We believe the market is underestimating the upfront costs of building US specialty and overestimating the pace of pick-up in US generic business. Rich valuation also keeps us Underweight.

Our views

Sun’s specialty pipeline appears overestimated by the Street. Ilumya is in a competitive market. Yonsa and Cequa may face ‘same therapy’ generic headwinds (gZytiga and gRestasis, respectively). The Xelpros opportunity is relatively small. Plus, the upfront cost of building US specialty front end is putting pressure on margins in the near term. Our reduced FY19-21 EPS estimates account for FY19 reset to a lower revenue/margin base. Our price target rises 5% because rolling valuation forward six months outweighs the estimate cuts. Our target P/E multiple of 20x remains unchanged.

Business outlook

Management believes that weak Q2FY19 results (Rs 9.96 bn adjusted profits vs. our estimate of Rs 11.9 bn) do not reflect the health of the underlying business. It expects a positive performance for H2FY19 (low double-digit sales guidance for FY19, 10% achieved in H1). It expects R&D expenses (6.8% of sales in H1) to rise in H2 (FY19 guidance of 8-9% of sales). It targets two more specialty launches (Cequa and Xelpros) in the US in H2FY19, which would lead to higher SG&A. EU Ilumitra commercialisation will commence in Q3FY19. Domestic business should grow in the low teens.

Adjusted net profit was Rs 8.4 bn

Sun reported sales of Rs 69.4 bn, down 4% q-o-q but up 4% y-o-y. Domestic business was down 16.3% y-o-y/- 13.6% q-o-q to Rs 18.6 bn (includes one-time inventory reduction). Export formulations was down 80bps q-o-q, to Rs 15.3 bn (mainly because of the US – no substantive launches in Q2, i.e., down 570bps q-o-q). Operating profit declined 4.7ppt q-o-q to Rs 15.3 bn with 22.1% margin.

Cut in EPS estimates

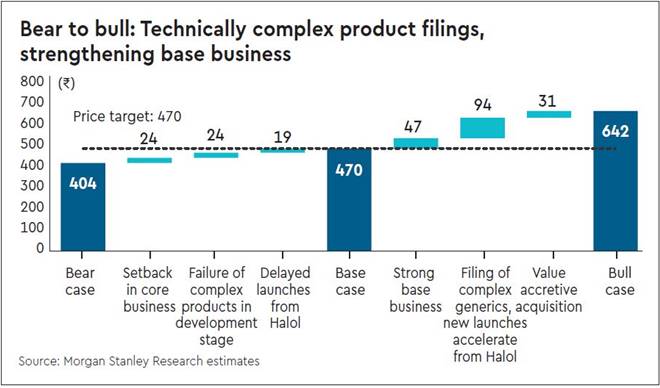

We have cut our EPS estimates 9.6% for FY19, 5.3% for FY20 and 4.6% for FY21. This reflects: (i) lower H1FY19 base (slow domestic growth, no substantive US launches which could bring immediate uptake; (ii) modest near-term outlook for the US business; (iii) near-term margin pressure from higher R&D and marketing expenses pertaining to specialty portfolio; and (iv) continual pricing pressure in Taro business. We have increased our price target to Rs 470 from Rs 448.