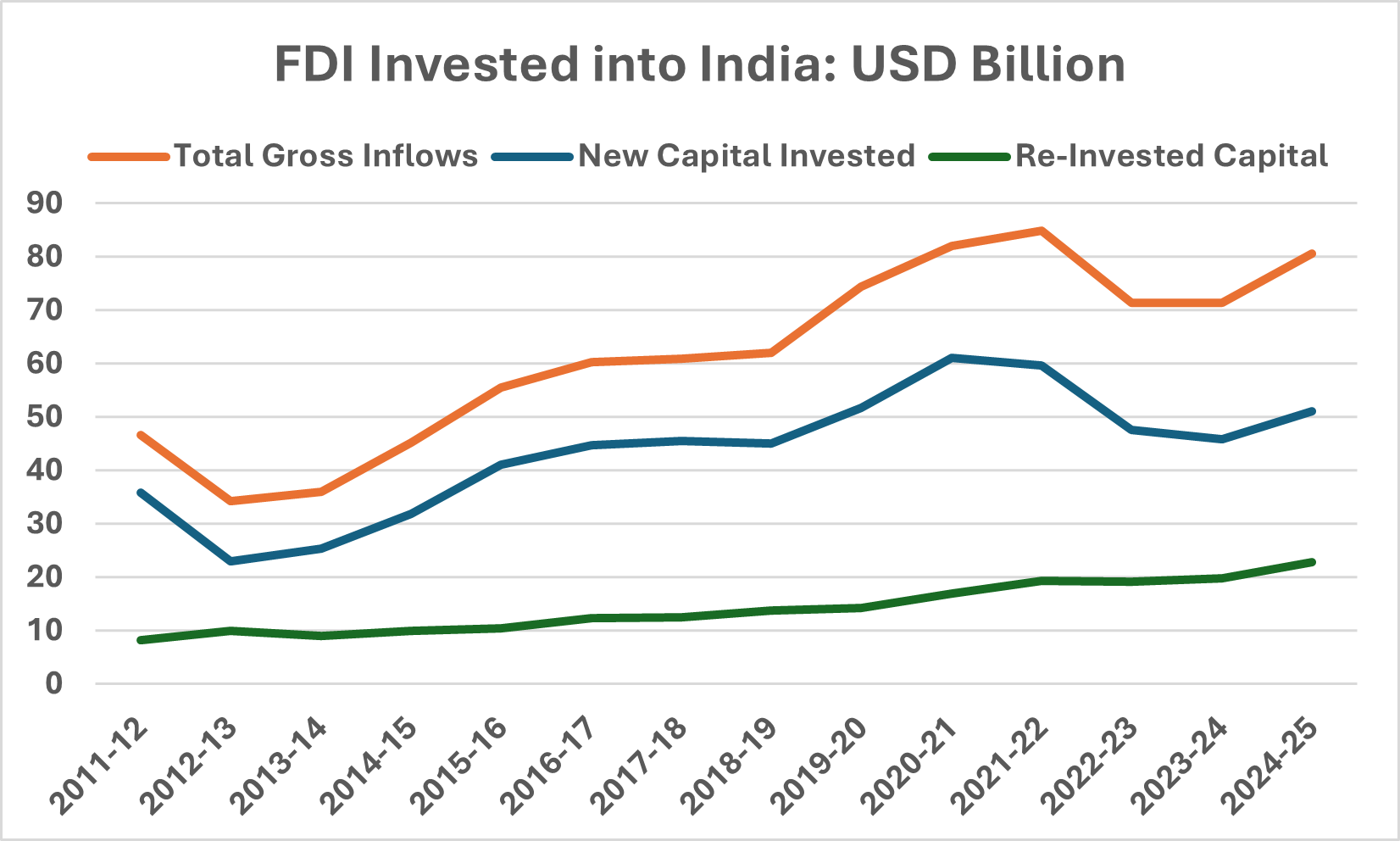

If we break that gross inflow number into Fresh capital and re-investments of profits by existing FDI investors, the reality is even more stretched.

Chart 3: India is not attracting enough fresh foreign capital into its economy.

Look at the blue line, New capital invested from outside every year by existing or new entities. It used to be ~USD 40 billion in FY 2016, ten years ago. It is now ~USD 50 billion in FY 2024-25. A mere annual increase of ~USD 10 billion.

This should be of deep concern. For all the hype about India, its economy, the size of its markets, its geo-political position, the political stability, strong stable government at Centre and States, fresh foreign direct investments have not grown at the expected pace.

We know that of that ~USD 50 billion of fresh capital inflow, private equity and venture capital funds dominate those investments. Global Corporations buying out and investing in India is a small share.

Apple, for eg, is the poster child of a global MNC setting up production assembly. I had written a piece then titled, ‘Apple a day to keep unemployment at bay’ – suggesting the need for many such ‘Apples’ to set up manufacturing and services in India.

Despite government policies like, ‘Make in India’, Production Linked Incentive (PLI), low corporate taxes for new manufacturing, and other measures, we are yet to see meaningful investment interest by large global corporations.

We know the usual reasons – ease of doing business, corruption, rule of law. However, the lack of large flows, could also be a function of explicit crony capitalism in large sectors, weaker domestic demand, change in the global trade dynamics and supply chain and India’s high tax environment on imports and GST system.

India should aim and prepare for a 4-5% of GDP of annual fresh foreign capital inflow into businesses, stock and bond markets, infrastructure, and real estate.

We are far from it.

So, though the net FDI chart is a misnomer. However, the reality remains that global corporations and global private investors do not yet see India to be a destination to commit large resources.

In my next column, I will look whether foreign investors are exiting the Indian public markets.

Disclaimer

Arvind Chari is a Chief Investment Strategist and has been with Quantum Advisors India group since 2004. Arvind has over 20 years of experience in long-term India investing across asset classes. Arvind is a thought leader and guides global investors on their India allocation.

This article is for educational and discussion purposes only and is not intended as an offer or solicitation for the purchase or sale of any investment in any jurisdiction. No advice is being offered nor recommendation given and any examples are purely for illustrative purposes. The views expressed contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, or reliability of the information.

The views and opinions expressed in this article are my personal views and should not be construed of the Firm. There is no assurance or guarantee that the historical result is indicative of future results and the future looking statements are inherently uncertain and cannot assure that the results or developments anticipated will be realized.