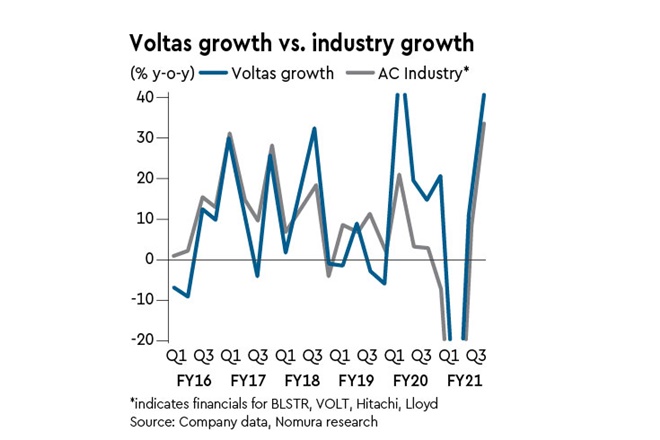

VOLT’s Q3FY21 revenue/Ebitda at Rs 20/1.5 bn came in significantly ahead of our forecasts (Rs 17/1.1 bn) and Bloomberg consensus (Rs 16.6/1.1 bn). AC business was strong with revenue growth/Ebit margin at 40% y-y/12.5%, well ahead of peers. VOLT’s share remained stable at 26% in 9MFY21 (24.2% in FY20) while it achieved leadership in inverter ACs with 21.8% share in Dec 2020. The project business reported 26% y-y revenue growth (Ebit margin 3.2%) and order book increased further to Rs 72.5 bn.

Management commentary: Healthy momentum continued in ACs in Q4, and price hikes of 5-6% in Jan 2021 are sufficient to protect margins. Beko billing points increased to 1000+ and there is significant demand pull from trade.

Production linked incentive (PLI) scheme envisages incremental production of Rs 1.7 trn and Rs 644 bn of exports, mainly ACs, over a five-year period with 4-6% incentive. This can aid VOLT’s Ebit by >7% and has strong potential for exports for ACs from India, as well. For VOLT’s room AC business, we now forecast revenue to decline 12% y-o-y in FY21F (-16% earlier) and maintain 53%/20% y-o-y growth for FY22/23F. Overall, we raise revenue estimates by +4%/9%/13% and EPS by ~9-10% for FY21-23F.

Valuation: SOTP-based TP of Rs 1,274 (Rs 1,110 earlier)— We raise our target PE for the UCP business to 50x (45x earlier), led by market-share gains and upside potential from the PLI scheme. We maintain 13x/15x target P/E for project/service business and Rs 127 for VoltBek (based on DCF). The stock is currently trading at 30.5x FY23F EPS (adjusted for Beko), which in our view is attractive. Reiterate Buy.